Explore the Power of Issuance Monitor

KopenTech offers the most comprehensive CLO primary data through its KTX platform. It’s an essential tool for arranging banks, buy-side investors, and CLO Managers. The Issuance Monitor turns complex data into clear, organized information, making it easy to explore both current and past primary market activities.

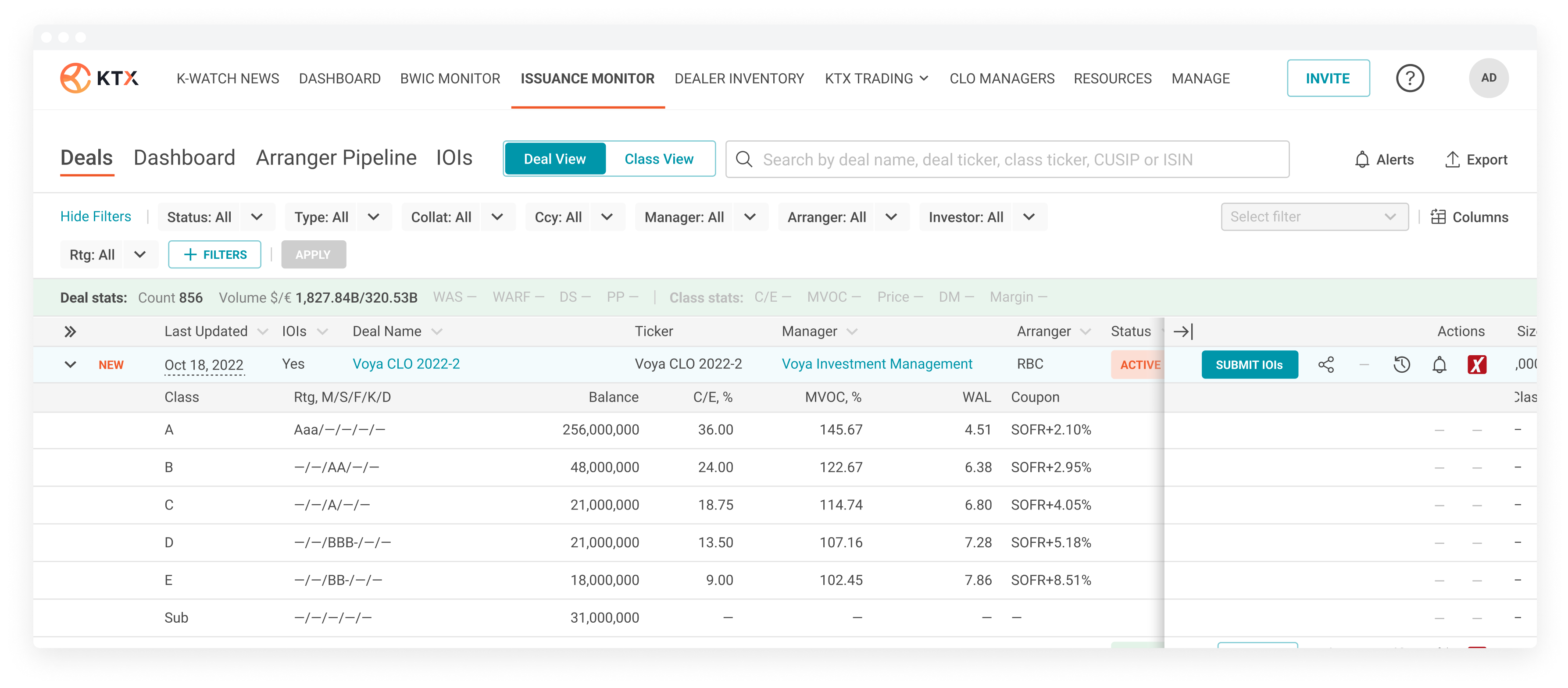

Centralized Repository

Issuance Monitor provides users with a holistic view of new issue, refi, reset, and AMR transactions – both historical and active. The platform empowers users with the ability to group data by deal or class tables, and 12 years of historical data are exportable for further analysis.

