KopenTech Year End CLO Review

With 2022 behind us, we review the CLO market major trends:

CLO Secondary Trading Skyrockets

42% increase YOY and 8% since 2020 Covid Spike.

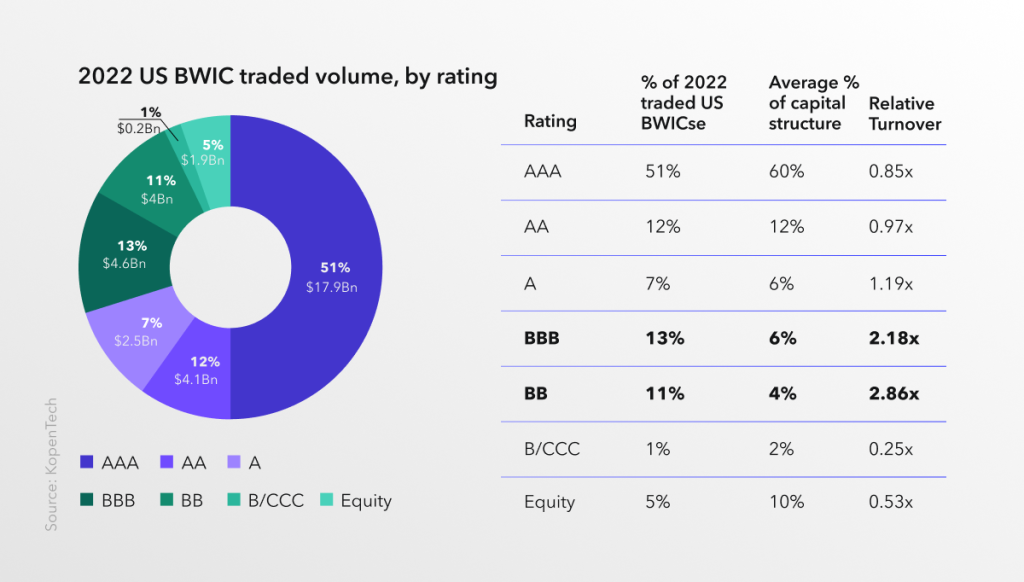

US BWIC volumes are driven by AAA tranches

AAA secondary trading is up 92% from 2021.

Equity trading decreased YOY, but up 99% from 2020

Most liquid tranches are BBBs and BBs

AAA-A tranches dominate trading volumes, but junior mezzanine trades more frequently relative to issuance.

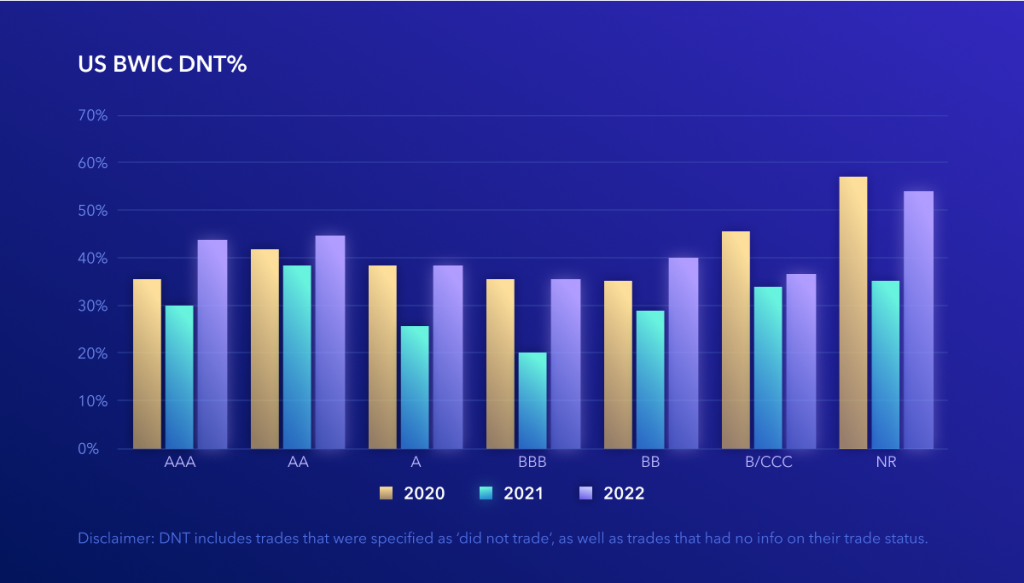

DNT% exceed prior years

Except for B/Equity that had higher DNT% during Covid.

