CLO Market Trends: January 2024 Edition

Monthly TRACE volumes are highest since 2020, with BWIC volumes climbing above LTM averages. New issue supply is at the record highs.

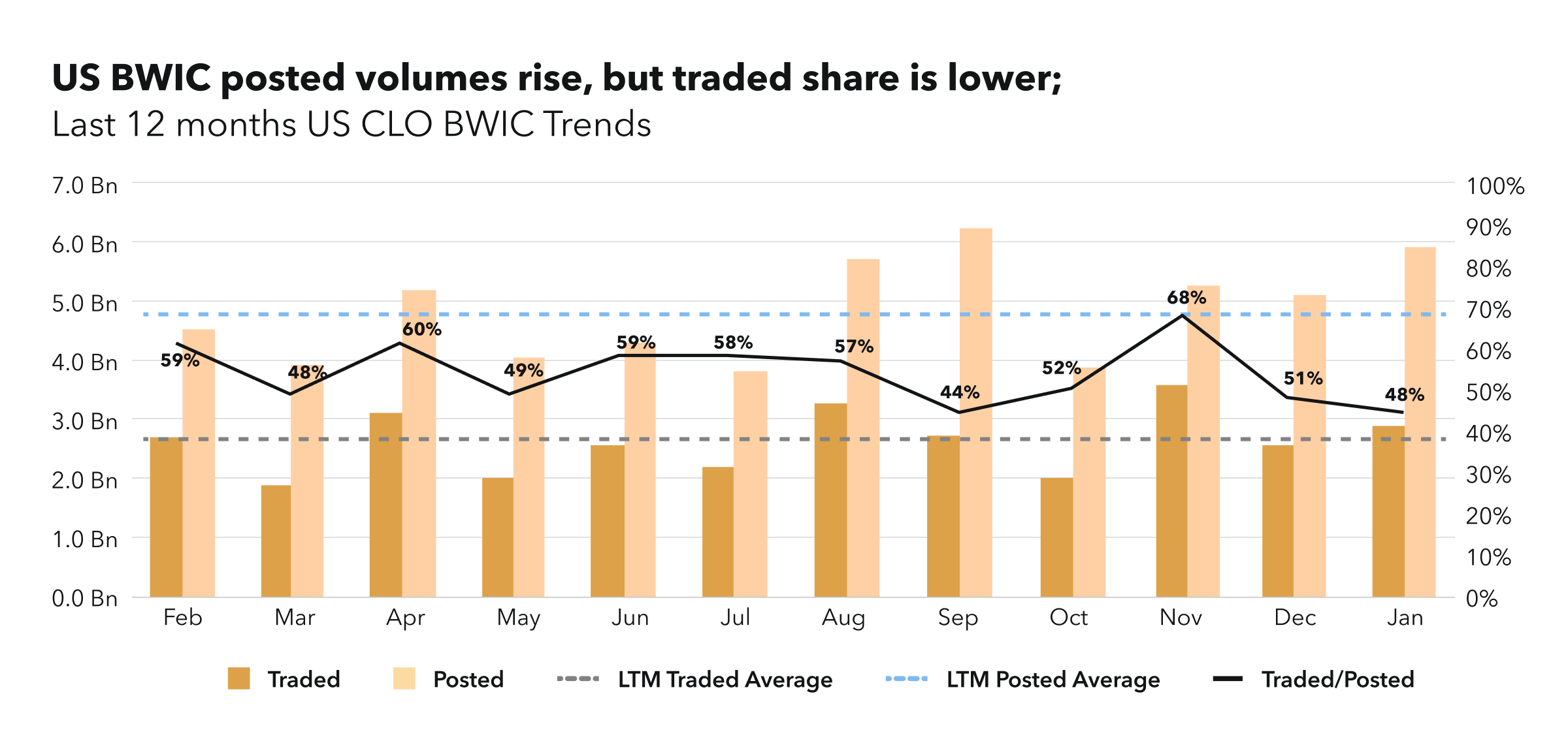

BWIC Volumes

US BWIC volumes increased above LTM averages, but the share of traded volumes is lower than previous quarter. There were $5.9 BN posted, of which $2.8 BN traded.

“January saw the short term rate market peaked and equity market making all-time highs.” – Yuan Zhou

BWIC Volumes by Rating & DNT rates

The traded volume breakdown by rating shows January BBBs and BBs were much higher than respective average LTM volumes. In fact, BBB traded volumes were the highest since November 2022. On the contrary, AAAs showed the lowest monthly traded volume in LTM, with only $731 MM traded. With this, investment grade trading accounted for 65% of the total January volume.

DNT rate is uneven across the stack for US BWICs, with DNT% almost nonexistent for AAAs and AAs. The share of deals that did not provide color increased compared to LTM averages, with 69% for AAAs and 42% for AAs.