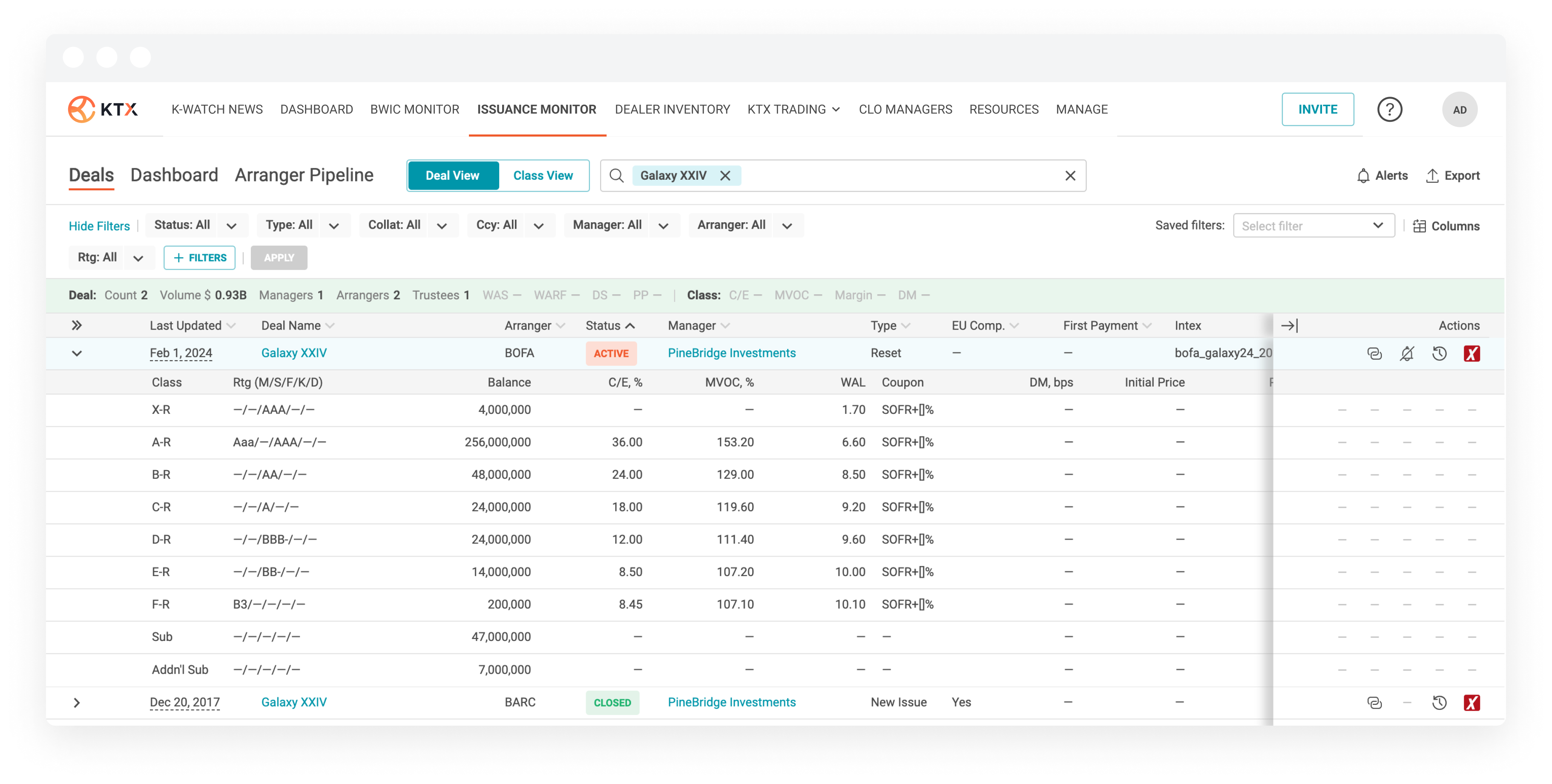

Real-time Updates and Version Tracking

Issuance Monitor tracks the progression of deal changes so that investors can clearly identify deal modifications over time. Changes in overall structure, tranche sizes, coupon spreads, subscription levels or any other important characteristics are tracked and easily identified in time-stamped version histories.

