CLO Market Trends: June 2023 Edition

New issue at YTD lows, $5.1BN, while secondary BWICs stay at LTM average, $2.5BN

June Webinar Guest Speaker: John Wu, Seix Advisors

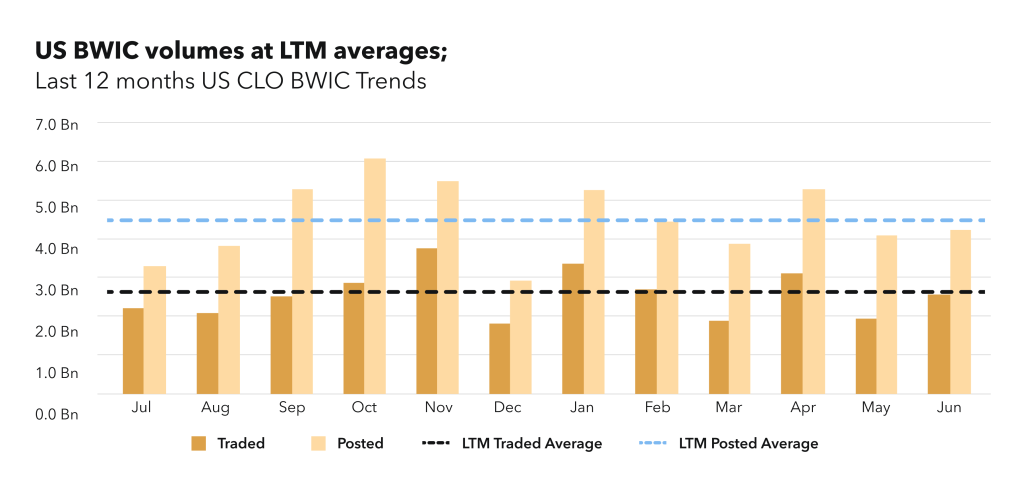

BWIC Volumes

US BWIC volumes improve by 28% from prior month. Both posted and traded volumes are approaching LTM averages ($4.3BN and $2.5BN respectively). YTD volumes are still 21% lower than 2022 numbers, both in posted and traded.

“Secondary market has been very strong and consistent. One of the possible reasons being that the new issue market has been a little slow, and investors may have been more active in the secondary.” – John Wu

BWIC Volumes by Rating & DNT rates

June saw traded US BWIC IG volumes take up 81% of the total, despite AA & BBB being lower than LTM average. AAA specifically improved by 30% from May, and stand at $1.4BN, largest since February.

“With more asset managers involved in the whole capital structure, including AAAs, we see more active trading in that market. This provides more liquidity to investors with smaller purchase sizes.” – John Wu

Reported DNT rates in June tracked lower for ratings A-BB and higher for both ends of the capital structure compared to LTM averages. AAA reported DNT rate was at 6%. It should be noted that the percentage of deals with unreported color decreases going down the stack for IG deals, with 38% for AAAs and only 18% for BBBs.

TRACE Volumes & Dealer’s inventory

TRACE total volumes remain consistent for the last five months, with IG volumes rising slightly above LTM average (at $12.4BN). HY TRACE volumes rose to 22% of the total in June. TRACE shows 4 days with daily trading volume above higher than $1BN, 2 more than last month. On the dealer inventory side, dealers maintain their net secondary positions, with dealer net flow at negative 29MM.

Prices Across the Stack

June average prices increased slightly from May across the stack. The biggest move was for As, to 96.95 cents on a dollar, the LTM high. AAA average price is 98.73 cents on a dollar, also close to LTM highs (observed in February).

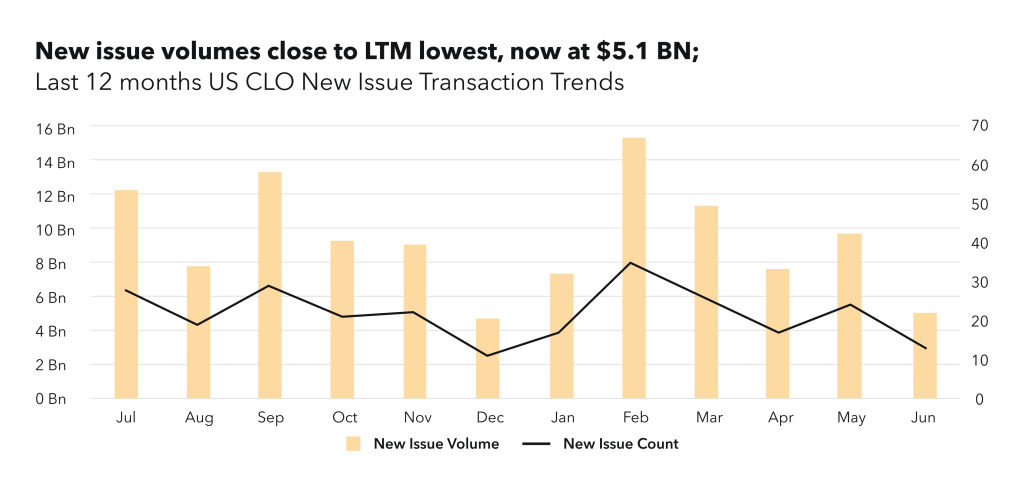

New Issue

New issue US volumes suffered a 48% drop from May, landing at $5.1BN, smallest monthly value since December of last year. No short deals were issued or price in June. Total YTD volumes are currently 23% lower than 2022.

“The arbitrage for CLO new issue equity is challenging right now. Through March-April regional bank crisis there was a little dip in the market, and since then the loan market has recovered nicely. The CLO market is recovering from that dip too, but slower compared to the loan market.” – John Wu

US AAA spreads for longer BSL transactions are in 180-190 bps range, with outliers ranging from 170 to 220 bps. Not taking outliers in consideration, the spread range is significantly lower, tightest in last twelve months. Over the past 4 months, regression analysis of WAS and WARF of the underlying portfolio shows strong correlation with AAA CLO spreads, in addition to manager tiering.

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at bwic.kopentech.com.

Please join us on August 8th for Market Trends Webinar and register here.

KopenTech is affiliated with KopenTech Capital Markets, a member of FINRA.