CLO Market Trends: August 2023 Edition

CLO markets show increased volumes both in primary and secondary, with secondary prices at LTM highs.

August Webinar Guest Speakers: Palak S. Pathak & Drew Sweeney, TCW Group

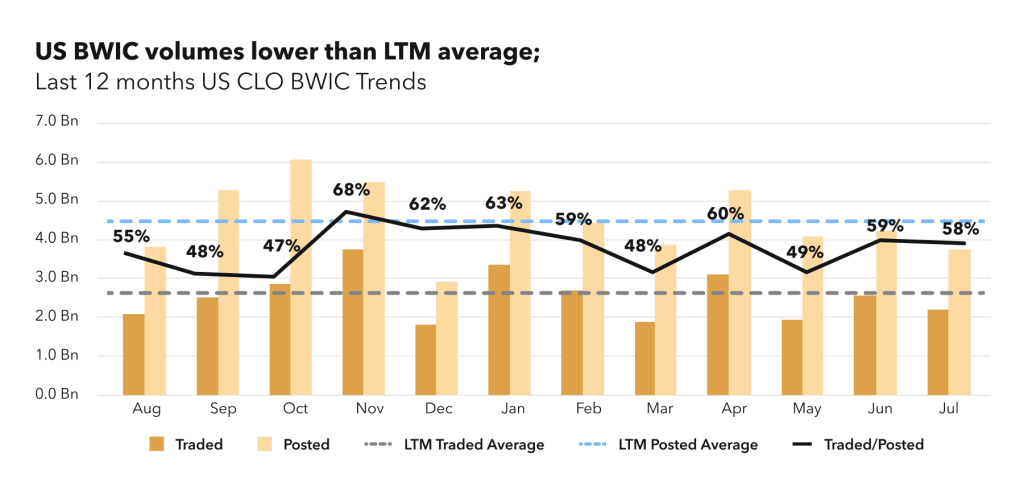

BWIC Volumes

US BWIC volumes increased in August, with posted volumes ($5.7Bn) being the highest LTM. Traded BWIC volumes ($3.3Bn) constitute 57% of the total posted.

“When investors see heavy supply in secondary market being well absorbed, and spreads tightening, that on itself gives investors a higher degree of comfort to post more BWICs.” — Palak S. Pathak

BWIC Volumes by Rating & DNT rates

Investment grade tranches now take up 77% of the total traded US BWIC volume, but AAA share increased to 53%, reaching $1.73 Bn in August. DNT% in US BWICs is less uneven across the stack compared to July, with 3% DNT in AAA and 24% DNT in equity.

TRACE Volumes & Dealer’s inventory

TRACE volumes continue the monthly trend of steady growth, hitting $19.8 Bn in August, with 8 strong days reporting higher than $1 BN in traded volume. On the dealer inventory side, dealers maintain their net secondary positions, with dealer net flow at $43 mm.

Leveraged Loan Prices & CLO Tranche

“On the loan side, most of the new issue this year has been refinancing activity. With new CLOs printing but not enough new loans being created, it drives a technical price increase in secondary market.” — Drew Sweeney

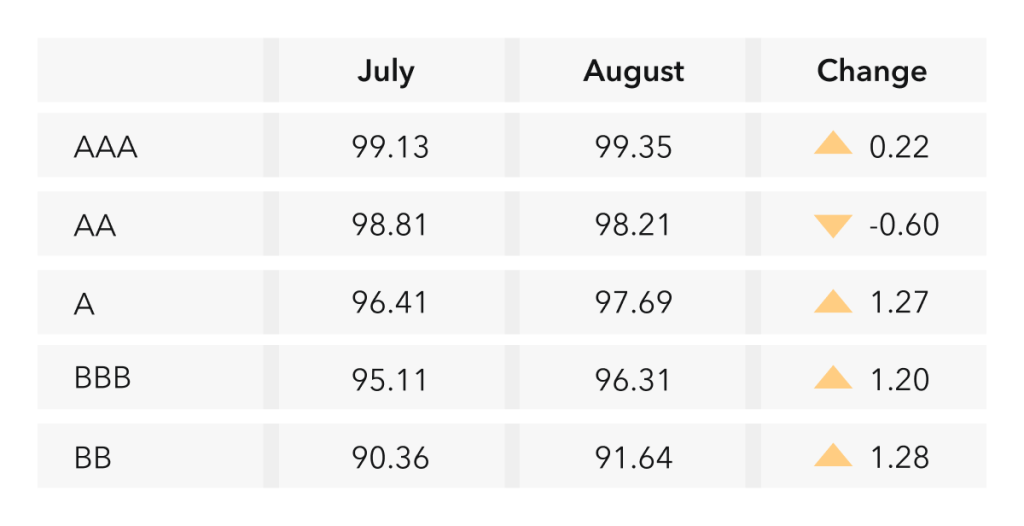

Prices Across the Stack

August average prices from US BWICs increase even higher, with almost all tranches taking the position of LTM highs. AAA average price is at 99.35 cents on a dollar.

Secondary spreads came tighter in July and filtered through into the primary CLO markets, hence the pick-up in issuance.” — Palak S. Pathak

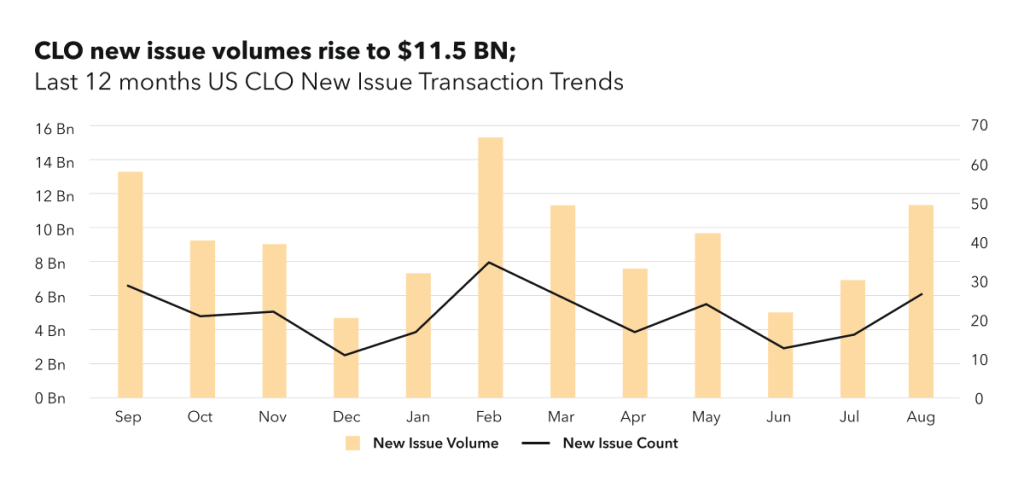

New Issue

New issue US volumes stand at $11.5 Bn, 66% increase from July and is the highest month-to-month growth since February. Despite this, YTD volumes are still 19% lower.

Although resets picked up in August (9 resets, 1 refinancing), 95% of active deals that have either past or are near their non-call periods have AAA spreads tighter than 175 bps. US AAA spreads for new issue BSL transactions range from 165 to 220 bps.

“We’ve seen some resets come to the market, and this is one of the forces driving the basis wider, especially in lower rated tranches. The other reason is a still wide manager tiering, both in secondary and in primary.” — Palak S. Pathak

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on October 10th for Market Trends Webinar.