KTX DirectBidding™ Quicktakes

What is KTX DirectBidding?

KTX DirectBidding CLO electronic trading protocol taps into the liquidity of broker-dealers and buy-side investors at the same time. Buy-side investors can trade directly and anonymously while settling via independent settlement and clearing firms.

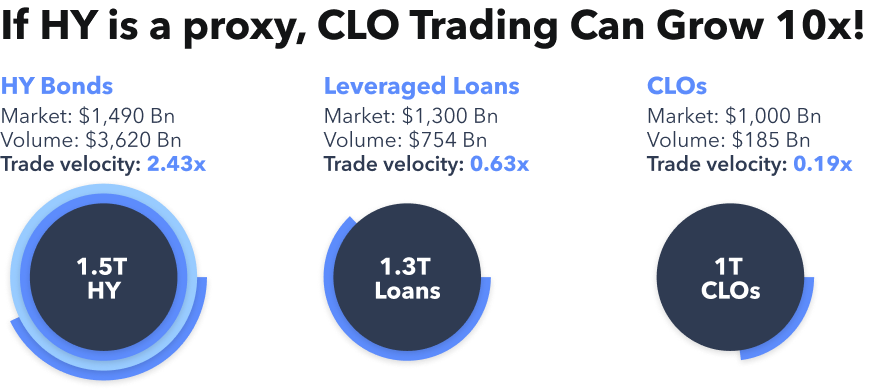

Source: TRACE, LCD, KopenTech, as of Q3 2021

Why KTX DirectBidding?

Evolution of the CLO marketplace is desperately needed. Despite having grown at a 30% rate to over $1 trillion, the CLO market’s secondary offering remains nascent. Other credit markets that have integrated electronic trading have seen tremendous growth: high yield corporate bonds annual trading volume is 2.5x the notional outstanding, while CLO’s annual turnover is only 0.19x. Trading practices have not kept up with the growth of the CLO marketplace. Better systems and easier trading protocols are poised to increase liquidity.

Greater Transparency

KTX DirectBidding provides superior information for both sellers and buyers with automated, guaranteed live feedback and post-trade color. Gathering information to make better trade decisions is critical for investors. Traditional BWIC processes have inconsistent practices regarding dissemination of information by sellers, frustrating bidders and causing some investors to abandon competitive execution. KopenTech’s platform automatically updates bidders when their status changes and when post-trade results are available. All bidding information is saved on the platform for best execution records and compliance review.

Wider Network

KTX DirectBidding gives investors direct access to a previously untapped bidding base: their peers. With hundreds of institutional investors on the KopenTech platform, buy-side participants have the chance to transact directly and anonymously with each other. KopenTech has 15 platform broker-dealers able to stream live prices for CLOs. Additionally, it has contacts for off-platform dealers who receive email communications. Sellers can easily input off-platform dealer bids and aggregate all information in one place for ranking and consistent communication.

Efficient Pricing

Cutting out intermediaries and timing delays, the KTX DirectBidding protocol provides an opportunity for unlimited bidding rounds in a manageable timeframe. Investors no longer need to limit bidding and give up best execution via top 3 or jump ball practices just to simplify the process and save time. Access to the KopenTech platform is free, settlement fee is paid only for executed trades by the buyer of securities. Settlement fees are low, transparent and consistent, reducing market friction and supporting higher trade volumes.

Shorter Timeframe

With an improved process due to direct access, automation and live pricing, KTX DirectBidding reduces the amount of time it takes to run a trading session. This is in deep contrast to a traditional BWIC process which can take several hours.

Better Experience

Sellers can create a new BWIC listing in seconds with a 5-step wizard and send their BWIC announcement to the entire CLO marketplace. Deal documents may be available on the platform or can be uploaded. KTX DirectBidding is designed for the modern investment team: it provides seamless, real-time collaboration online. With many investment professionals working remotely, there’s a critical need for online collaboration tools to improve productivity. The KopenTech platform is web-based and requires no software downloads. It can be easily accessed by new and current users from any location.

Fewer Errors

With all communication taking place on the platform, KTX DirectBidding is designed to ensure information is accurate and timely. Bid confirmation popups act as fat-finger error prevention tools.

Confidential Bidding

While negotiating directly, buy-side clients execute anonymously via a settlement agent. Additionally, with KTX DirectBidding, trade confidentiality goes even further: all bidding and negotiations on the platform are private. The settlement and clearing agents are independent, non-bidding firms; their personnel will see only matched, executed trades. Bidding privacy helps buy-side firms avoid front-running and maintain their investment edge.

Source: TRACE, LCD, KopenTech, as of Q3 2021

Learn about KTX DirectBidding, an online trading protocol where buy-side firms negotiate directly and trade anonymously.

KopenTech is affiliated with KopenTech Capital Markets, a member of FINRA.