CLO Market Trends: May 2022 Edition

Guest Speaker: Michelle Manuel, Investec Bank

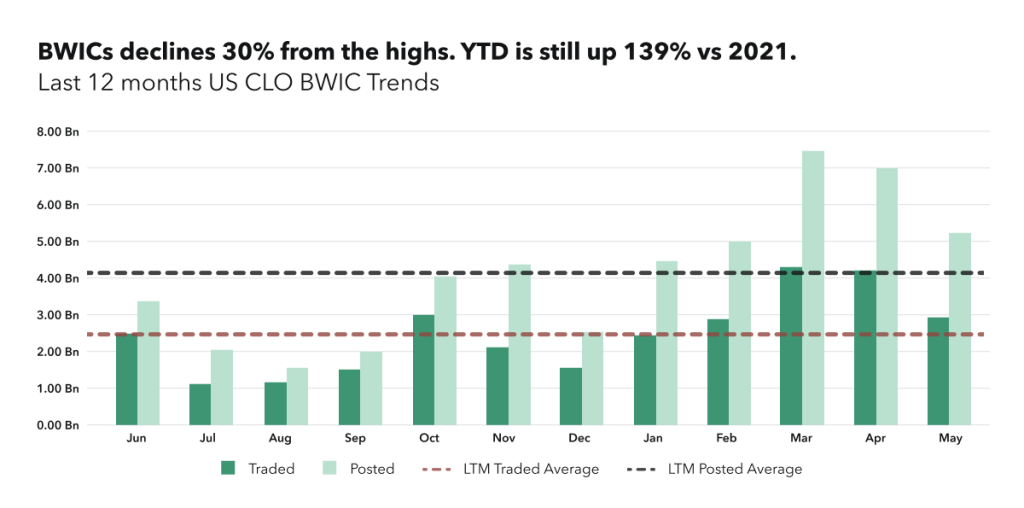

BWIC Volumes

May BWIC volumes declined 30% from the highs of March with $2.92BN trades/ $5.2BN posted. However, year to date volume of $16.93BN is up 139% versus 2021 of $12.20BN.

TRACE Volumes

TRACE volume is $18BN in May, flat to April and slightly down from the record high of $21BN in March. May 11th was the 4th largest volume date in the past 5 years with 2.53BN trading.

“In periods of extreme stress the correlation between CLO IG and the VIX is 90% when generally it is 74%. The 11th of May was when CPI numbers came out. But on the 10th of May, in preparation for that, the stock market sold off and the VIX spiked and low and behold we had this huge BWIC trade on the 11th…” Michelle Manuel.

BWIC Volumes by Rating

BWIC volume continues to be driven by IG-rated tranches with 90% of the total. AAAs represented $2.44BN traded. IG-rated tranches experience the largest price dislocations year to date given macro volatility and rebalancing vs. other asset classes.

“Despite volatility there does seem to be healthy liquidity in CLO IG tranches. AAA tranche is the largest tranche, and we expect to see the action there” Michelle Manuel.

Dealer’s Inventory

Dealer net flows show clients buying $388MM. Dealers added $1BN in April, and now it looks like there is some de-risking happening.

DNT Rates

CLO equity trading came to a halt. BWIC DNT rates skyrocketed in equity with only one trade; this compares to 90 trades in May of 2021 and an average of 32 equity trades/month this year.

