CLO Market Trends: July 2023 Edition

Primary volumes bounce back, new issue AAAs tighten to 175bps. Secondary prices are at LTM highs.

June Webinar Guest Speaker: Amir Vardi, CSAM

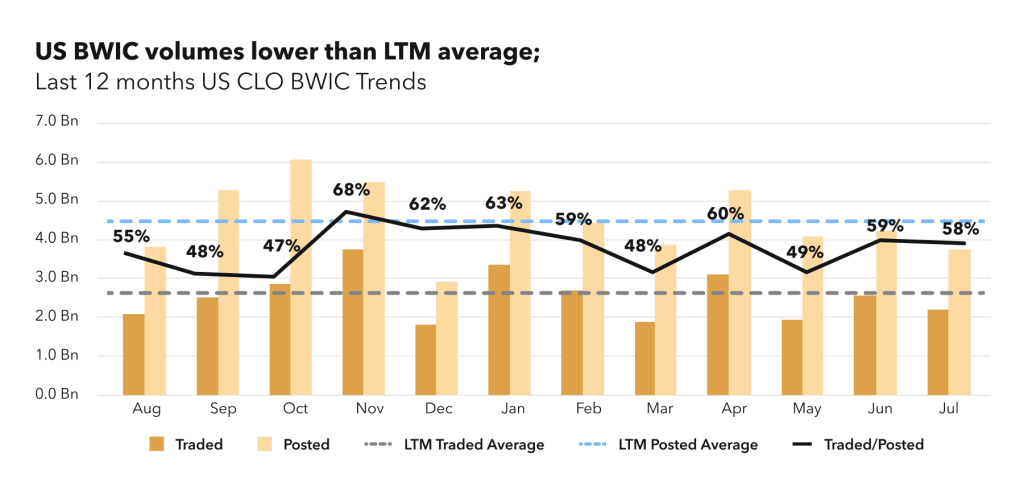

BWIC Volumes

US BWIC traded volumes in July fall a touch from June values, but are still close to LTM averages, suggesting a stable secondary market. Traded BWIC volumes constitute 58% of posted volumes, with $2.2 BN and $3.9 BN respectively. YTD volumes are lower than 2022 numbers, by 18% in traded and 20% in posted.

BWIC Volumes by Rating & DNT rates

Investment grade tranches take up 83% of the total traded US BWIC volumes in July, despite a very slow trading in AA, only $133 MM compared to LTM average of $310 MM. AAA traded volumes take up 55% of the stack, just behind June numbers.

“83% of trading is IG, which is typically 88% of the cap stack, meaning that IG is trading less than its proportional share. High yield trading tends to punch above its weight because the owners are generally faster money.” — Amir Vardi

DNT% in US BWICs is uneven across the stack, from 3% DNT in AAA to 45% DNT in equity. Interesting to note that the largest percentage of deals with no information about their color was reported in AAAs and AAs (42% and 44% respectively) in July, but the smallest % is in As – only 7% of deals had no indication of color.

TRACE Volumes & Dealer’s inventory

TRACE volumes continue to improve above LTM averages, hitting $17.8 BN in July, with 8 days reporting higher than $1 BN in traded volume. On the dealer inventory side, net flow shows dealers selling $574 MM, the highest dealer selling in the last twelve months.

Prices Across the Stack

July average prices from US BWICs rise to LTM highs for AAA-BB ratings except for A, where the LTM high was in June this year. AAA average price is at 99.13 cents on a dollar.

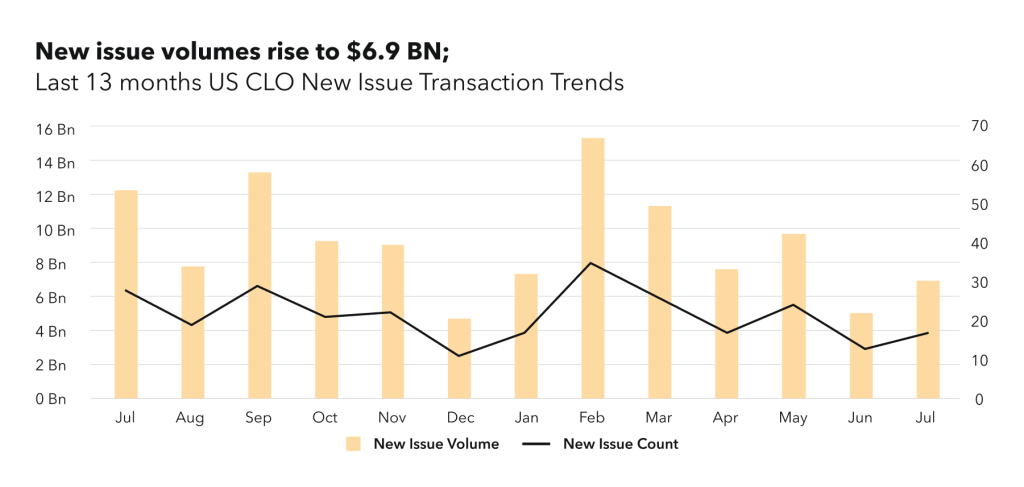

New Issue

New issue US volumes improved by 36% from June lows, standing at $7.4B. Despite this, YTD volumes are still 25% lower than last year and 30% below July 2022. Repricing activity comes to life with 3 resets and 1 refinancing transaction, which was the first refi since May and the only short duration new issue deal in July.

“Last year investors preferred short deals with 1-year non-call to minimize the time they have such expensive liabilities. Now with spreads having tightened, and everyone’s preferring to go with longer RPs.” — Amir Vardi

US AAA spreads for longer BSL transactions tighten with a range spanning 174-220 bps. Looking at CLO universe of transactions which have already exited their non-call period (or will exit within 3 months), 95% printed tighter than 175 bps – meaning that refinancings and resets are not likely to be a prominent part of the market unless the recent rally continues.

“Tier-1 managers are getting 170-175 bps AAAs, and newer managers or someone perceived as a tier-3 would get as high as 220. It depends whether you’re on the approved list of a small select number of very large investors.” – Amir Vardi

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at bwic.kopentech.com.