CLO Market Trends: June 2022 Edition

Prices fall across the stack and new issue spreads continue to widen

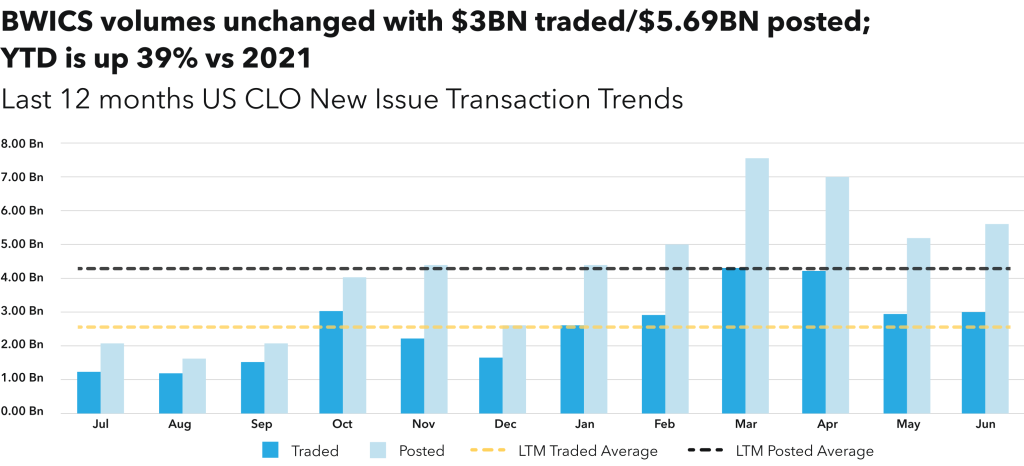

BWIC Volumes

June BWIC volumes remained unchanged vs. May, with $3BN traded/ $5.69BN posted. YTD secondary BWICs are tracking at $19.93BN, 39% YoY increase. BWICs continue to be driven by IG-rated tranches with 93% of the total. AAAs tranches traded stood at $1.28BN.

DNT Rates

BWIC DNT rates are higher than their historical averages in AAA, A and BBBs pointing to market softness. However, June marks quarter end and we observe consistent spike in DNT rates pointing to the fact that clients could be using BWICs for price discovery and marking purposes.

TRACE Volumes

TRACE volume is $16.88BN in June, which is slightly down from May, and we continue to see this driven by investment grade.

Dealer’s Inventory

Dealer net flows are flat with clients selling $49MM, continuing minor de-risking which started in May.

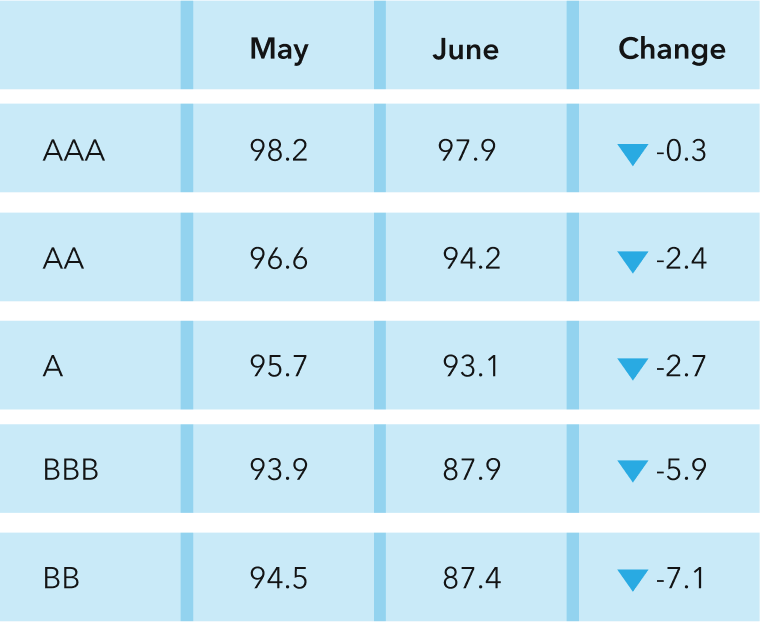

Prices** Across The Stack

Prices fell across the stack in June with the biggest move in BBs which are down 7 points. BBBs had a big move as well down 5.9 points. The spread basis between BBBs and BBs has tightened; on price-basis, they are almost flat now, at $87.9 and $87.4 respectively.

**Prices are based on trades that provided color and are likely to underestimate actual traded levels.

Equity Returns

CLO Equity trading is returning, with 22 trades in June. Of those trades, 10 provided color. As such, we calculate the IRR median to be 19.71%, based on standard secondary market pricing assumptions. Most of these tranches had longer reinvestment periods remaining which makes it advantageous for the buyer as there is more time for the manager to trade and improve equity returns.

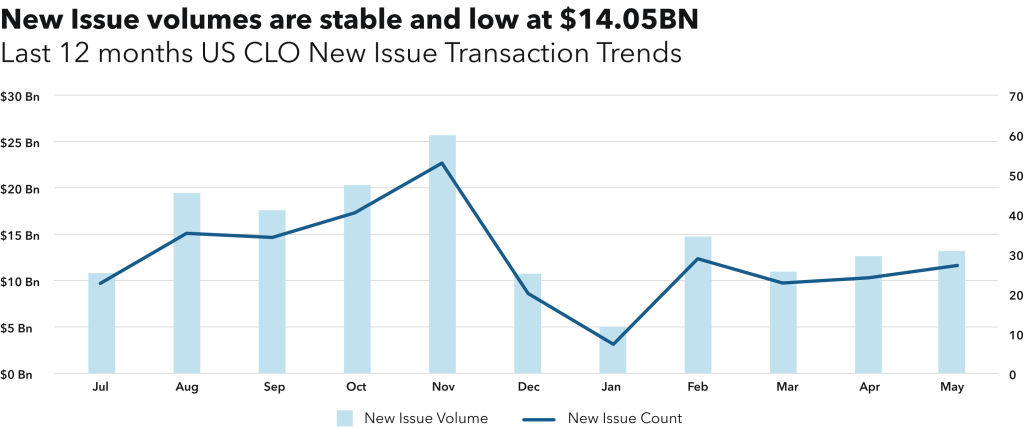

New Issue

New Issue CLO volumes are stable and low at $14.05BN. New issue AAA spreads for short deals (<3.5yr reinvestment) versus long deals (>3.5yr reinvestment) inverted in March and widened further in June to 10.11bps. We see a similar inversion in the secondary market which is inverted by 13.30bps. As for spread dispersion, new issue AAAs are 15bps wider in June (185-200 bps over SOFR) range, but there have been prints as tight as 145 and as wide as 220.

Get up-to-the-minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on August 9th for Market Trends Webinar and register here.

KopenTech is affiliated with KopenTech Capital Markets, a member of FINRA.