CLO Market Trends: October 2022 Edition

Volatility continues to drive higher trading volumes, new issue is close to 2022 lows.

Guest Speaker: Dagmara Michalczuk, Tetragon Credit Partners

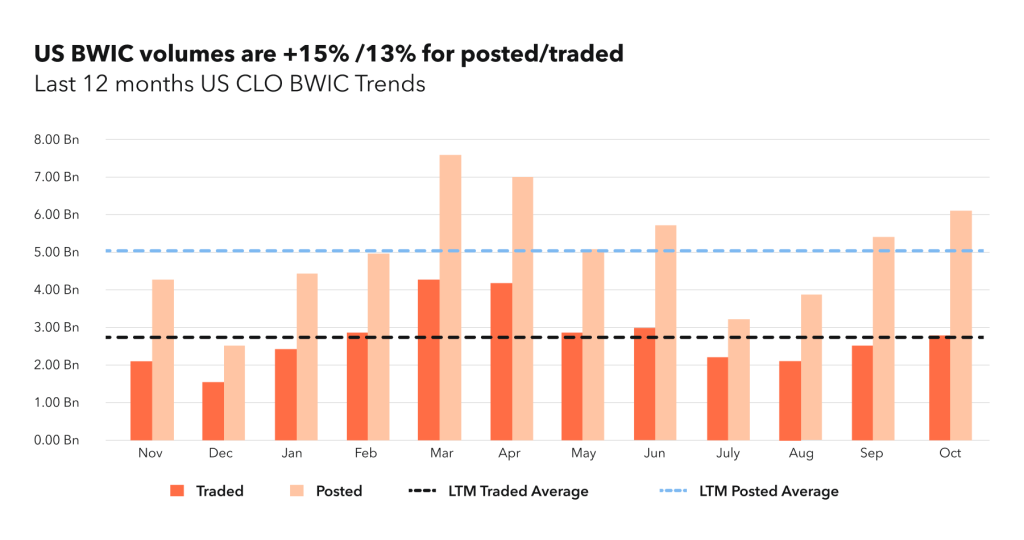

BWIC Volumes

A shaky US economy continues to drive price volatility and as a result, trading volumes continue to rise. US BWIC volumes are up +15% for posted and +13% for traded. However, the biggest move we saw was in Europe, BWIC traded volume was up 77% to $1.67BN, still shy of the US market of $2.86BN but a significant jump. In the US, year-to-date volume continues to track 41% higher with $29.72BN traded in 2022 versus $21.11BN in 2021.

“The big exogenous event in the market is liquidity seeking by UK pensions, first reported last month… and likely is the biggest driver of the pickup in October volumes.” – Dagmara Michalczuk.

BWIC Volumes by Rating

October saw a return to normalcy as it relates to the composition of BWICs with investment grade tranches rising from 71% to 84% of total. This is due to a significant decrease in mezzanine activity.

“Typically, when we see volatility rise and bid-ask spread widening, BWIC trading in lower tranches may not be the ideal way of price seeking.” – Dagmara Michalczuk.

TRACE Volumes and DNT rates

TRACE volumes continued to climb to $23BN and are up 43% from September. Given lower prices this month, US BWIC DNT rates noticeably rose with the B-rated tranches peaking at 80%.

“Volatility in the loan market caused spillover volatility in long-duration tranches and CLO equity resulting in trade activity decline.” – Dagmara Michalczuk.

Dealer’s Inventory

Dealer net flows show banks buying $240MM from clients. This is the second month in a row of dealer buying, though not nearly as large as the $1.6BN purchased from clients in September.

Prices Across the Stack

Prices are down across the stack hitting LTM lows. The most noticeable drop was in lower mezzanine: BBBs were down 4.1 points and BBs were down 5.33 points.

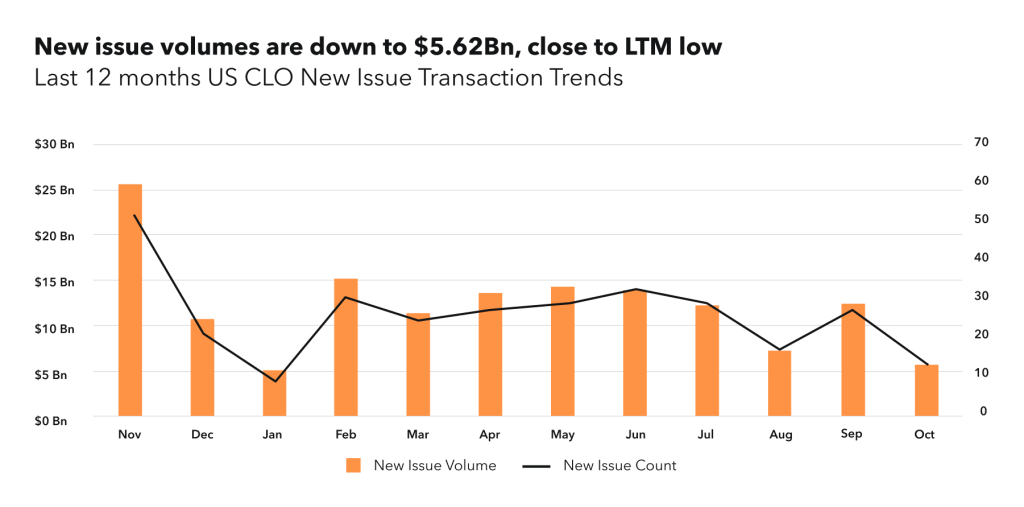

New Issue

New Issue CLO volumes are down to $5.62BN for October, close to LTM lows. The last time we were here was during the LIBOR SOFR transition in January where there was $5BN in new issue. However, YTD issuance for 2022 is at $111BN, only down 25% from last year the record of $150BN, and significantly higher then 2020. So, taking all the headwinds into consideration, the new issue market is holding up.

“I expect a total of $120BN in CLO issuance this year and $100-$110BN for 2023.”

– Dagmara Michalczuk.

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on December 13th for Market Trends Webinar and register here.