AMR Refinancing Results: Catamaran CLO 2014-1

KopenTech is pleased to announce the successful refinancing of Catamaran CLO 2014-1 LTD., managed by Trimaran Advisors, via an AMR auction on June 23, 2021. The auction featured the largest CLO transaction to ever be refinanced on the AMR platform, as well as significant participation from the CLO broker-dealer community. Trimaran’s CRMN 2014-1 is a $665mm CLO which is significantly higher than an average $400mm CLO transaction. Successful refinancing amid the investor fatigue caused by high issuance and elevated volumes of refis and resets is a further testament to the success of the AMR.

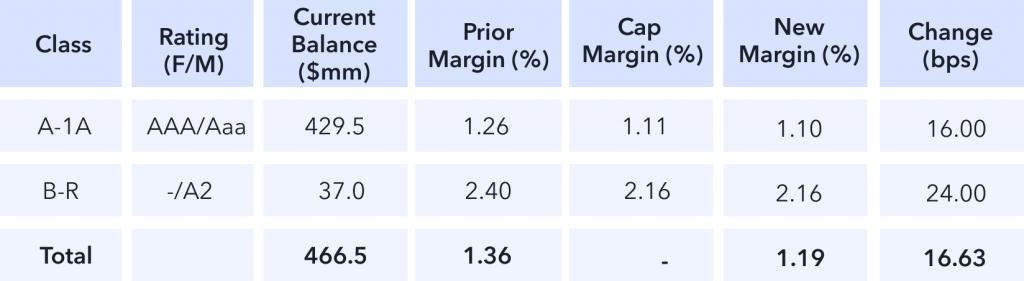

Catamaran CLO 2014-1 had two tranches available for refinancing: A-1A (Aaa-rated by Moody’s and Fitch) and B-R (A2-rated by Moody’s). A-1A was a $429.5 million tranche which received $478 million in bids resulting in a 1.11x oversubscription. B-R was a $37 million tranche which received $37 million in bids. In total, over $515 million in bids were submitted to the KopenTech platform for the Catamaran CLO refinancing, with the auction being 1.10x oversubscribed.

Overall, the AMR auction reduced the weighted average cost of debt for the CLO by 17 bps. The A-1A tranche was the largest AAA tranche to have ever been up for AMR auction. In fact, since AMR is a secondary trade, this print also broke all historical BWIC records. This is the largest AAA print in the secondary market since we started to track BWICs in 2014.

The Catamaran CLO 2014-1 AMR auction was the fourth successful AMR auction hosted on KopenTech’s platform in 2021 and the fifth since the auctions started in 2020. The first AMR auction took place in January 2020 and while refinancings were temporarily halted by the Covid crisis, they quickly returned once market conditions stabilized.

AMR Sees Strong Investor Demand

In total, the KopenTech AMR platform has refinanced over $1.78 billion in CLO AUM with just over $4.1 billion in total bids received and total oversubscription being 2.35x.

AMR is currently embedded within 15 deals, representing over $6.5 billion in AUM. The feature continues to gain traction among investors, with platform now boasting 17 broker-dealers.

The AMR feature has been especially appreciated by investors in 2021 when ratings agencies backlogs caused delays to many refinancings. Bidding wars for a better place in line at the rating agencies are not a factor in AMR transactions where the original CUSIPs are maintained, thus removing the need to obtain tranche ratings.

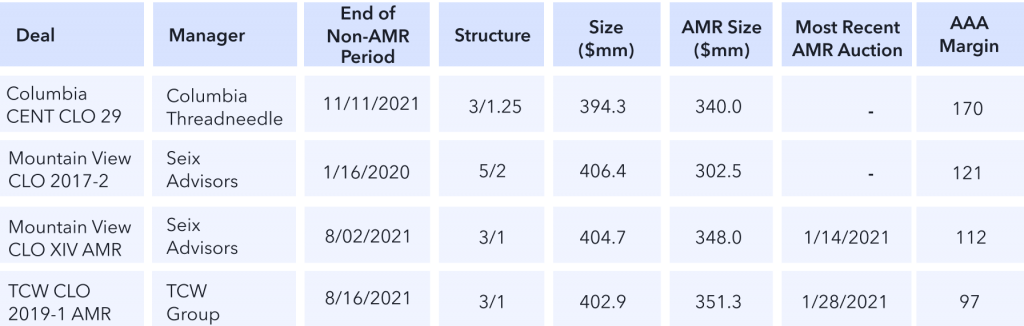

KopenTech expects that additional online refinancings might occur this year given the current market conditions. In addition to Catamaran CLO 2014-1 LTD., four CLO transactions with the AMR feature are currently out of their non-call period, totaling a potential $1.851 billion that could be up for auction on the platform. Potential candidates for AMR refinancing are listed below.

This is intended solely for institutional investors and broker-dealers.