CLO Market Trends: March 2024 Edition

Steady $2.9BN US BWIC trades volume amid surging refi/resets ($8.99BN/$10.70BN)

BWIC Volumes

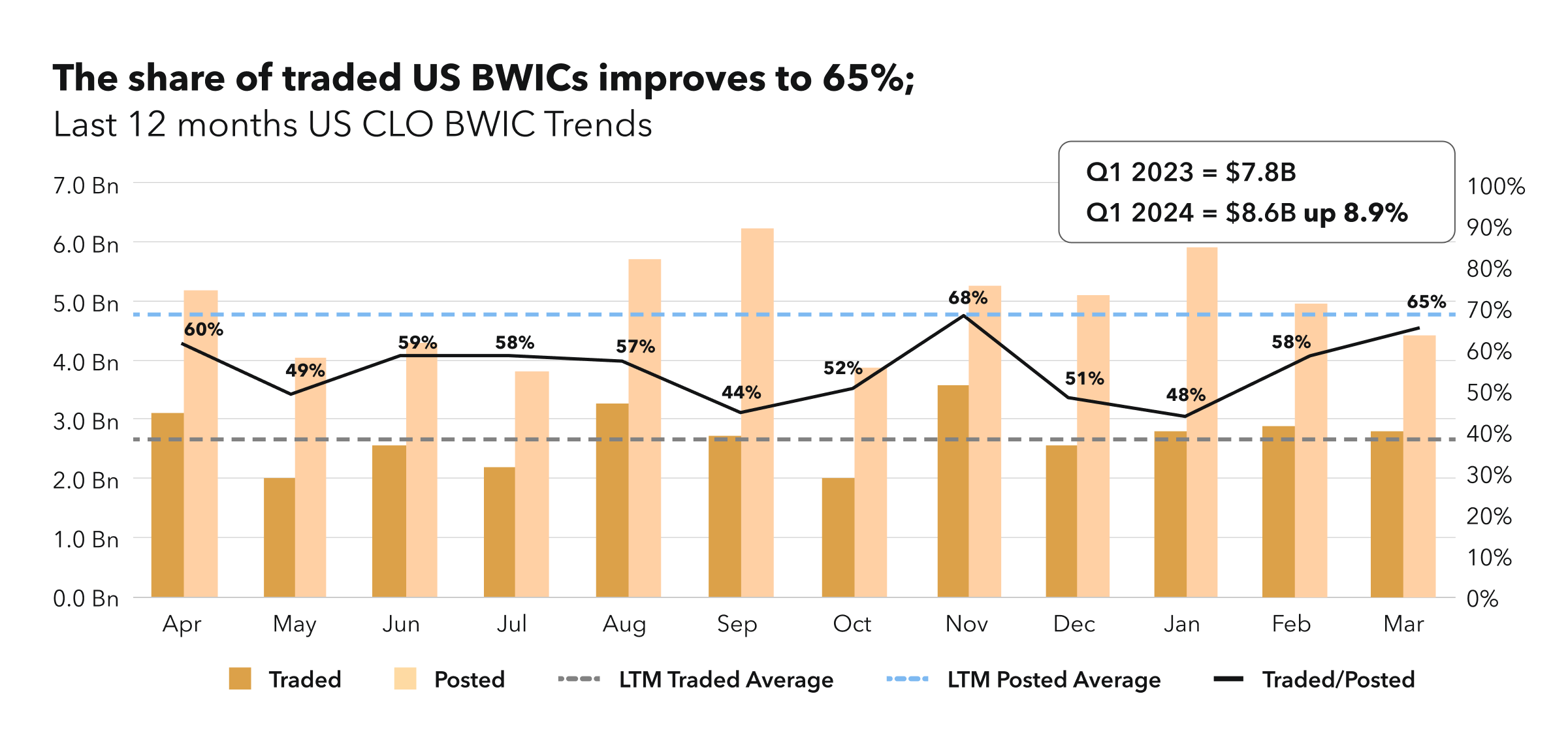

US BWIC volumes keep falling below January highs for posted volumes, but traded volumes stay consistently above LTM averages. There were $4.4 BN posted, of which $2.9 BN traded, creating the 65% traded to posted ratio.

BWIC Volumes by Rating & DNT rates

The traded volume breakdown by rating shows highest monthly AAA volume since November last year, and the second monthly AAA volume in last twelve months. Other investment grade tranches were lower than their respective LTM averages, but with AAA volume of $1.9 BN IG share of securities took up 83% of total traded volume.

There has been a lot of liquidity in the AAAs, which might be attributed to a fairly new ETF buyer in the marketplace.” – Michael Shinners

The DNT (Did Not Trade) rate across the US BWIC stack remains inconsistent, with most tranches exhibiting lower DNT percentages than the Last Twelve Months (LTM) average, excluding the AAA, AA, and equity tranches. The DNT rate for AA-rated securities has decreased since February to 10%, yet this is still double the LTM average of 5%. Furthermore, there is an increase in the transparency of trade color, particularly noticeable in the BB tranche where 87% of traded securities now disclose their color, an improvement compared to previous averages.