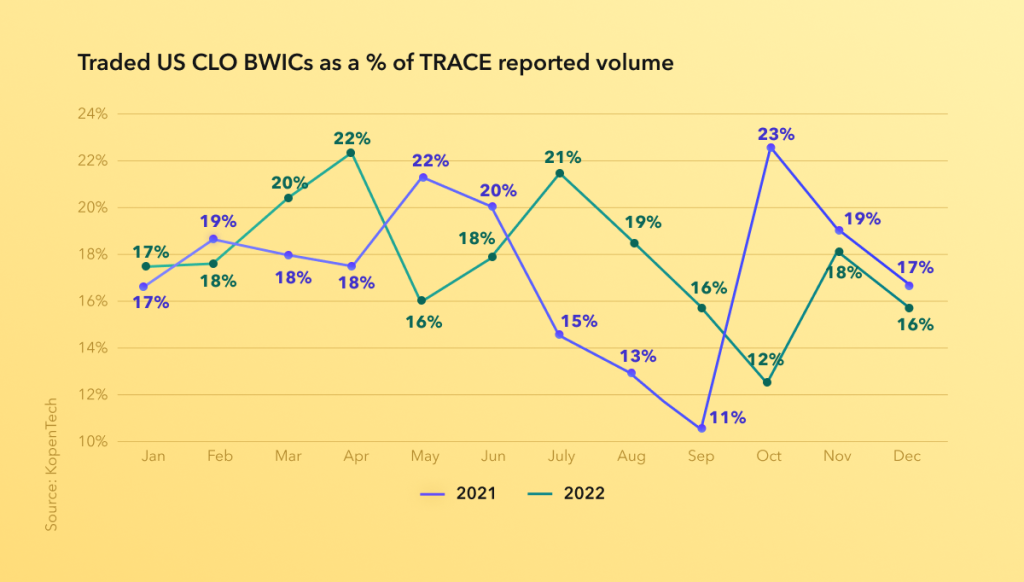

BWICs as a % of TRACE had a similar trajectory

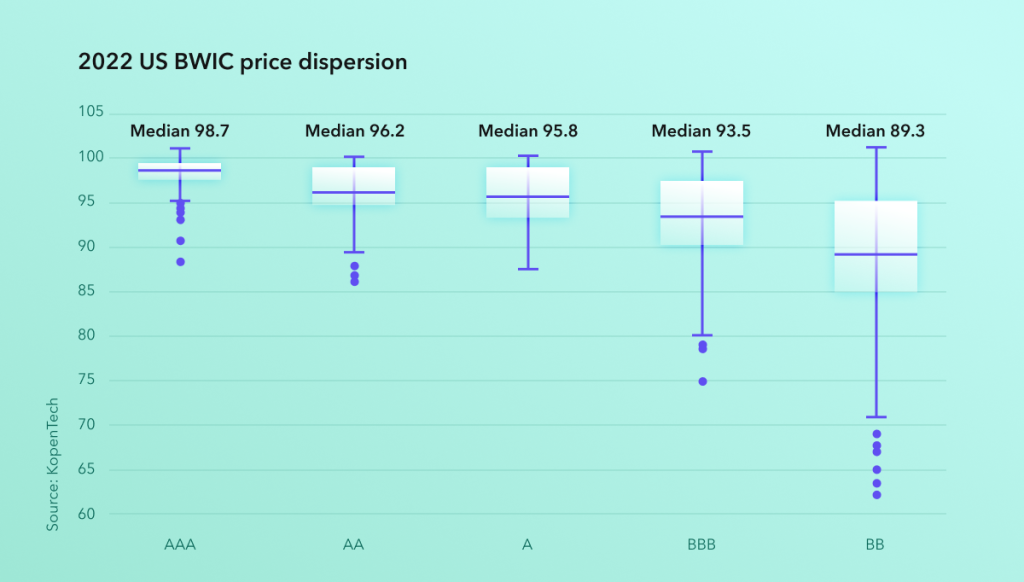

CLO prices had wide ranges

Collateral quality drives dispersion in junior mezzanine; BB prices range 40 points.