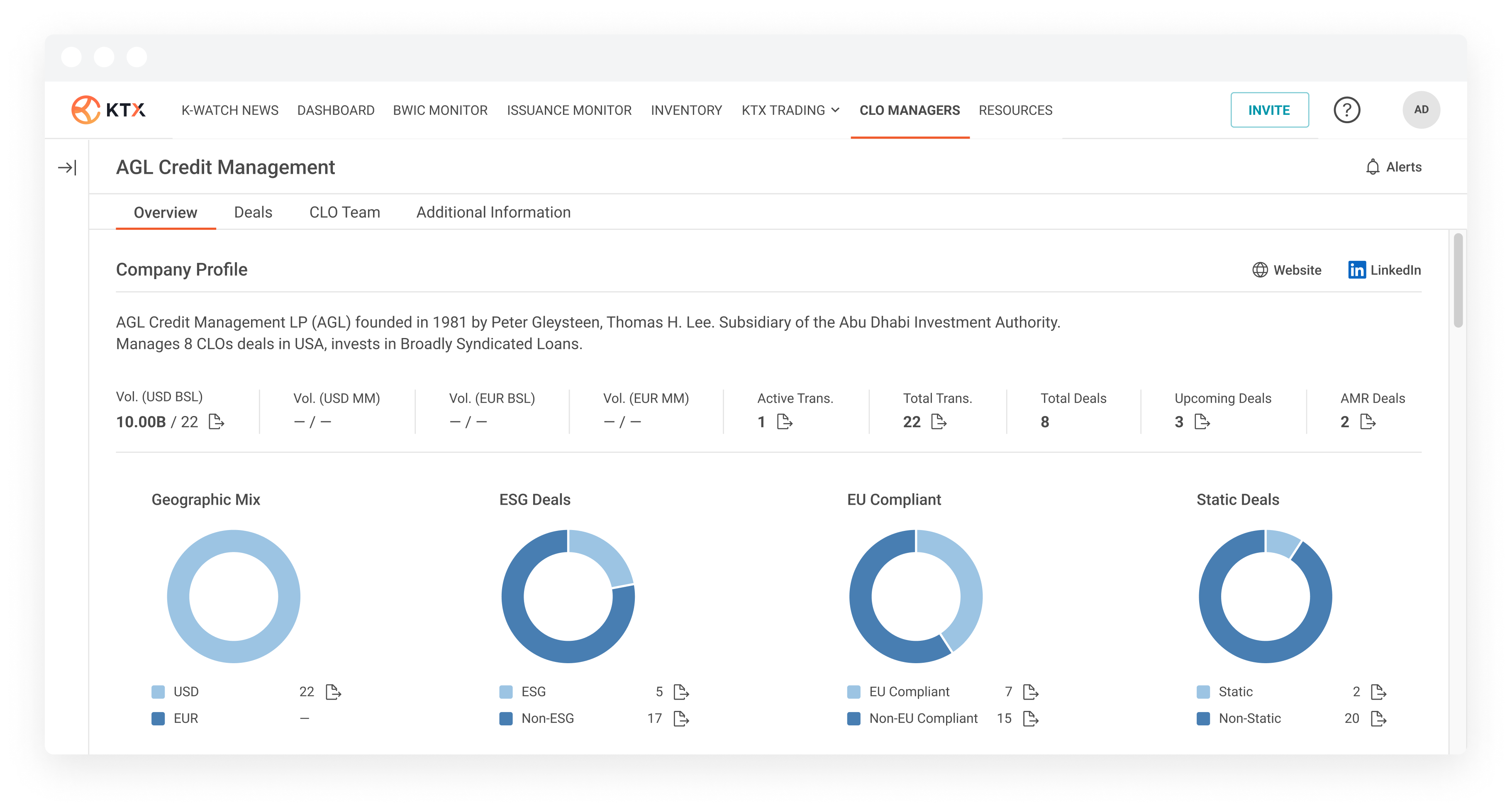

CLO Manager Directory

Every CLO Manager that has issued a 2.0 CLO is given a profile that includes their overall platform characteristics, deal database, team members and other important information. This serves as a complete description to assist investors in quickly assessing a CLO manager’s capabilities.

