CLO Market Trends: July 2022 Edition

Guest Speaker: Allan Fan, Credit Suisse Asset Management

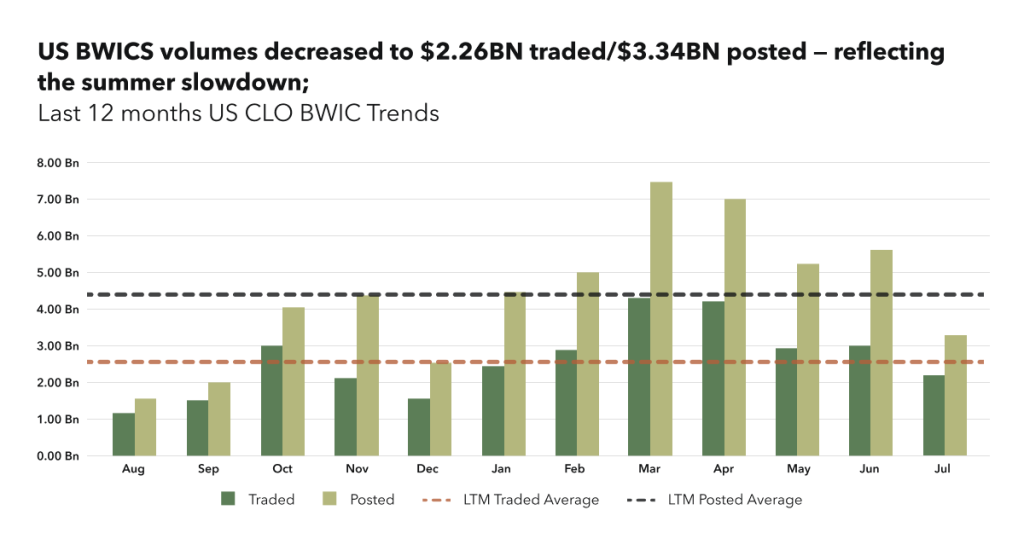

BWIC Volumes

July BWIC volumes are down from last month due to the SF Vegas conference which took market participants away for a week and a general summer slowdown. With $2.26BN trades/ $3.34BN posted, year to date volume is still tracking 43% higher at $22.18BN traded versus $15.48BN in 2021.

TRACE Volumes

TRACE volume is down 37.6% month over month for the same reasons with

$10.53BN in July, however, year to date, we are still up 39% compared to last year.

Secondary trading for HY decreased in the month of July with volumes being driven

by investment grade tranches.

BWIC Volumes by Rating

BWIC volumes also continue to be driven by IG-rated tranches, however IG dropped

from 93% to 86% of total traded. This is due to a drop in AAs with only $.16BN

traded versus $.55BN in June. Total AAAs traded is flat to last month at $1.32BN.

“AAA volume week by week was consistent during the month (except the Vegas

week). BBs are more interesting, volume was high the first 2 weeks, before BBs gapped tighter.” – Allan Fan.

Dealer’s Inventory

Dealer net flows show clients buying $529.07MM. Dealers added $1BN in April, and

it seems they are continuing to de-risk.

“On the BB side, in the last 2 weeks of July, supply dried up, together with the loan rally, buyers had no other choice but to start to lift dealer offers”. – Allan Fan

DNT Rates

BWIC DNT rates in AAAs drop to 20%, and As, BBBs, BBs and Equity all saw higher than average DNT rates. There were no trades in B and CCC.

“Bs generally have poor liquidity, there’s probably an even smaller buyer base in Bs than equities.” – explains Allan Fan

