CLO Market Trends: December 2023 Edition

US BWIC traded volumes fall below LTM averages, while BWIC average prices continue to climb to LTM highs. New issue volumes face the sharpest monthly drop.

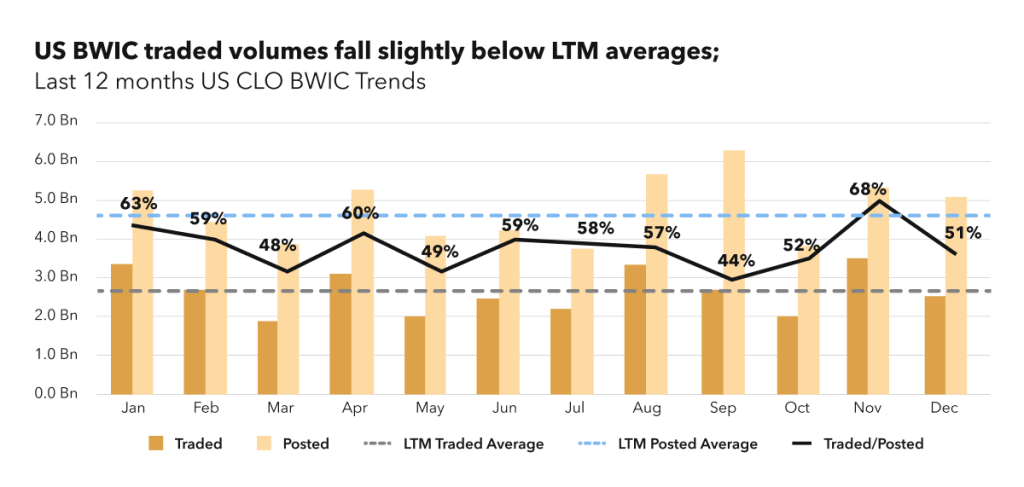

BWIC Volumes

Given traditionally slow month due to holidays, December traded BWIC volumes fall by 28% compared to November and were slightly below LTM average. The volumes are at $5.1 BN and $2.6 BN for posted and traded, respectively. The traded to posted volume ratio is at 51%.

Despite the slower month, BWIC volumes showed improvements compared to December 2022: posted volumes are higher by 73%, and traded volumes are higher by 40%.

BWIC Volumes by Rating & DNT rates

December shows traded volumes lower than LTM averages for all tranches except AAAs and AAs. AAAs specifically are down 19% from November highs. Investment grade trading accounted for 84% of the total monthly volume.

DNT rate continues to stay uneven across the stack for US BWICs, with DNT% for AAA securities at 4%, same as the LTM average. 79% of the A deals had no disclosed color (information on their trading level).

TRACE Volumes & Dealer’s inventory

TRACE volumes are on par with November levels, with IG volume of $14.2 BN and HY volume of $3.9 BN. 8 days are reporting higher than 1 BN. With the slight fall of BWIC traded volumes, the BWIC/TRACE ratio falls for both HY and IG, with HY ratio falling from November’s 21% to 10% in December. On the dealer inventory side, December is still on the dealer buying side, with net flow of $836 MM.

Prices Across the Stack

Despite the slower trading this month, December average US BWIC prices are moving higher towards LTM highs across the stack, with AAAs approaching par and trading at 99.8 cents on a dollar on average.

Comparing the price levels between December 2022 and December 2023, the AAA monthly average increased by 1.71 cent on a dollar. At the same time, BB monthly average price level jumped by 6.99 cents on a dollar in 12 months.

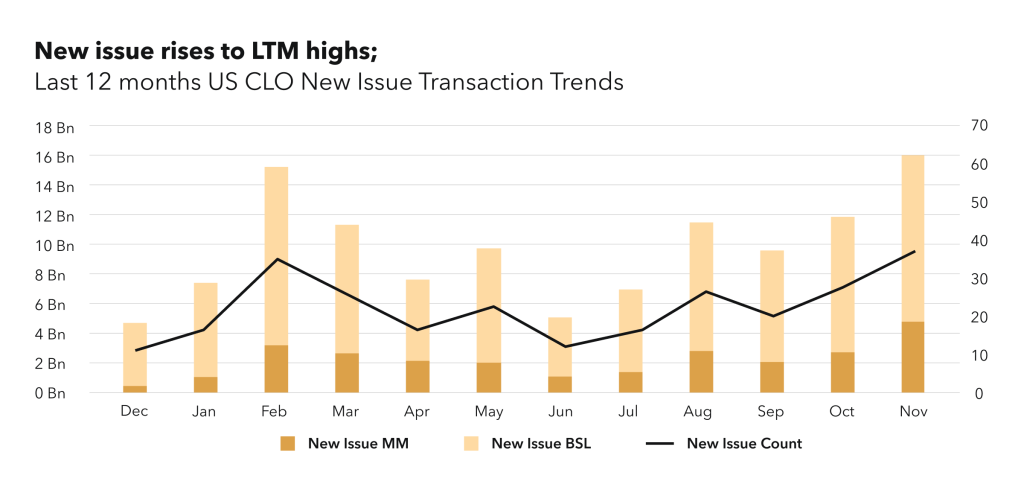

New Issue

New issue volumes fall by 67% from November highs, now at $5.27 BN. This is the lowest they’ve been since June, but a natural phenomenon due to Opal conference and holiday season. Short-dated deals drop to 10% of the total issuance. AAA spreads for US BSL deals with longer duration tighten up throughout the year, with December ending up in the 160-195 range.

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on February 6th for Market Trends Webinar here.