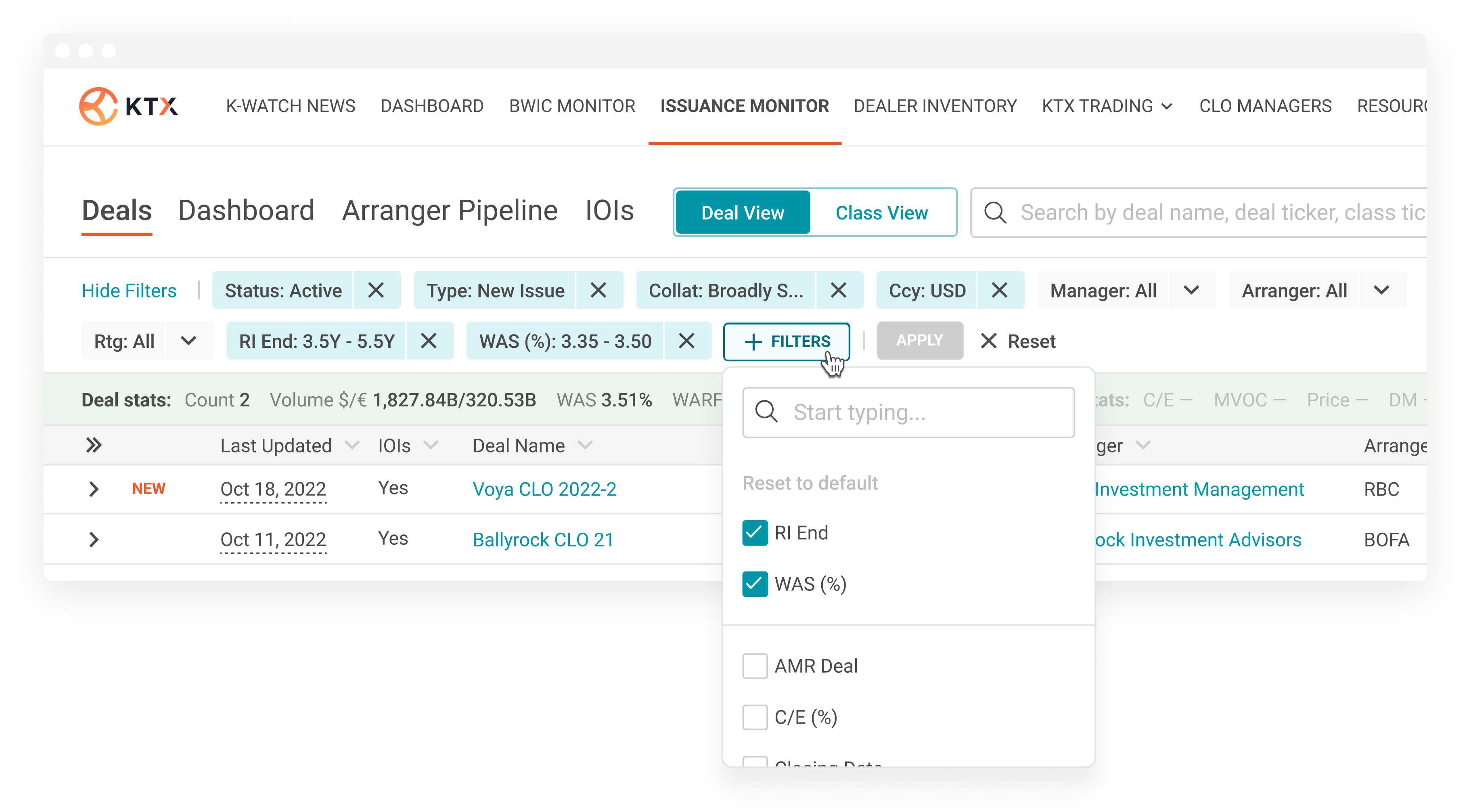

Advanced Filtering & Customization

One of the standout features of Issuance Monitor lies in its Advanced Filtering & Customization options. Users can leverage more than 20 criteria for filtering, including transaction type and status, while also sorting by 15+ portfolio characteristics. The tool allows users to save filters, receive notifications for matching transactions, and customize their view by adding and reordering columns. This level of customization ensures a tailored experience that aligns with the unique needs of each user.

