CLO Equity Liquidity Rises

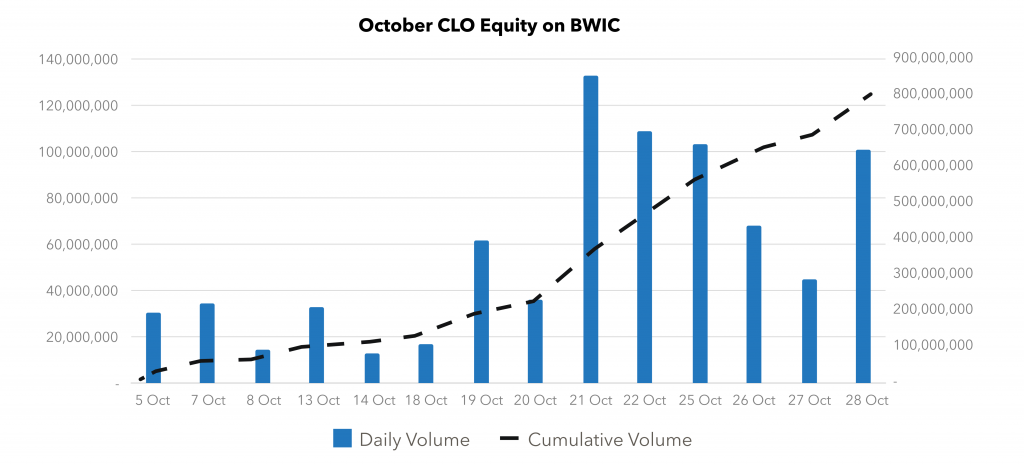

While October started out slow, the second half of the month saw over $660 million of equity in for the bid bringing the total to $780 million.

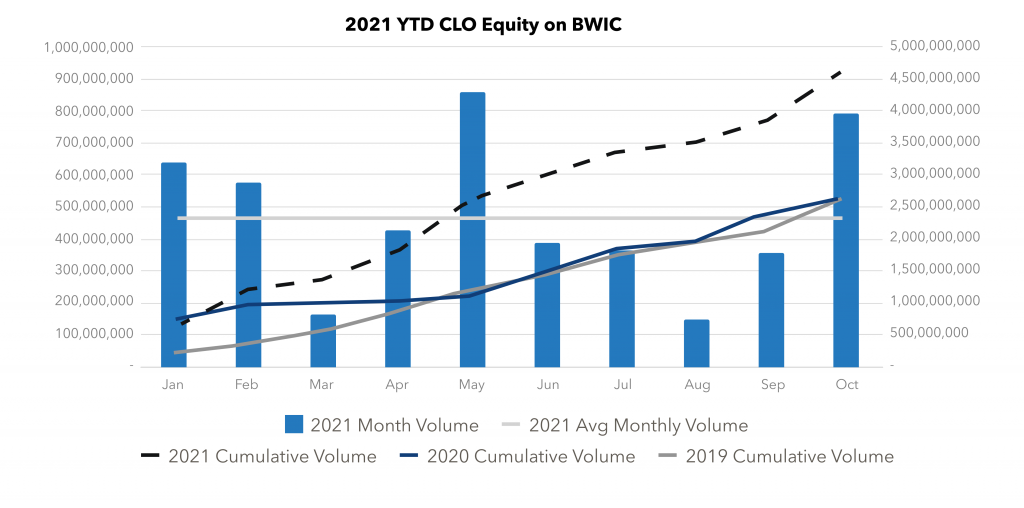

Half of the volume has been this week with $348.5MM of CLO equity in BWICs. This brings the cumulative total to $4.5 billion for 2021. Compare this to 2019 and 2020, which had a total annual traded volume of $0.9 billion and $1.5 billion, and we see 2021 CLO equity volumes are up 93% YTD. This is a major breakthrough for the asset class and a welcome development for equity investors.

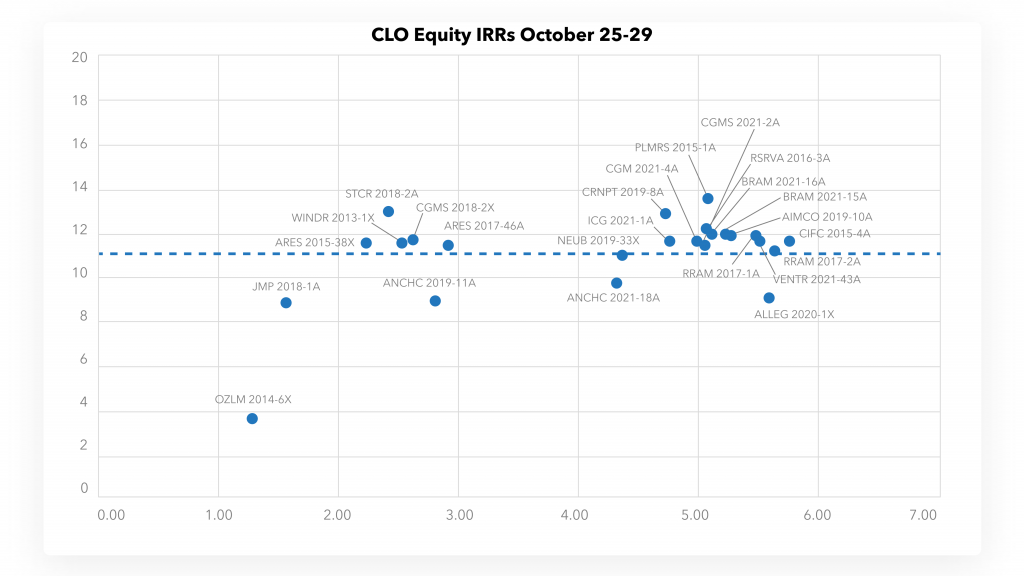

This week CLO equity BWICs had 25 trades with public color. Applying standard secondary market valuation assumptions*, CLO equity traded better, at an average IRR of 11.1%. In comparison, trades conducted October 1-22 had an average equity IRR of 12.4%. In total, October 2021 saw 52 CLO equity trades with public color. The range of IRRs was 3.7% to 19.2% with an average of 11.8%.

Get more information on upcoming BWICs and sign up for free at bwic.kopentech.com.