CLO Market Trends: May 2023 Edition

CLO New Issuance bounces back to LTM average, secondary trading levels fall

March Webinar Guest Speaker: Scott D’Orsi, Putnam Investments

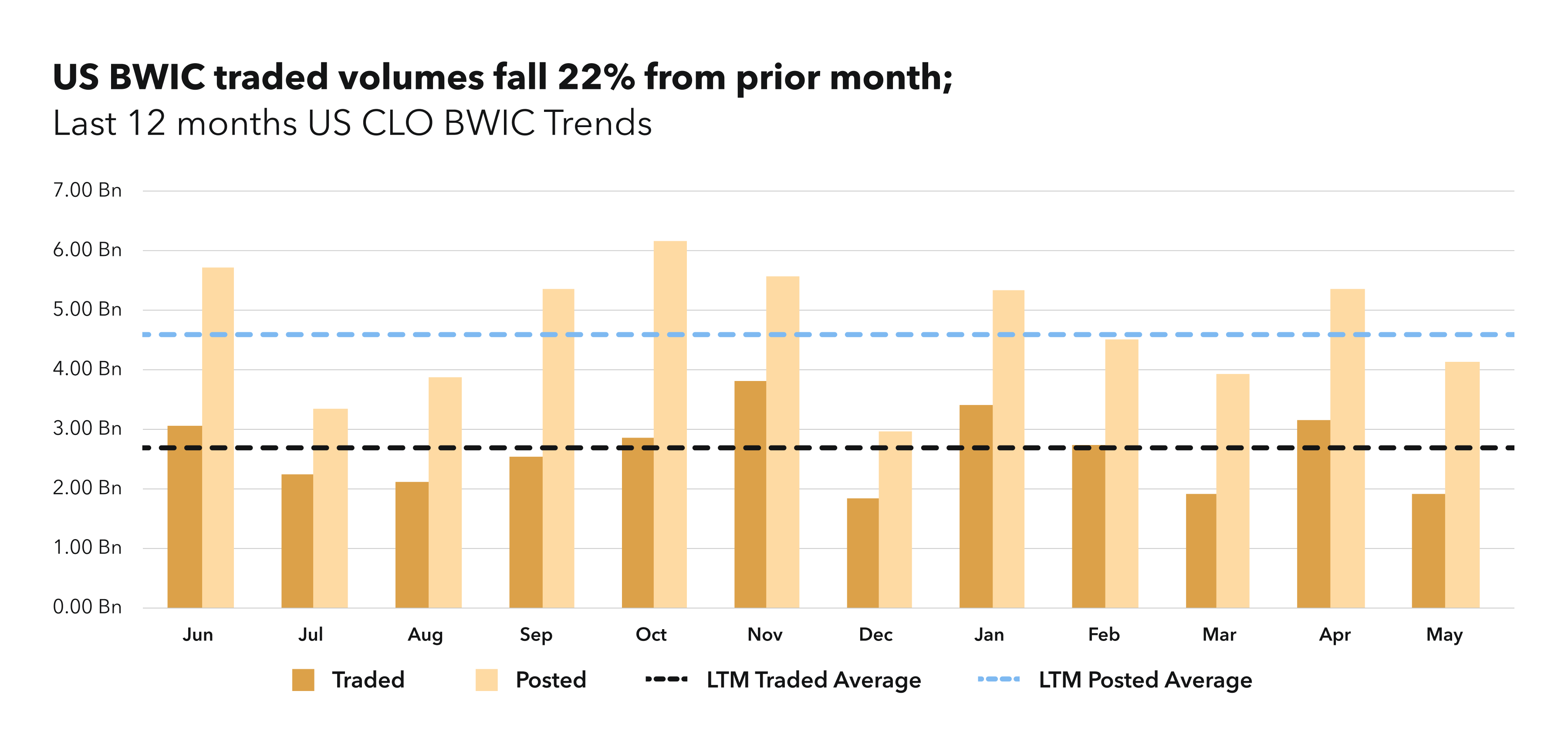

BWIC Volumes

US BWIC volumes fall by 22% from prior month, with both posted and traded volumes below LTM averages ($4.1BN and $2BN respectively). YTD volumes are 20% lower than 2022 numbers.