Without Issuance Monitor, investment teams often find themselves dedicating significant analyst time, sometimes an entire day, to manually compile and analyze data – a task that this tool can accomplish in mere seconds. By utilizing KopenTech’s powerful filters, teams can achieve in a flash what used to be a time-consuming, resource-heavy endeavor.

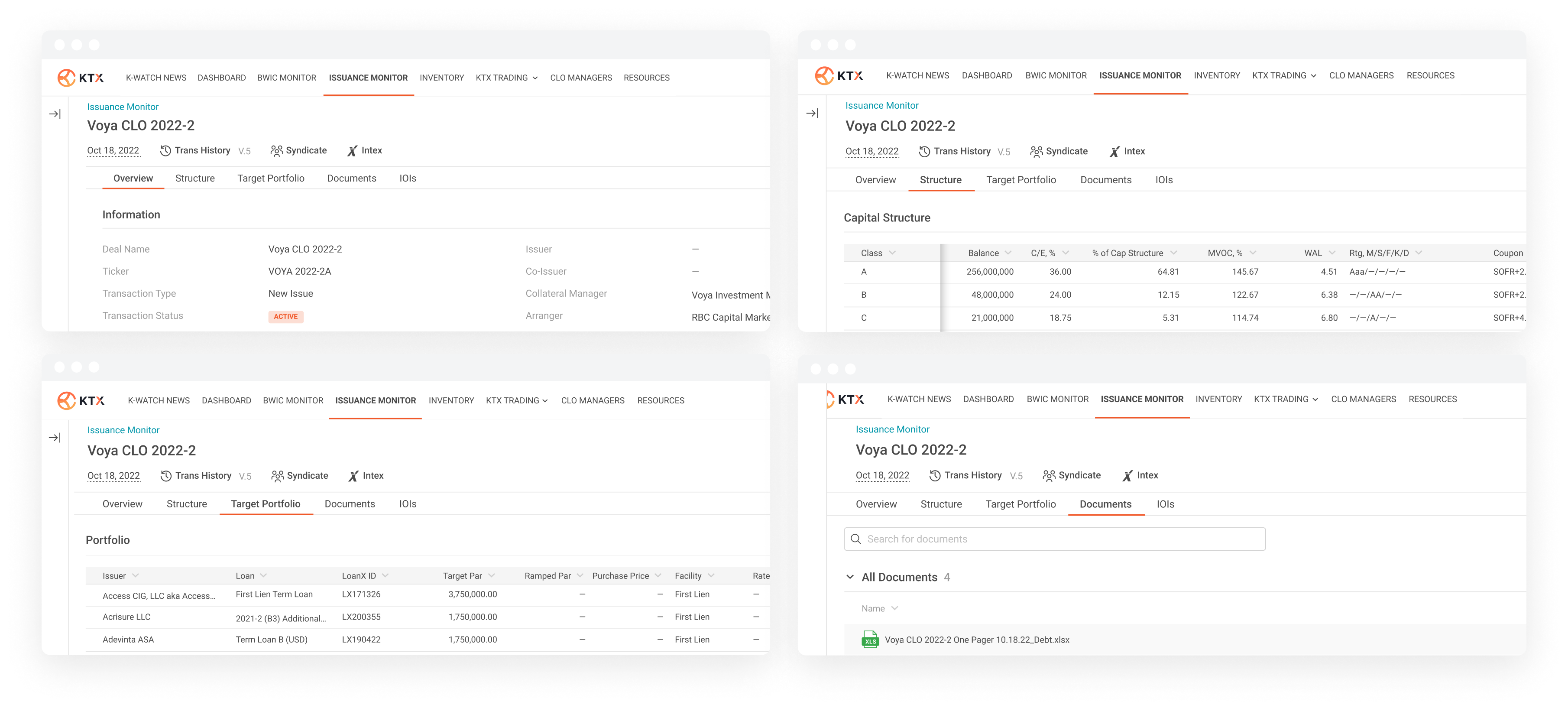

Key Transaction Terms in 5 Standardized Tabs

Buyside investors can delve deeper into specific deals by clicking on the Deal Name. The platform presents Key Terms in 4 standardized tabs: Overview, Structure, Target Portfolio, and Documents. Additionally, a 5th tab offers users the ability to send indications of interest directly to the syndicate team, streamlining communication and collaboration.

