CLO Market Trends: November 2023 Edition

BWIC volumes rise as CLO prices climb to LTM highs. New issue volumes are second highest YTD.

November Webinar Guest Speakers: Colin McGinnis, Prospect Capital

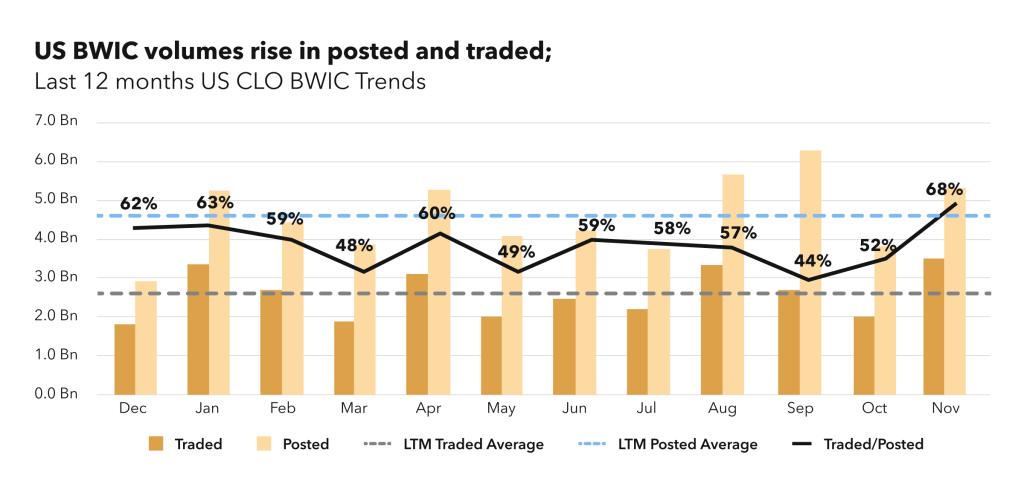

BWIC Volumes

US BWIC volumes rise from October lows both in posted and in traded. The volumes are at $5.2 BN and $3.6 BN for posted and traded, respectively. This brings the portion of traded volumes to 68%, highest in last twelve months.

BWIC Volumes by Rating & DNT rates

November shows strong AAA trading, with $2.1 BN traded, highest volume since January. Investment grade trading accounted for 80% of the total monthly volume. Traded volumes for equity are at $402 MM, highest since April, with 84 deals traded.

DNT rate is uneven across the stack for US BWICs, with DNT% higher for AAA and AA and lower for the rest of the cap stack. Only 21% of the AAA deals did not provide color (price) information, compared to the 39% LTM average.

TRACE Volumes & Dealer’s inventory

TRACE volumes increased from October, with IG volume at $15.1 BN, and HY volume at $3.3 BN. 10 days are reporting higher than 1 BN. The BWIC/TRACE ratio rises for both IG and HY, currently at 19% and 21% respectively. On the dealer inventory side, dealers flip back to buying, with net flow at $844 MM.

Prices Across the Stack

November average US BWIC prices across the stack climb back to LTM highs in AAAs and AAs, with AAA average price approaching par and standing at 99.64 cents on a dollar.

“November was really the largest rally in risk assets that we’ve seen in quite a while, which brought us close to the tights across most of the capital stack.” — Colin McGinnis

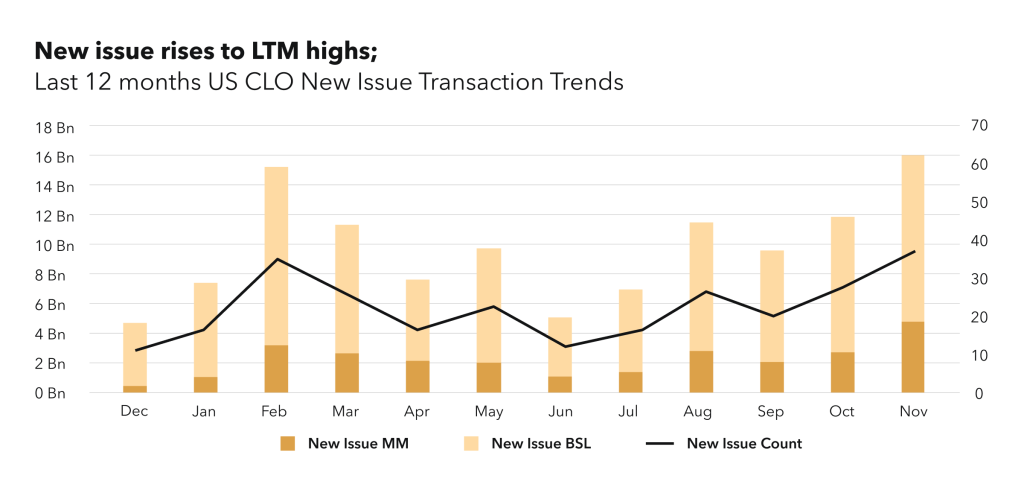

New Issue

New issue volumes rise once again, now at $15.97 BN, highest since February. Short deals take up 22% of the total issuance. US AAA spreads for longer BSL transactions are wider, now at 170-198 bps.

“One of the big trends that we’re seeing now is that almost 30% of the notional value of new issue deals in November were private credit or middle market, and we’ve seen a substantial increase over the last couple years.” — Colin McGinnis

“This year the biggest managers were the ones who were able to issue, and the top 50 managers were about 80% of issuance.” — Colin McGinnis

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on January 9th for Market Trends Webinar here.