Second Largest AAA BWIC in 7 years

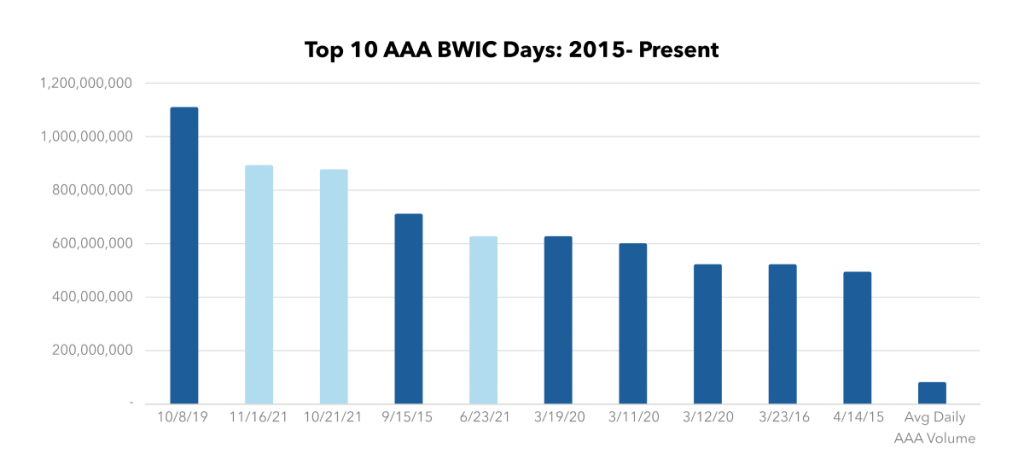

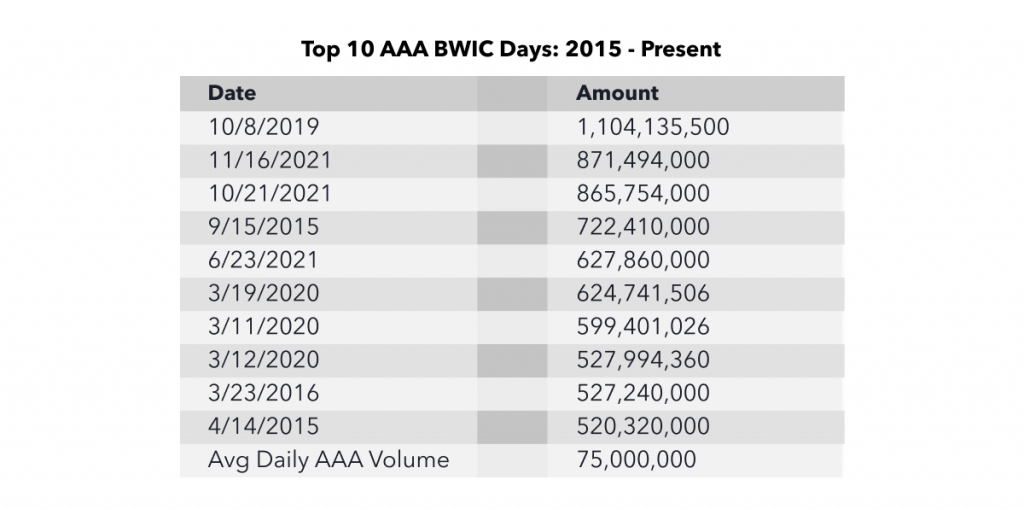

A listing of 21 AAA securities totaling $818 million is coming up on BWIC on Tuesday, November 16, 2021. This represents the second-largest AAA BWIC day in the last seven years. The highest was October 8, 2019, having seen over $1.1 billion posted.

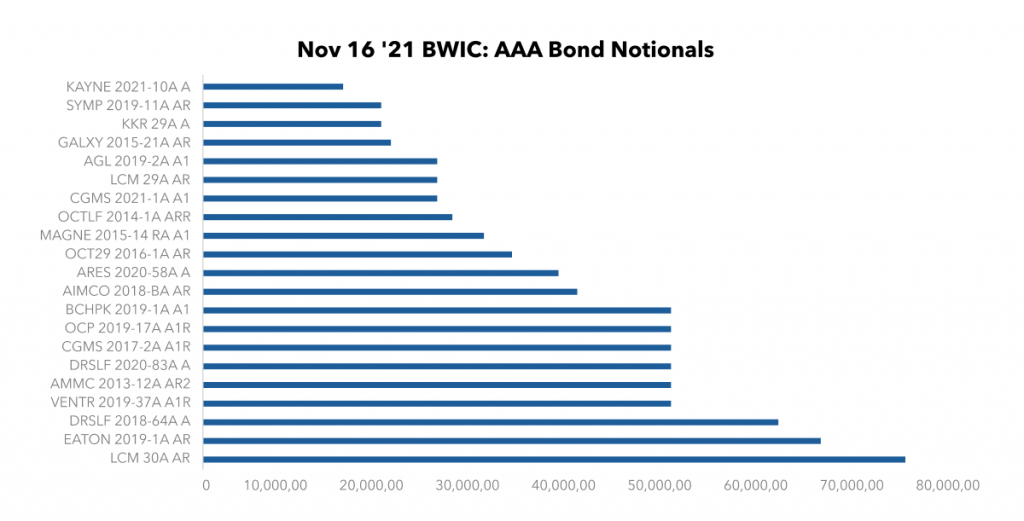

21 AAAs, none perfectly alike

Of the 21-line items, the average position size is $38 million with some large positions including a $75 million LCM bond and a $66 million Eaton Vance 2019 vintage CLO.