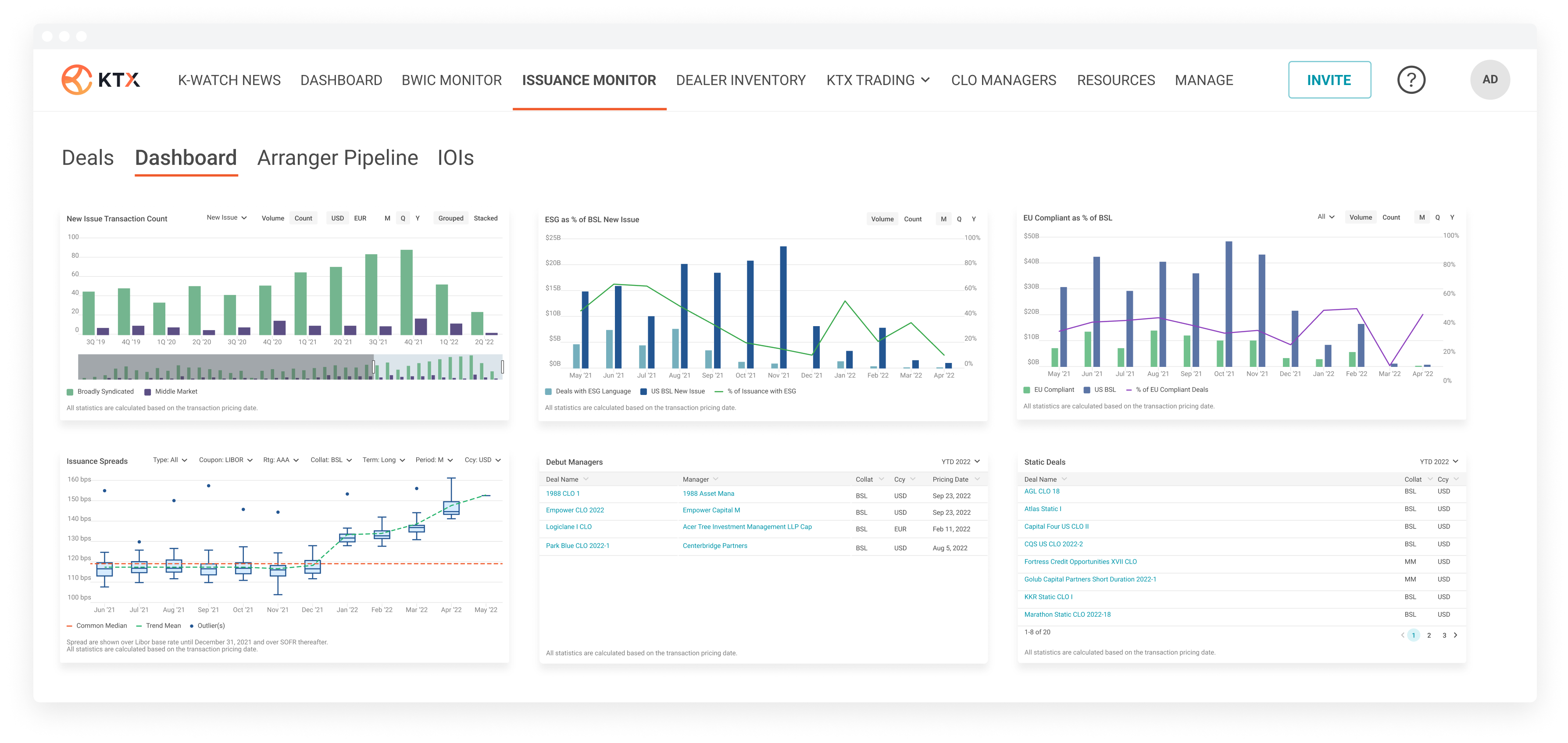

Issuance Dashboard

Issuance Monitor data is complemented by the Dashboard which helps to visualize the CLO primary market trends with graphs and tables. Data going back to 2014 is calculated based on deal pricing date. Additional tables include Top 10 Issuers, Top 10 Trustees, Top 10 Arrangers, Debut Managers, Static Deals, EU Compliance Deals, and Short vs Long-term deals. This graphical representation facilitates a quick understanding of market trends and dynamics.

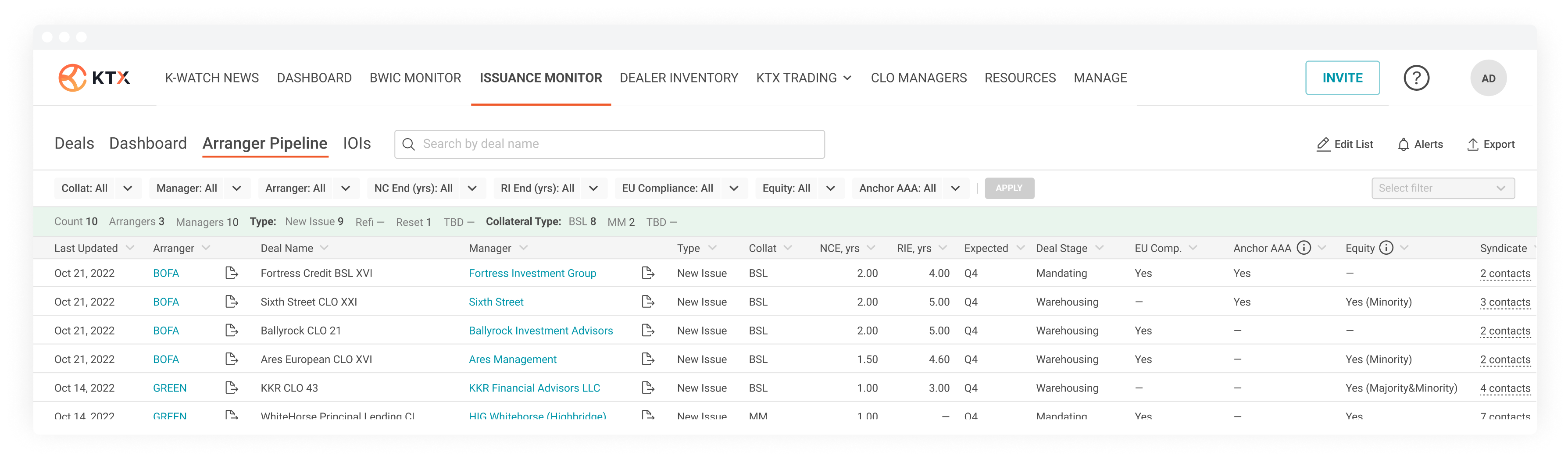

Arranger Pipeline

Issuance Monitor contains an additional tab called Arranger Pipeline which provides an aggregated view across the market of the upcoming deals and shows which managers already engaged which arrangers for their upcoming primary activity. The pipeline of future deals allows equity and AAA investors to engage arrangers and managers early on. This feature enhances strategic decision-making by providing a comprehensive outlook on upcoming managers’ transactions.

Issuance Monitor stands out as a cost-effective and time-efficient solution by aggregating data from across the primary market. Its ability to deliver comprehensive insights at a fraction of the cost and time makes it an invaluable resource for anyone involved in issuing a CLO or investing in specific parts of the capital stack. Sign up now to harness the power of this transformative tool.