CLO Market Trends: February 2023 Edition

New issue volumes are at $15BN, the LTM highs. CLO prices rise across the stack.

February Webinar Guest Speaker: Ed Trampolsky, Marathon Asset Management

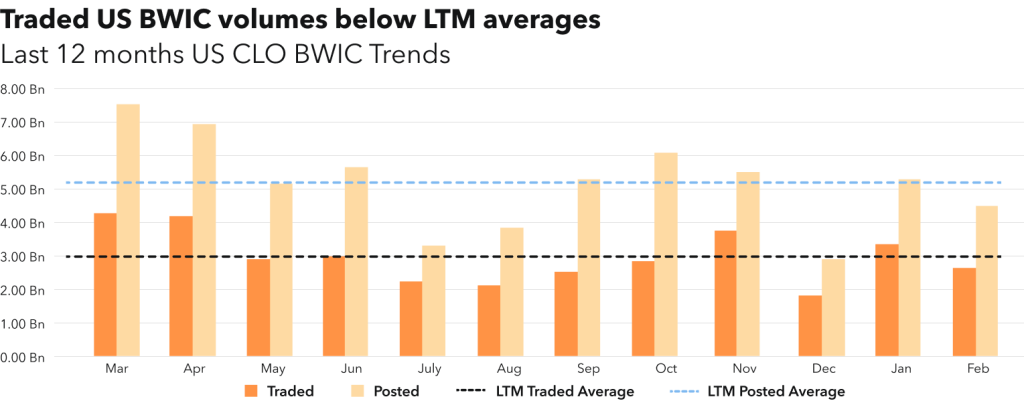

BWIC Volumes

Trading volumes in US BWICs drop below LTM averages, down 21% in posted (now $4.5BN) and 15% in traded (now $2.7BN) compared to last month figures. YTD trading volume is still up 10% from 2022 carried by a strong January performance.

“February was an ok month for liquidity. We had a little bit of volatility, the conference and a short month overall. That’s why there was a slowdown in trading.” — Ed Trampolsky.

BWIC Volumes by Rating

IG share in US BWICs remains high at 82%, with February AAA traded volumes being close to the LTM average of $1.6BN. AA and A traded volumes were less than 50% of their LTM average, with A being only $0.1BN. Average trade sizes for AA were flat, rose for A’s, both at $4MM, but dropped for AAA and equity.

“February smaller average trade size for AAAs was due to several lists with multiple odd-lot positions from $.5MM to $.10MM; on the equity side, there were no control blocks sold, partially due to the fact it was mid-quarter and not a payment month.” – Ed Trampolsky.

TRACE Volumes and DNT rates

TRACE volumes are down 15%, dropping to $15.1BN, with 22% of total being HY. The daily TRACE shows 5 days with volumes higher than $1BN, all in the first half of the month. February BWIC DNT rate is higher than LTM average for all ratings except BBB.

Most notable difference is seen in A with 33% DNT rate, compared to 14% LTM average (excluding deals that had no info on their trading status).

Dealer’s inventory

Banks sell $30MM to clients, which effectively ends a 5-month streak of dealer buying. Despite this, dealers remain net long approximately $2.5BN.

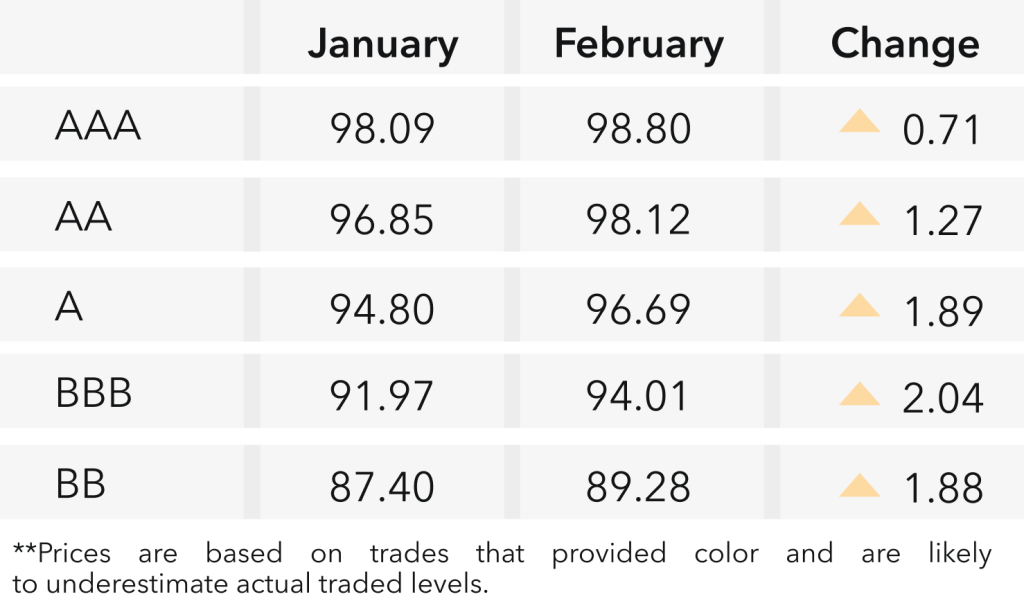

Prices Across the Stack

Observed US BWIC prices continue to rise across the stack, with AAA trading at 98.8 cents on the dollar on average. BBB climbs 2.04 points from 91.97 to 94.01. The prices currently are halfway from LTM lows in October and LTM highs in April 2022.

“As for relative value: I like sourcing a portfolio of A/BBB securities in the low $90s, with 8-9% YTM and likely low double-digits returns over the next two years. I think this return profile should be extremely compelling.” — Ed Trampolsky.

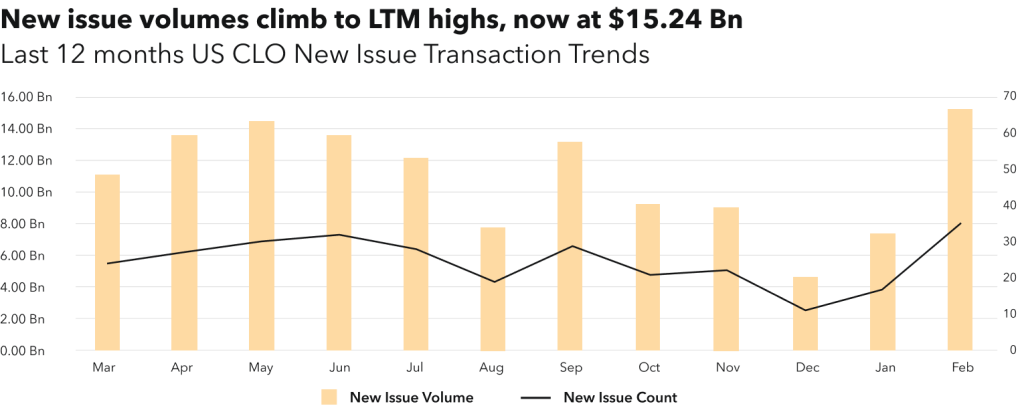

New Issue

February new issue volumes climb to $15.24BN, a new LTM high. This 52% increase is exceptional, following the low issuance months of December and January. Long deals constitute 86% of those issued deals. New issue spreads continue to fall despite big dispersion: US AAA spreads for longer BSL transactions are at 175-232 bps range, the interquartile range (quartile 1 to quartile 3) dropping to 180-199, as opposed to 193-210 interquartile range in January.

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at bwic.kopentech.com.

Please join us on April 11th for Market Trends Webinar and register here.

KopenTech is affiliated with KopenTech Capital Markets, a member of FINRA.