CLO Market Trends: November 2022 Edition

Prices are off the year’s lows in secondary, new issue AAAs remain at the year’s widest levels.

Guest Speaker: Michelle Liu, KKR

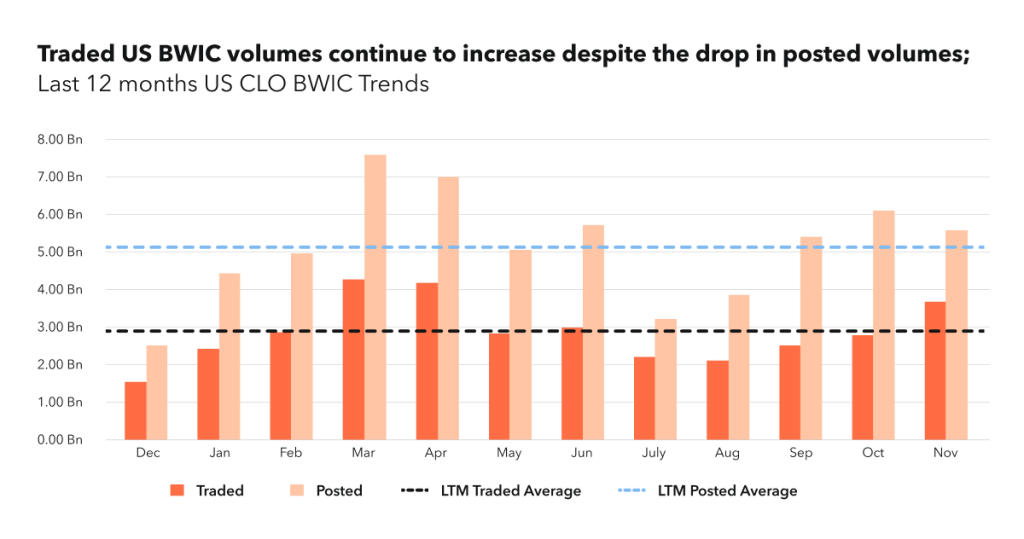

BWIC Volumes

We have seen a continued increase in US BWIC trading since August, though we are still shy of the highs we saw in March and April of this year at $4.3 BN and $4.21 BN respectively. BWIC traded volumes for November are up 16%, at $3.78 BN despite the drop in posted volumes which was down 9%. The US economy and NAIC pending reserve changes continue to add pressure and support higher trading volumes. In Europe, BWIC trading was down 50%, and back to its LTM average of $.75 BN traded. The liquidity event of last month in Europe has abated for now.

“It’s been a great year for trading given additional liquidity. We saw the highest trading volume in CLO secondary market ever.” – Michelle Liu

BWIC Volumes by Rating

IG share in US BWICs remained at 85% which is the historical average and flat to October. As expected, AAAs dominated this share representing 40% of total traded at $1.32BN. What stood out was $.72 BN in AAs trading which is double their LTM average of $.34 BN. Mezzanine and equity volumes were back to their LTM averages, as prices stabilized higher and sellers accepted bids.

TRACE Volumes and DNT rates

Trace volumes are down 9% to $20.8 BN but we saw the most HY traded this year at $6.9 BN. Outsized volumes occurred on two days: November 1st with $1.96 BN and November 14th with $1.59 BN. Given higher prices this month, US DNT% decreased in IG with A’s showing only 7% DNT.

BWIC as a % of TRACE trends diverged across ratings: IG BWIC volumes spiked to 23% of the total monthly volume, while HY-rated tranche trading stayed at 8%, close to the last 12 months lows.

Dealer’s Inventory

Banks continue to be net buyers for the third month in a row buying $.50 BN from clients. This is up slightly from last month of $.24 BN but still shy of the largest month this year which was $1.6BN purchased from clients in September.

K-Indicator

KopenTech barometer of market stress remained in negative territory, after a brief intra-month spike above zero.

Prices Across the Stack

Prices are up across the stack. The most noticeable increases were naturally in lower mezzanine tranches, with BBs up 3.5 points.

“The combination of the manager’s reputation and portfolio quality, especially for lower-rated tranches such as BBB, BB are in the first order determinants in CLO pricing.” – Michelle Liu

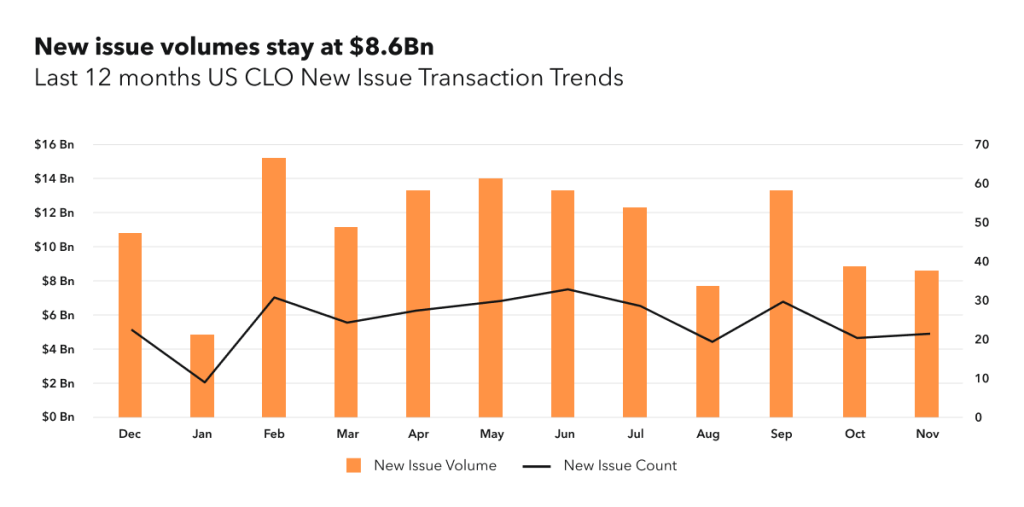

New Issue

New Issue CLOs are continuing to get done despite AAAs being at their wides of the year. New Issue volumes are flat to last month at $8.6 BN. When we compare this to last year at $25.89 BN, this seems to be light, but it is in line with volumes for 2020 and 2019. YTD issuance for 2022 is at $122BN, only down 30% from where we were last year at $176BN and significantly higher than YTD for 2020 at $82BN.

“We had a very respectable year in terms of primary market volumes given all challenges. The total issuance volume this year is 122BN, it the second-largest historically.” – Michelle Liu

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on Our 2022 Year in Review Webinar on January 10th and register here.