CLO Secondary Market Trends: June 2021 Edition

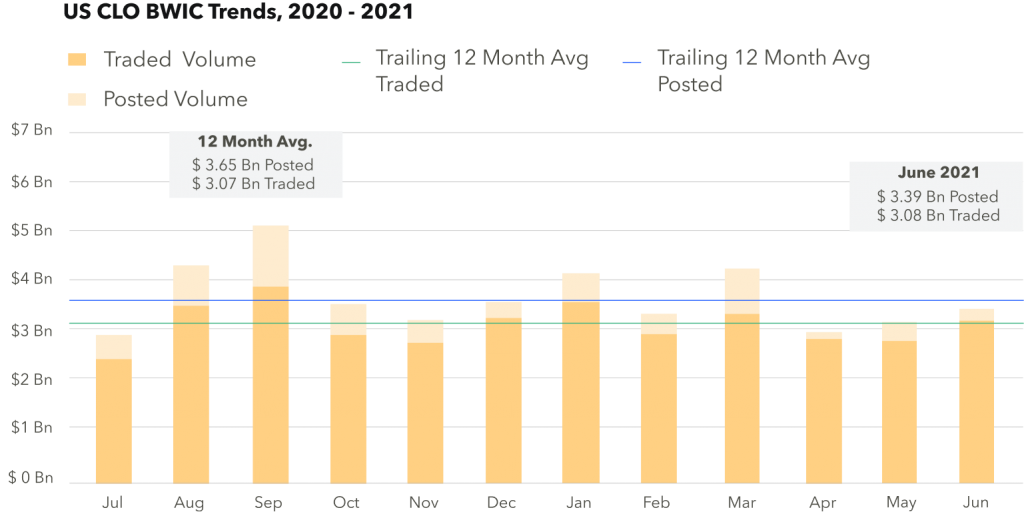

BWIC Volumes

June BWIC volumes continued to rise since April’s low. Posted and Traded volumes were $3.39 Bn and $3.08 Bn respectively. We also saw the trend of high ratio of successful BWICs continue this month.

TRACE* Volumes

Reported CLO trading volumes were $10.3 Bn in June, down almost $1 Bn from May. This marks a 12-month low for IG + HY trading volumes.

BWICs as % of TRACE

IG-rated tranches executed via BWICs rose to 47% of TRACE, setting a record for the last 12 months. HY tranches on the other hand dropped to 12%, the second lowest % of TRACE volume.

BWIC Volumes By Rating

In June, AAA tranche trading more than doubled to $1.62 Bn since May, but stayed lower than the trailing 12-month average of $1.82 Bn. Except for B/CCC and equity, volumes were below average across the capital stack.

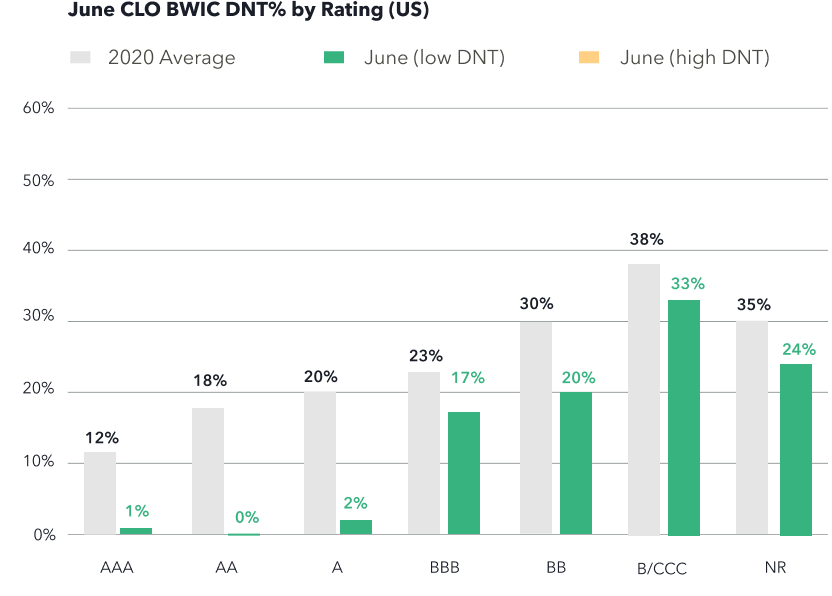

DNT Rates

CLOs continued their trend of low DNT%, with 99% of AAA BWICs trading. 100% of AA and 98% of A BWICs also traded. Average DNT rates across the stack remained significantly lower than average, indicating strong demand.

Dealers Inventory

Dealers were net bond sellers in June with an outflow of $15 mm. In 2021, dealers have been net sellers every month, except for May when $271 mm were purchased from clients.

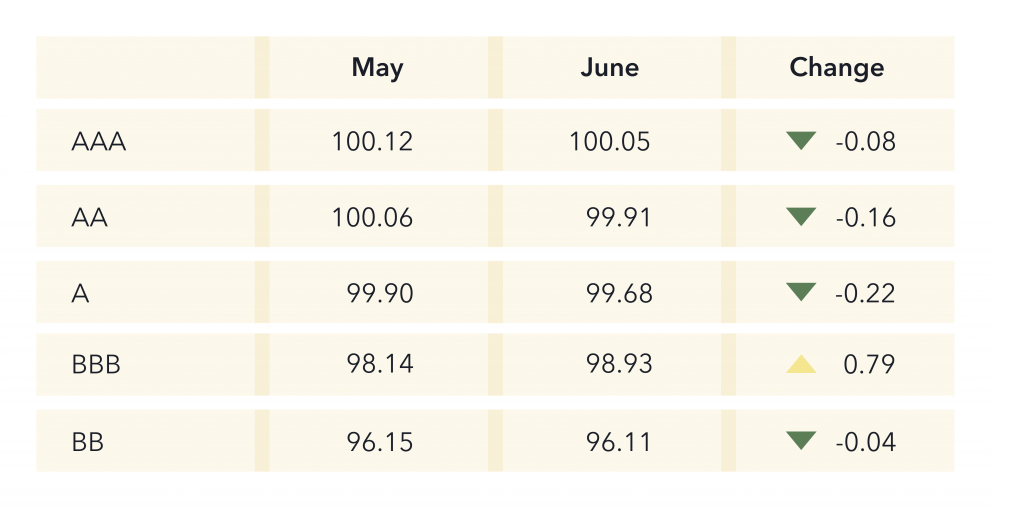

Prices** Across the Stack

Prices decreased across the stack, except in BBB bonds where we saw a strong increase.

Catamaran CLO 2014-1 Refi Marks Largest Secondary Trade

Trimaran’s Catamaran CLO 2014-1 made waves this month with the successful refinancing of its $427.3 mm AAA tranche via AMR online auction. This set the bar for the largest historical secondary transaction in CLO trading history. The refi lowered the weighted average cost of debt by 17 bp, while the AAA tranche was reduced from L+126 to L+110. More exciting AMR news is expected as demand continues to grow and 17 broker-dealers are now on the platform.

*TRACE reports all CLO trades involving FINRA members.

**Prices are based on trades that provided color and are likely to underestimate actual traded levels.