CLO Market Trends: October 2023 Edition

BWIC volumes drop, prices fall, but new issue keeps coming

October Webinar Guest Speakers: Jim Stehli, Polen Capital

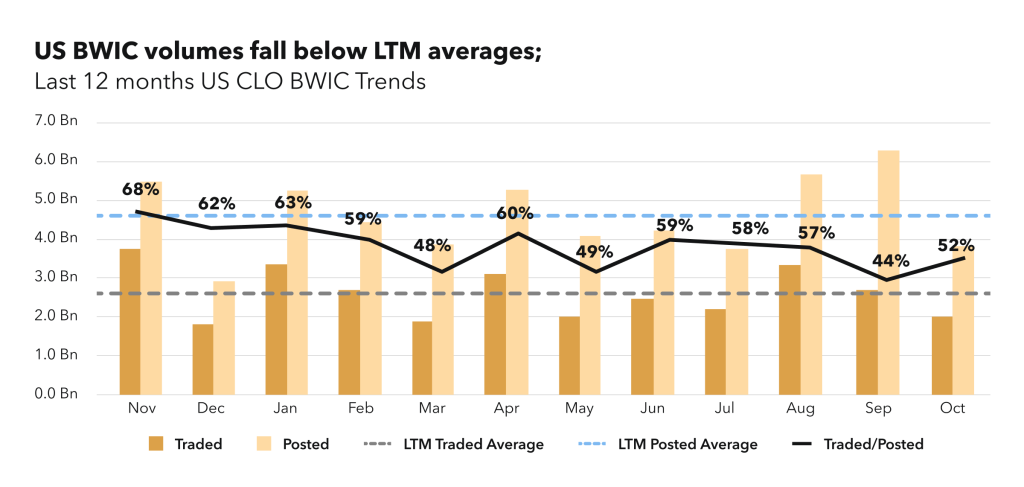

BWIC Volumes

US BWIC posted volumes fall from last month’s LTM highs, now at $3.9 BN. Traded volumes are at $2 BN, lowest since May this year. Both statistics are currently lower than LTM averages, which are at $2.6 BN and $4.6 BN for traded and posted volumes respectively. YTD volumes are lower by 13% in traded and 12% in posted.

“There was a lot of selling activity in September with new issue deal flow and major profit taking in secondary, leading into October being more risk-off.” – Jim Stehli

BWIC Volumes by Rating & DNT rates

Investment grade tranche is regaining its portion of the cap stack, now at 83% (vs 67% in September). Main reason is the return of AAA trading, currently at $1.21 BN. However, the traded volumes are lower than LTM averages across the stack, especially in the lower-rated tranches.

DNT rate is uneven across the stack for US BWICs, with lower DNT% for AAA and AA. However, large portion of deals still report no information on their color for IG tranches. Traded volumes for equity are lower than September, but the average traded security size has increased: $8.1 M in October vs $3.8 M in September.

TRACE Volumes & Dealer’s inventory

Following the trend of BWIC volumes, TRACE volumes fell to $15.2 BN, with IG TRACE volumes approaching LTM averages at $12.9 BN. 5 days are reporting higher than 1 BN. The BWIC/TRACE ratio for IG and HY are closing the gap, now at 15% and 13% respectively. On the dealer inventory side, dealers flip back to selling, with net outflows at $474MM.

Prices Across the Stack

October average US BWIC prices across the stack start to fall from LTM highs established in September, with AAA average price being at 99.29 cents on a dollar. BB price is halfway between the LTM low and LTM high.

“We were grinding tighter week-over-week through September and things began to cool off. In particular, when you get some liquidity concerns you see the focus down-the-stack. Credit went wider, so mezz paper in primary and secondary went wider.” – Jim Stehli

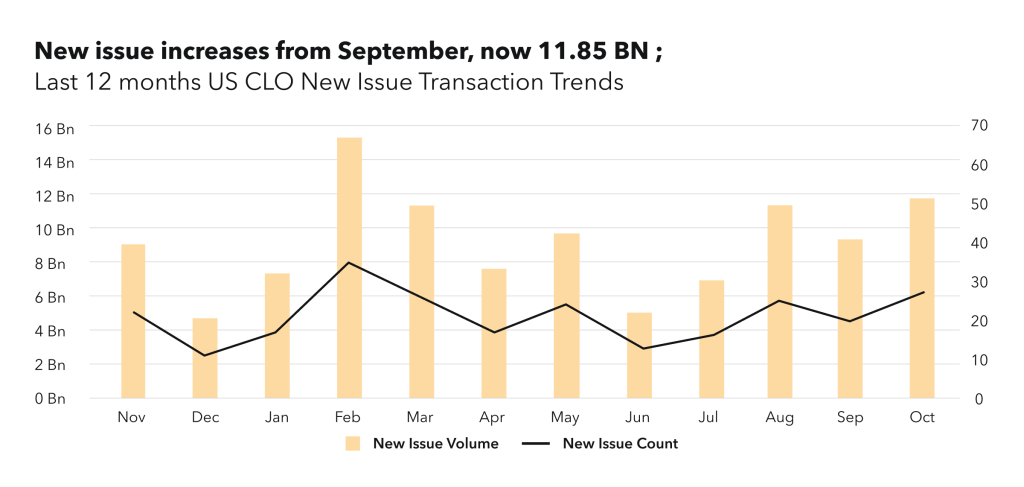

New Issue

New issue volumes rise to $11.9 BN, highest since February. Short deals are still part of the primary market, taking up 16% of the total issuance. US AAA spreads for longer BSL transactions remain rangebound at 165-195 bps.

“Second half of the year we’ve seen syndicated deals and not so much anchored deals, allowing the broadening of managers that came to market: not only tier 1, but tier 2, tier 3 and new managers.” – Jim Stehli

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on December 7th for Market Trends Webinar.