CLO Market Trends: April 2024 Edition

New issue volumes rise to $17.4 BN, AAA spreads hit 145 bps, BWIC volumes drop to $1.8 BN

Guest Speaker: Angela Best, MetLife

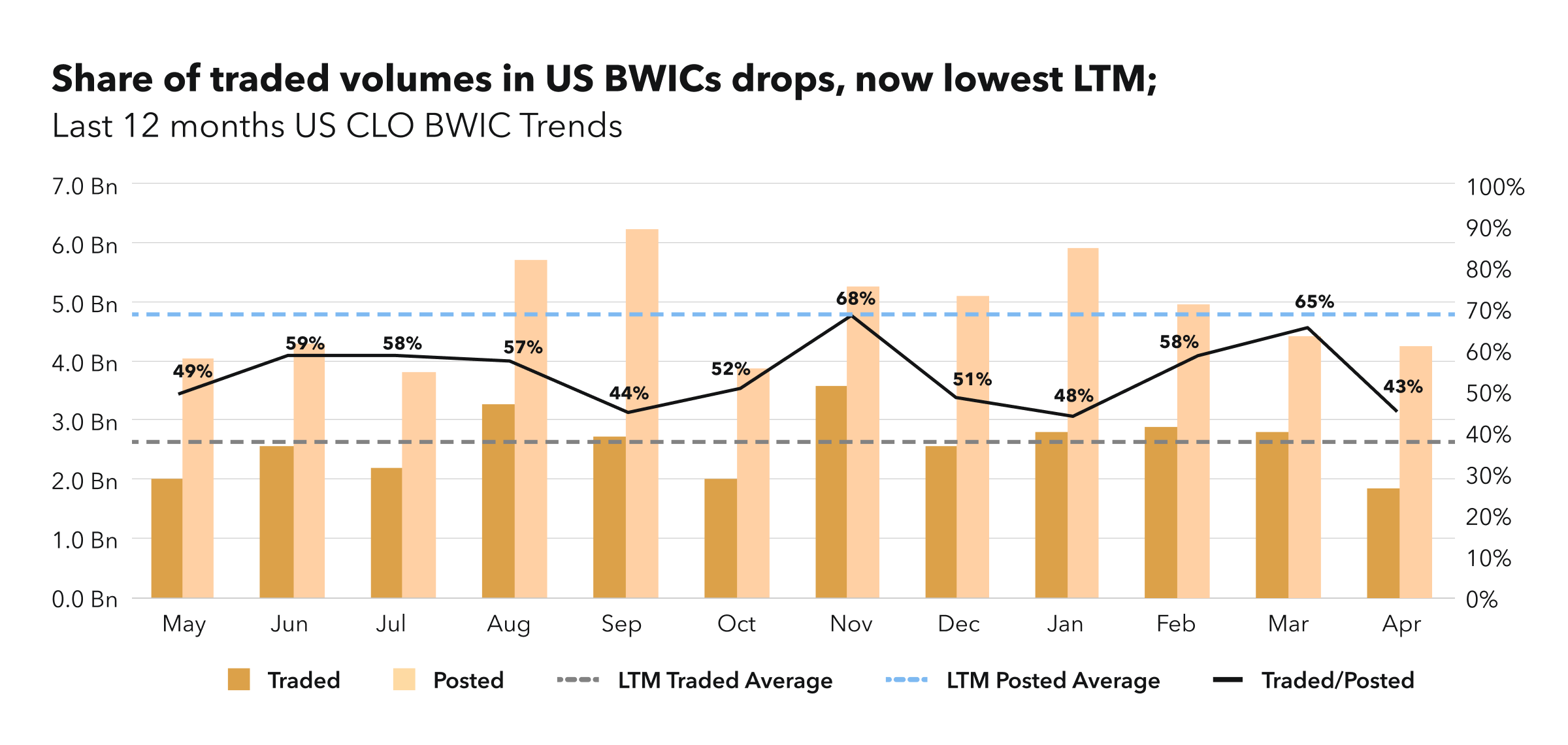

BWIC Volumes

US BWIC volumes are lower amid strong primary issuance, with traded volumes showing a 36% decrease from last month’s numbers. There were $4.3 BN posted, of which only $1.8 BN traded, resulting in 43% traded to posted ratio.

BWIC Volumes by Rating & DNT rates

Breaking down US BWIC traded volumes by rating reveals the lowest AAA volume in last twelve months: only $648 MM, contrasting the March situation, where the AAA volumes were highest since November last year. This brought down the IG share of cap stack to 66%.

DNT rates continue to fluctuate across the stack, showing lower April DNT volumes compared to LTM averages, which can be attributed to the fact that larger share of deals didn’t show information on their trade status: for AA, only 15% of deals were transparent about the color.

TRACE Volumes & Dealer’s inventory

TRACE volumes decline in line with BWICs. IG volume stands at $12.3 BN, below LTM average. HY share of TRACE volumes increases to 30% of the total. Only five days are reporting to have traded volume higher than $1 BN. Dealer balance sheets shrink as the buyside lifts them out of paper, with dealers selling $515 MM.

