New BWIC Selling Protocol – KTX LiveBidding™

LiveBidding is an innovative method of selling CLO securities on KopenTech’s electronic trading platform KopenTech BWIC. The platform’s objective is to increase trading volumes and transparency, as well as improving the CLO market for investors and broker-dealers alike.

Historically, CLO BWICs are conducted in a first-price, sealed-bid auction format. Buyers submit sealed bids directly to the seller in a “blind” manner with the top bidder paying their final submitted bid. Given the bilateral communication in the CLO market, sellers and dealers have no limits on how much color they can give or receive; despite this, color is never consistently provided. One would believe that unlimited color would benefit all parties. However, according to auction theory, breaking seals by providing selective feedback for a limited subset of participants does not lead to a well-functioning marketplace.

Why LiveBidding?

LiveBidding can be utilized to achieve fast-paced bidding with increased competition, similar to high-end art auctions. It consists of quick, time-limited rounds, saving time for both buyers and sellers. Bidders can request minute-by-minute price updates from their sales coverage with the most serious bidders encouraged to bid high in the first stage to get to the second stage.

This process leads to increased competition for investors and faster results for broker-dealers, ultimately leading to higher trading volumes and increased opportunities in the CLO market.

How does LiveBidding work?

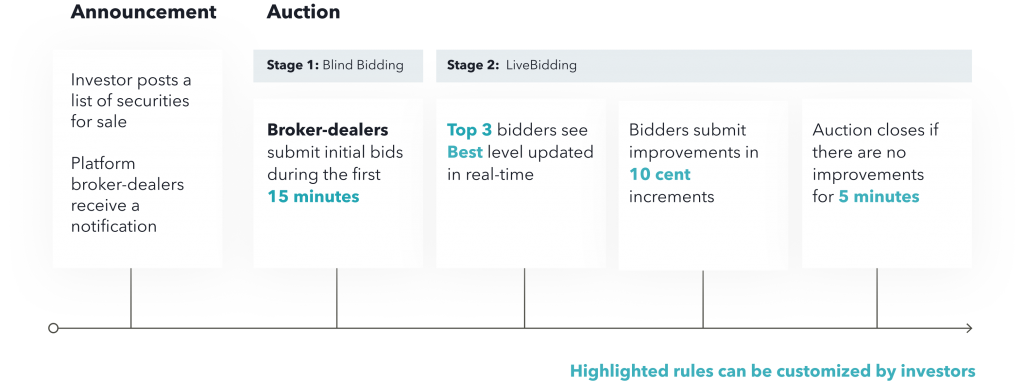

LiveBidding is a 2-stage process.

In Stage 1, investors have a capped time limit (15-20 minutes recommended) to bid on securities in a “blind” fashion. There are unlimited opportunities to improve their bids in the allotted time with a 10 cent minimum bid increment. When five minutes have passed without a bid, the top 3 bidders proceed to the next stage.

In Stage 2, bidders have unlimited small-bidding increments in 5-10 minute rounds. Participants can see top bids updated in real time. The auction ends when bids cease to improve after five minutes.

Customized to Your Requirements

Each individual auction can be customized to the seller’s requirement. Sellers decide on the duration of each round, how many bidders can proceed to the Improvement Round, the minimum bid increment, as well as the price type (Best or Cover). Auctions no longer have to take several hours; they can be completed within a couple hours saving all parties valuable time and resources.

Benefits to the Marketplace

As an investor, LiveBidding will provide for a better auction experience, increased competition and best execution of trades. Broker-Dealers can expect quicker results, spending less time per BWIC, resulting in more securities traded. Overall, this equates to higher trading volumes across the marketplace.

Participating Broker-Dealers

LiveBidding requires participants to bid through KopenTech’s on-platform broker-dealers. As of March 2021 we have the following broker-dealers on the KopenTech BWIC platform:

Alliance Global Partners

Bank of America Securities

BNP Paribas Securities

Brean Capital

Brownstone Investment Group

Deutsche Bank Securities

Greensledge Capital Markets

Janney Montgomery Scott

Jefferies LLC

MUFG Securities

Nomura Securities International

Odeon Capital Group

RBC Capital Markets

Robert W. Baird & Co.

Seaport Global Securities

Please contact your broker-dealer if you want to participate in their next LiveBidding auction. If you would like to see a live demo of the features, contact us at info@kopentech.com