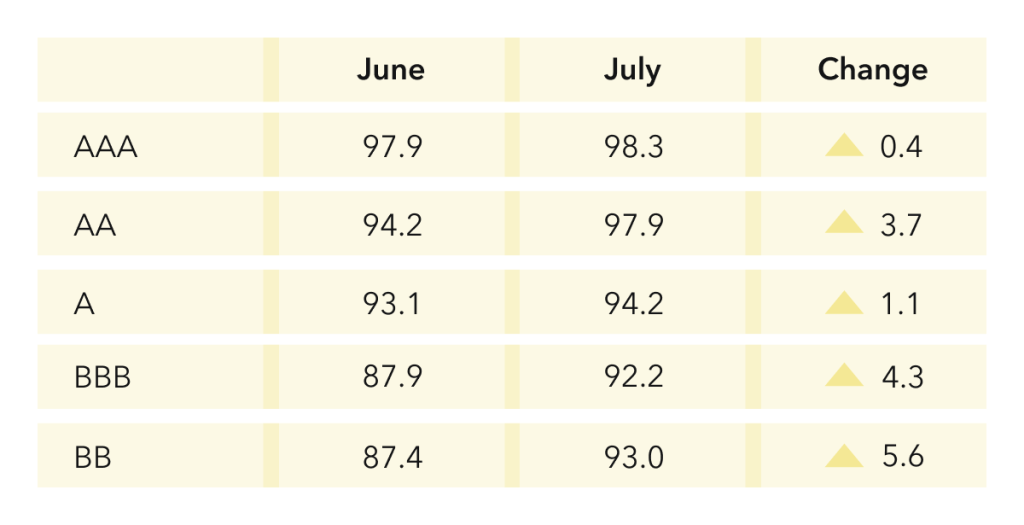

Prices** Across The Stack

Prices increased, especially in lower mezzanine: BBs were up 5.6 points and BBBs had a big move of 4.3 points. The move up across the stack can be attributed to the underlying loan market which rallied almost 2 points.

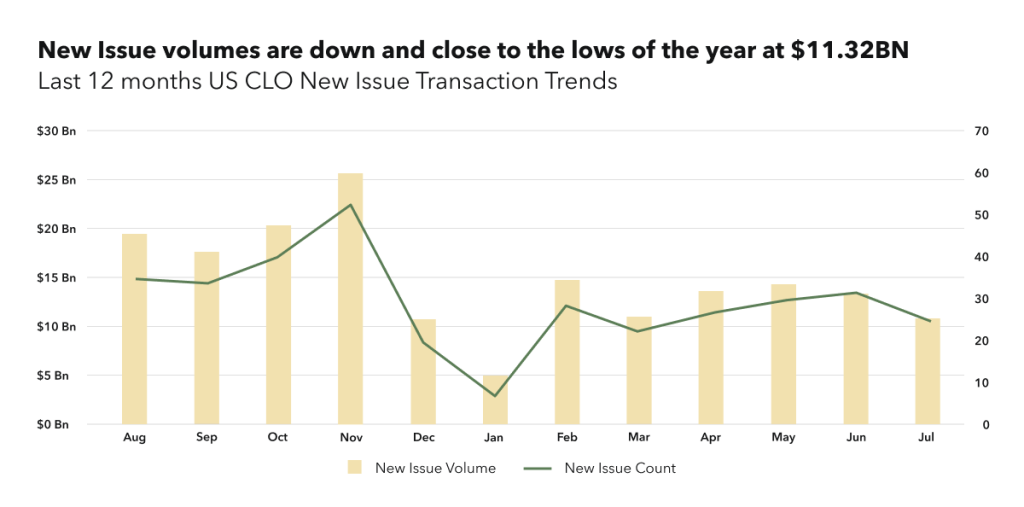

New Issue

New issue AAA spreads for short (<3.5yr of reinvestment) versus long (>3.5yr of reinvestment) inverted in March but flattened in July. Very few 5yr reinvestment transactions were printed, and the “long” deals are now 4 years of reinvestment. AAA dispersion has increased in this extremely volatile market, most AAAs have moved in the opposite direction of the loan market, and were 15-20 bps wider in the 208-217 range, in terms of spread. Discount margins were reported in 240-290 range given most new issue AAAs in July had some OID.

“The biggest issue that everyone knows is the lack of sizable and significant AAA bids. US banks were very active in adding AAAs last year, it doesn’t look like they are coming back, and it is a big loss for the market. The European new issue market looks even worse: it has no AAAs. However, we saw a decent amount of European new issues done in August which is pretty encouraging going forward.” “While most of the year, secondary was wider than primary, secondary top tier is now +195 to SOFR at a 97-to-98-dollar price, while primary is at 210 to 225. Taking into account the value of the discount, the value (new issue to secondary) is somewhat comparable.” – Allan Fan

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on September 8th for Market Trends Webinar and register here.