TRACE Volumes & Dealer’s inventory

Similar to trends in BWICs, TRACE volumes have continued to decline from their January peaks. Investment Grade (IG) volume has decreased to $13.5 billion, falling below the Last Twelve Months (LTM) average. Conversely, High Yield (HY) volume has risen from February levels to $4.9 billion, now constituting 26.5% of the total volume. Despite these shifts, high-activity trading days are frequent, with 10 days this month recording traded volumes exceeding $1 billion. Additionally, the BWIC/TRACE ratio for IG and HY has diverged, currently standing at 18% and 10%, respectively.

Prices Across the Stack

US BWIC prices are unchanged except for a part of the capstack: single As and BBBs show highest average cover levels LTM. Average numeric color for AAA tranche stays above par, at 100.14 cents on a dollar.

“There has been a strong demand, with roughly 40% of loans priced at par and tightening of the manager tiers.” – Michael Shinners

Primary Issuance

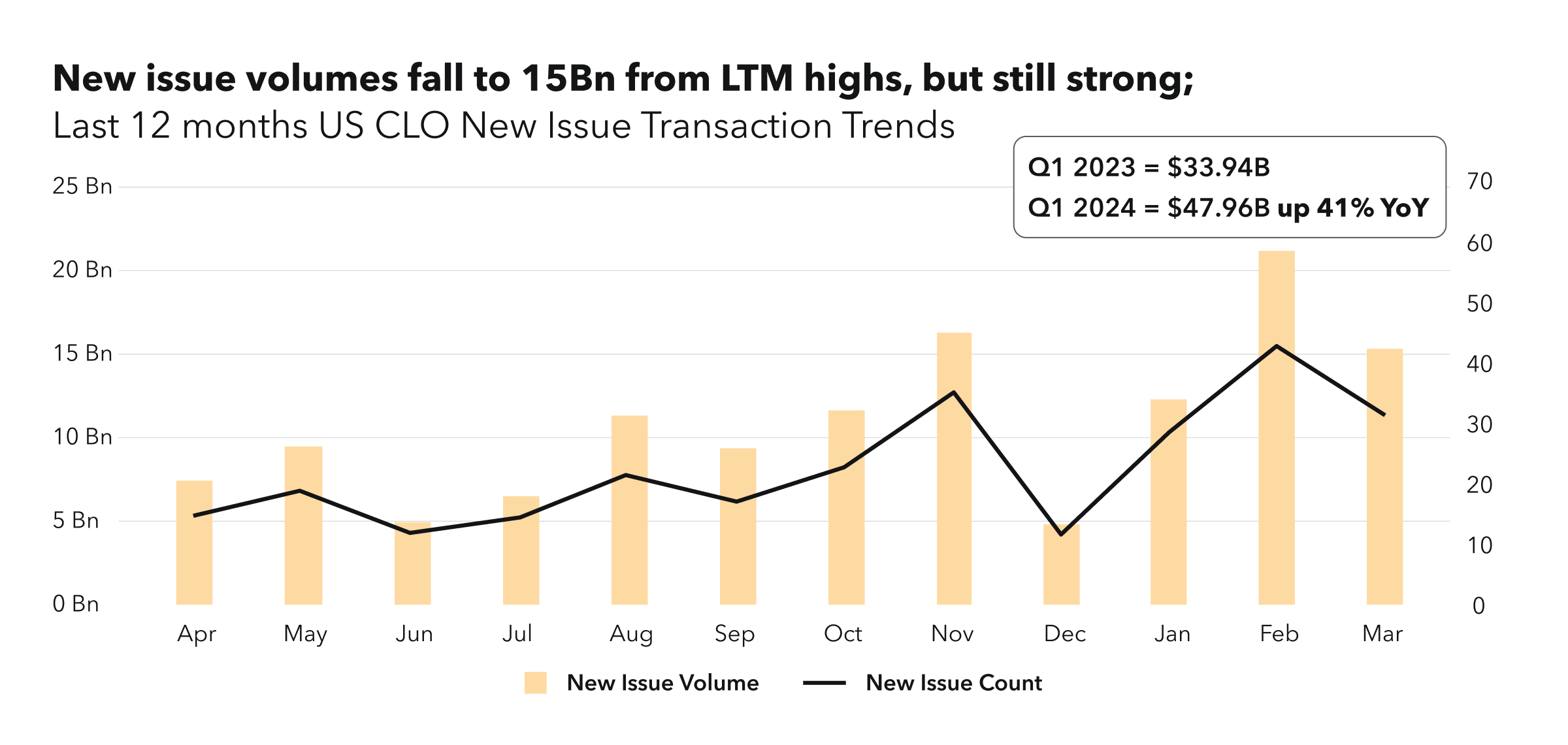

New Issue monthly volumes fall slightly compared to February highs, but still remain the third highest right after November volumes, currently at $15 BN. New issue US spreads are stabilizing, ranging 150-165 bps. The share of short deals in total issuance keeps increasing, currently at 20%. Refinancing and resets are surging, with $10.70 BN priced resets and $8.99 BN priced refi deals in March. This is a 91% increase for the refies compared to last month.

“Given spreads levels in primary, there still will likely be very active volume in the refi/resets in the foreseeable future.” – Michael Shinners

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on May 7th for Market Trends Webinar and register here.