“Back in October the lower part of capital stack didn’t see much trading volume due to wide levels, but by January market recovered.” – Yuan Zhou

TRACE Volumes & Dealer’s inventory

TRACE volumes have surged to their highest level since March 2020, with $26 BN traded in January. Both IG and HY were highest LTM, with $20.9 BN and $5.1 BN traded respectively. 15 days are reporting higher than 1 BN. The BWIC/TRACE ratio falls for IG, but increases for HY (now at 20%). On the dealer inventory side, dealers are still buying, with net flow at $192 MM.

Prices Across the Stack

US BWIC prices are at their highest since 2022 for a big portion of the capstack: AAAs through As and BBs show highest average cover levels LTM, and BBBs are not far behind December. AAAs average price is slightly above par, at 100.06 cents on a dollar.

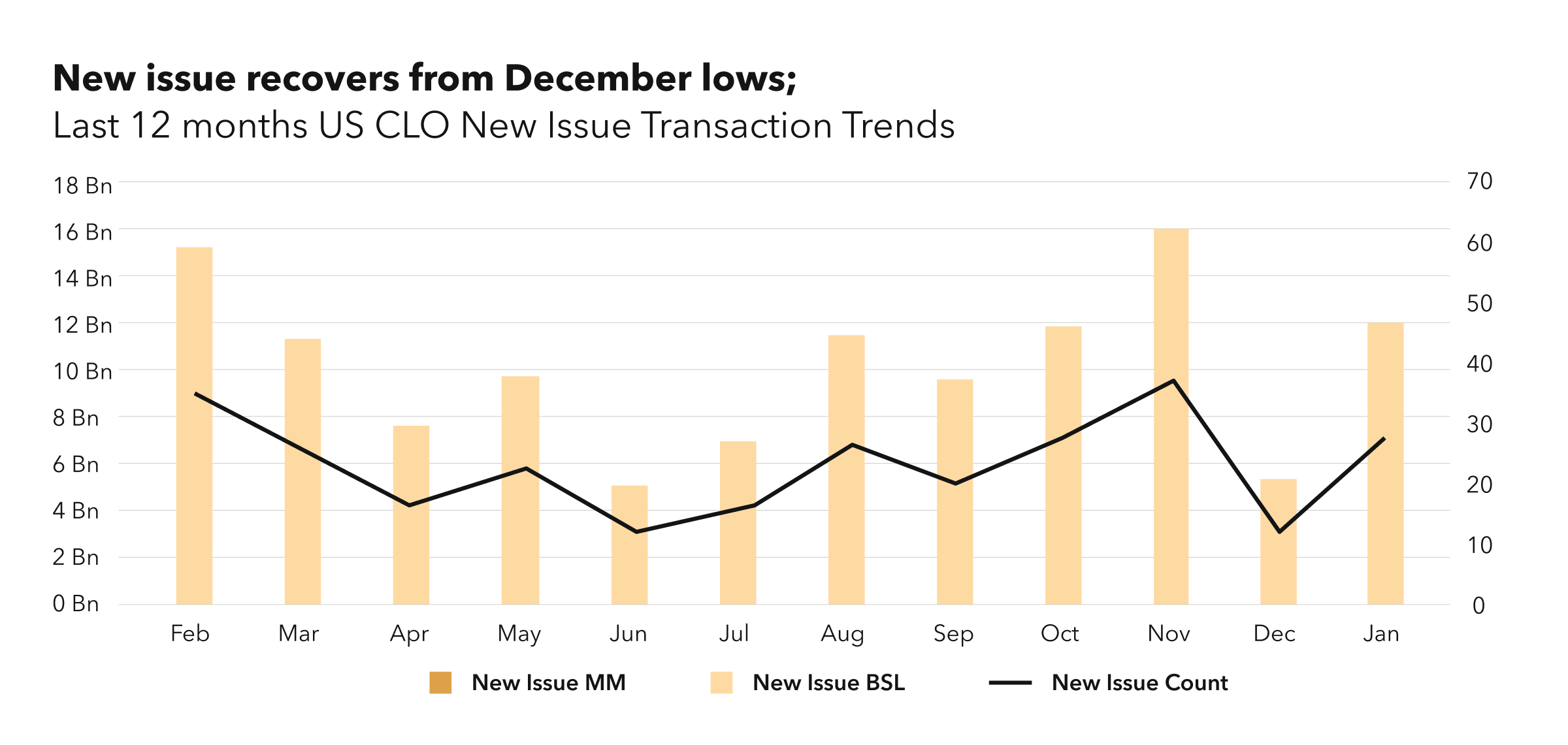

New Issue

New issue volumes rise once again, reaching the highest supply ever achieved in one month, surpassing $12 billion across 28 newly issued deals. The portion of short deals in total issued volumes dropped, now taking up only 9% of the total issuance. There has been a notable tightening in US AAA spreads for longer BSL transactions, with the lower end of the range reaching 148 basis points. The spreads have not been this low since May 2022.

“Middle market CLOs are becoming more and more popular, so the spreads are expected to tighten over time for middle markets.” – Yuan Zhou

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on March 5th for Market Trends Webinar and register here.