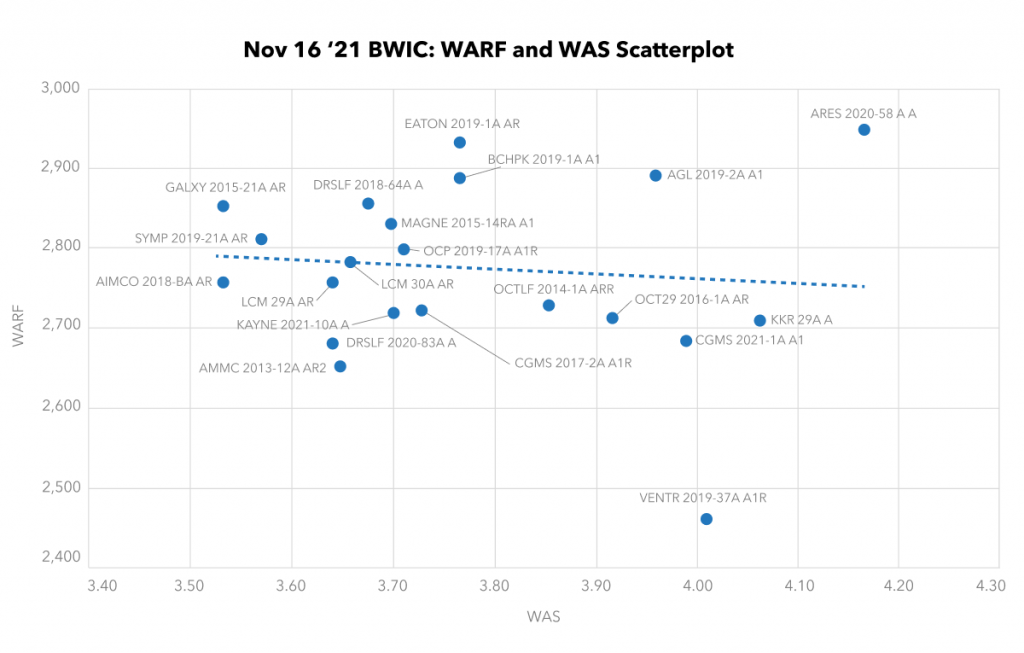

Over 80% of the listed bonds are short dated, with reinvestment periods 3 years or under. Weighted average spread (WAS) ranges from 3.53% to 4.18%, with an average of 3.78%. Weighted average ratings factor (WARF) ranges from 2,460 to 2,944 with an average of 2,772.

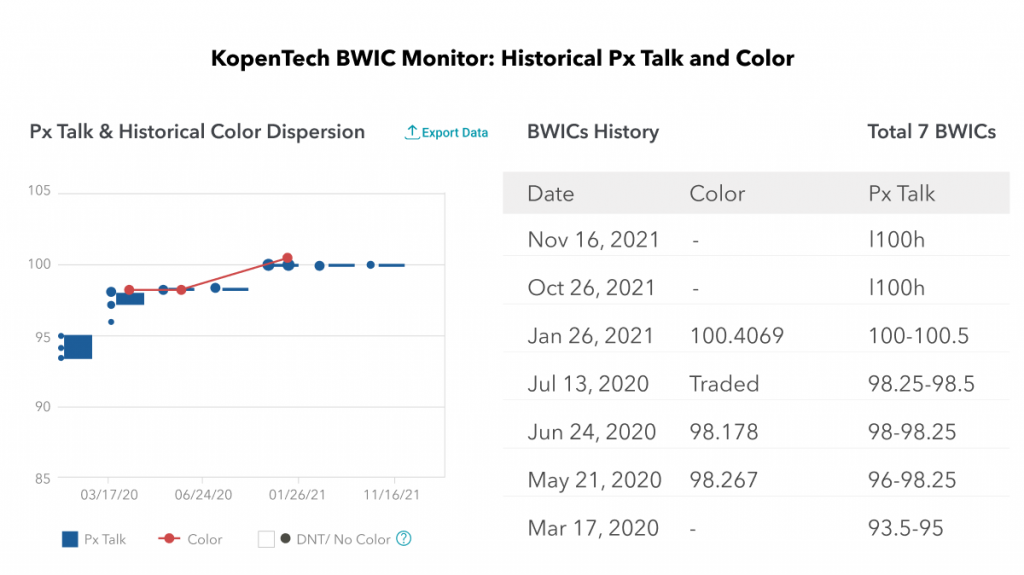

These bonds look familiar…

Most of the bonds have traded previously in the secondary market. Utilizing KopenTech’s database of that consists of over 7 years of BWIC statistics, we can see historical price talk and color for many of these CUSIPs. Below is historical trading data for one bond on this BWIC: Blackstone/GSO’s Beechwood Park, a 2019 vintage AAA. This bond has been offered via BWIC 7 times over the last 18 months, according to the KopenTech database.