“Dealers are lightening up on the inventory given spread compression across the capital stack.” – Angela Best

Prices Across the Stack

US BWIC prices continue to climb to LTM highs, now breaking par in most of the IG ratings except BBBs. AAs, As and BBBs show the highest average cover levels LTM. Average numeric color for AAA tranche is at 100.18 cents on a dollar.

“There have been aggressive repricings and a pull to par, similar to what we see in leveraged loans.” – Angela Best

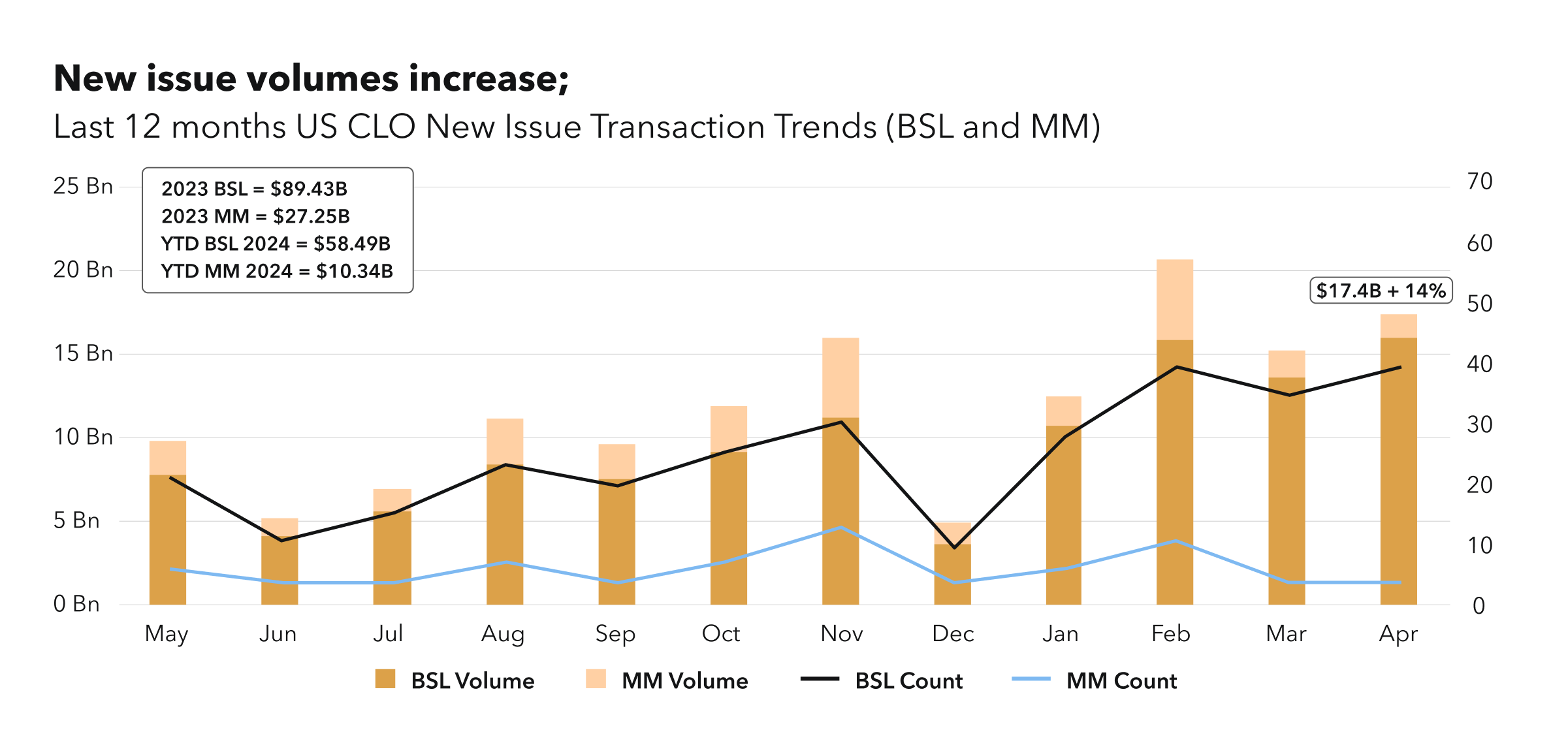

Primary Issuance

AAA primary spreads have broken through 150 bps support level, and forecasted to compress further, below 140 bps.” – Angela Best

New issue US monthly volumes rise to $17.4 BN, second highest in the last twelve months. 8% of that volume was represented by middle market deals. New issue US spreads are maintaining their ranges, currently in the 145-165 bps range for AAAs, excluding the outliers. Refinancing and reset deals are a prominent part of the market, with reset volumes rising to $14.5 BN, 35% increase from March volumes.

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on June 13th for Market Trends Webinar and register here.