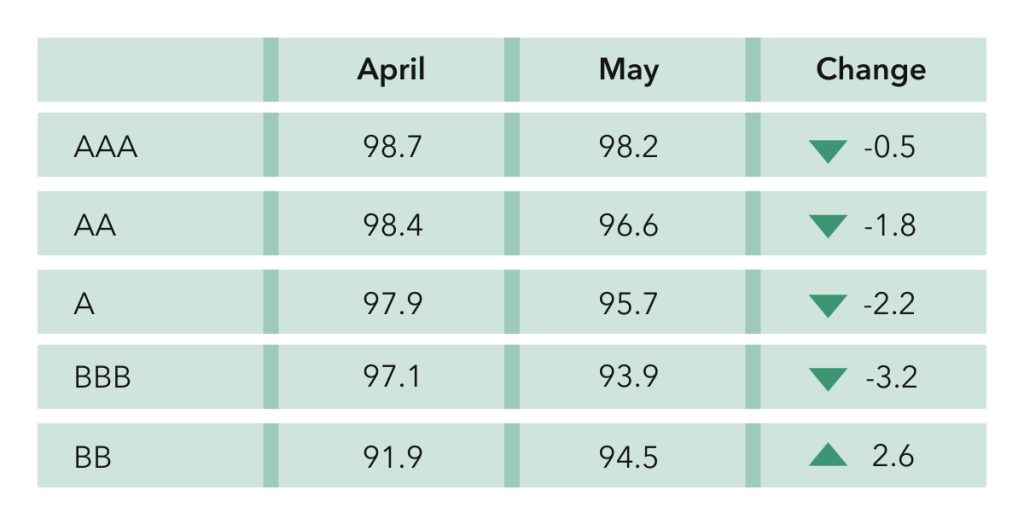

Prices** Across The Stack

Prices continued to drop across the stack in May except for BBs which were up 2.6 points. Lower mezzanine usually stabilizes first, and this proved to be true again. Not surprising with this volatility, Bs and CCCs have not traded since April.

**Prices are based on trades that provided color and are likely to underestimate actual traded levels.

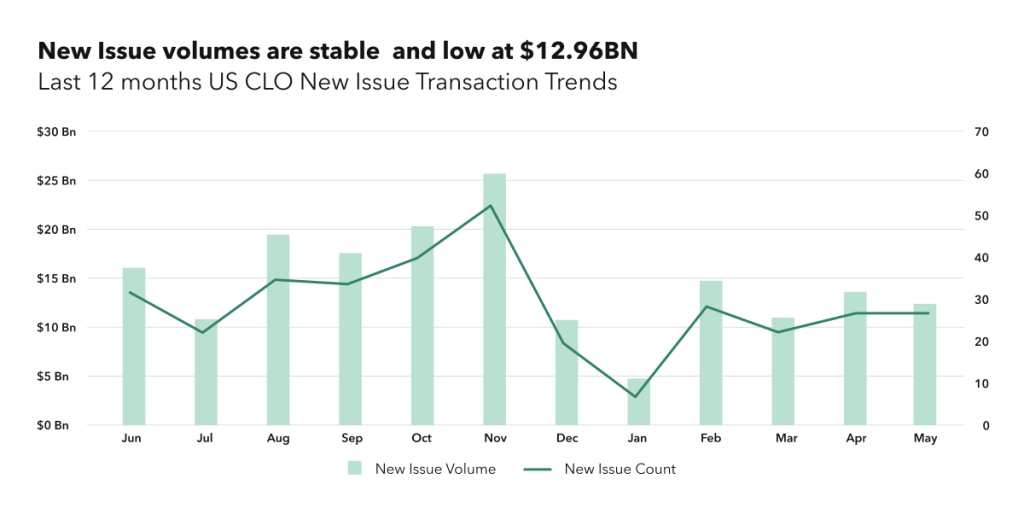

New Issue

New Issue CLO volumes are stable and low at $12.9BN. New issue AAA spreads for 3yr versus 5yr inverted in March and stayed flat in May. New issue AAA spread dispersion increased, most AAAs are in the 165-180 basis point range but there have been 145 and 190 prints on the tape.

As it relates to dispersion, “pre-covid we didn’t really see very much performance tiering, but after Covid, it had divided the playing field in terms of performance” Michelle Manuel.

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com

Please join us on July 8th for Market Trends Webinar and register here

KopenTech is affiliated with KopenTech Capital Markets, a member of FINRA.