BWIC Volumes by Rating & DNT rates

May saw traded BWIC volumes fall lower than LTM average for every rating except for A. In contrast to April, where AA traded volume was the highest amongst other ratings, May AA total traded was the lowest, at $117MM (88% lower than April AA volume). Despite this decrease, the IG share in traded BWICs is at 84% due to increase in total AAA traded ($1.1BN in May).

Reported DNT rates were lower in May compared to LTM averages for all ratings except for AA and equity. AAA reported DNT rate was only at 2%. However, for ratings like AAA, AA and BB, the percentage of deals with unreported color was noticeably higher than LTM average (53% of “no info” AAA transactions in May compared to 41% LTM average), so the overall numbers are skewed by this difference.

TRACE Volumes and Dealer’s inventory

TRACE total volumes remain steady and healthy, with IG volumes rising to LTM average (at $11.8BN). HY volumes fell however, now constituting 18% of the total. Daily TRACE shows 2 days trade higher than $1BN. On the dealer inventory side, May flips to the dealer selling, with clients buying $226MM.

“This is a fairly orderly market from a secondary standpoint. That said, we’re looking at a 15BN of monthly trading volume for a trillion plus asset class, so it’s not a high frequency trading product.” — Scott D’Orsi

Prices Across the Stack

May average prices fell slightly from April in all ratings except AA. AAAs are 98.31 cents on a dollar, only .5 less than LTM highs (in February).

“All tranches YTD had positive returns, AAA down to BB… a lot of that comes from coupon clipping. In May, AAA are +- 5 bps in DM, so it’s pretty much range bound.” — Scott D’Orsi

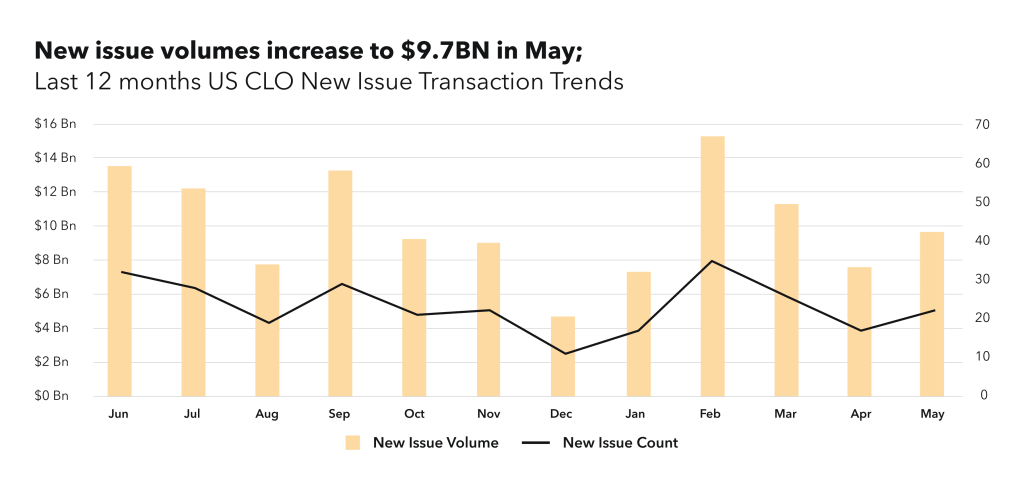

New Issue

New issue volumes were at $9.7BN in May, improving 28% from last month and returning to LTM average. This is a welcomed change and breaks the trend of falling monthly volumes started February. YTD volumes are 13% lower than in 2022.

11% of May volumes were short deals, with 0-1.5 years non-call period and 0-3.5 years reinvestment period. US AAA spreads for longer BSL transactions are at 175-230 bps, a slightly wider range than April.

“Striking amount of dispersion exists in our market at the AAA level. Cost of capital is somewhat prohibitive for the debut managers. Repeat Tier 1 managers are the only ones who have success.” — Scott D’Orsi

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at bwic.kopentech.com.

Please join us on July 11th for Market Trends Webinar and register here.

KopenTech is affiliated with KopenTech Capital Markets, a member of FINRA.