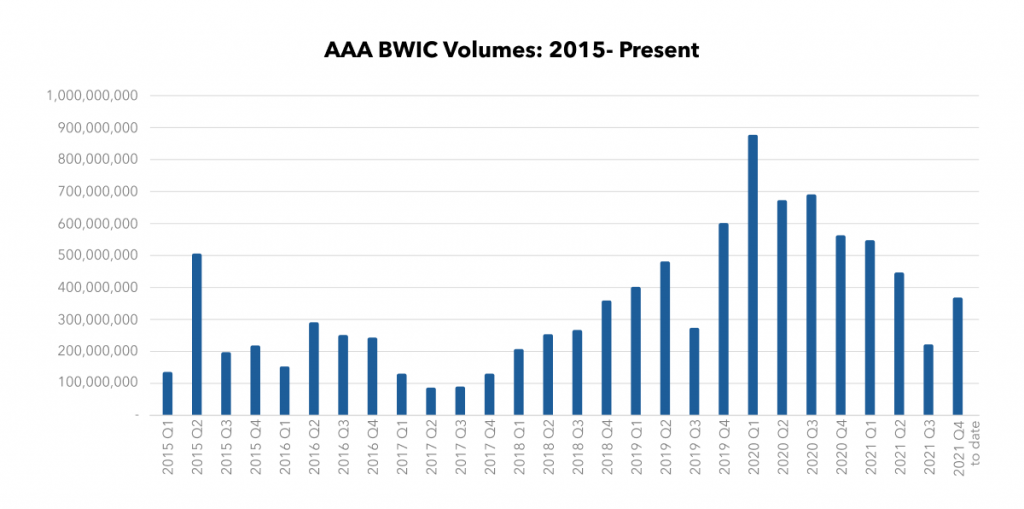

In recent years, BWIC trading across the capital stack has increased at a rapid pace. The largest quarterly volume was during Q1 of 2020 when the coronavirus pandemic hit with nearly $9 billion AAAs on BWIC. The Q4 2021 has already seen $3.7 billion posted compared to $2.2 billion in Q3 with several weeks of trading before the end of the quarter.

Putting large AAA days in perspective

On average over the last several years, $75 million of AAAs are put on BWIC daily, making this listing nearly 11 times larger than the daily average. Of the top 10 largest AAA BWIC days, 3 have been in 2021, as indicated by the light blue bars.

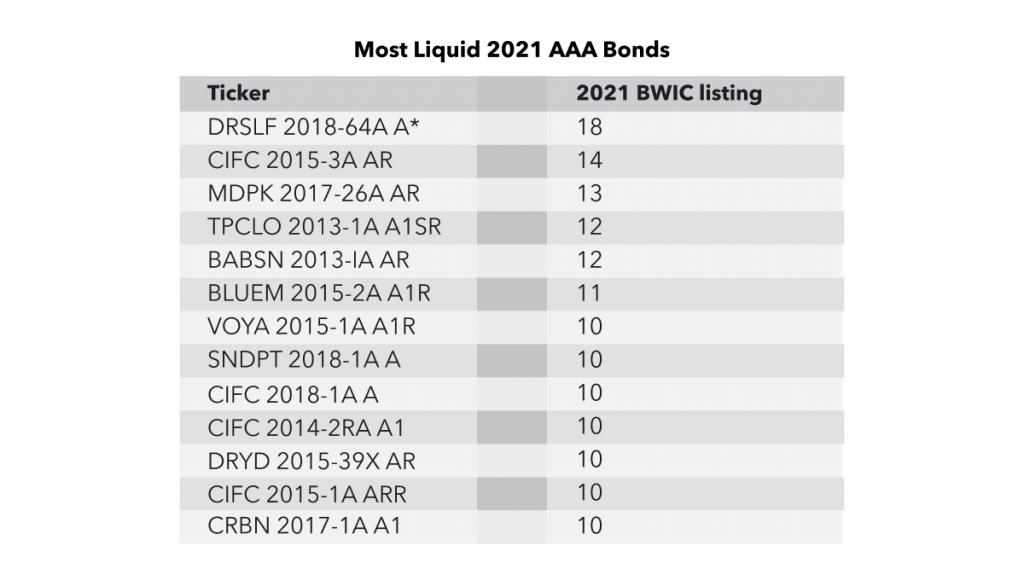

AAA bonds which top 2021 liquidity rankings trade 10 times or more. Some bonds change hands upwards of 18 times, including DRSLF 2018-64A which is on the $818 million November 16 BWIC*.

For more information and data, log in or sign up at kopentech.com.