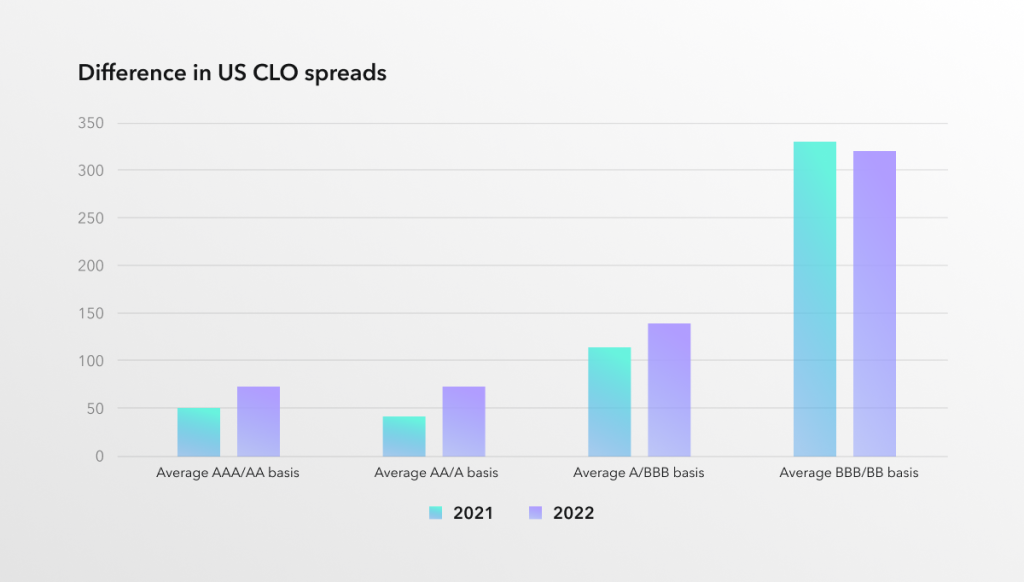

IG-rated spread basis soar, while BB/BBB stays constant

Average basis among AAA-A-rated securities widens sharply in 2022 vs. prior year.

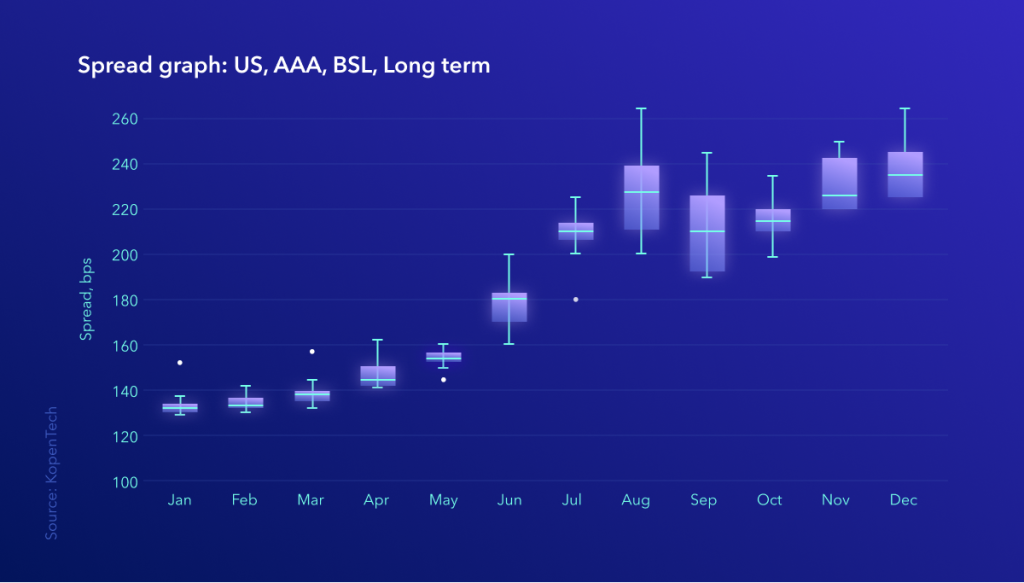

New Issue AAA spreads are ending the year at the wides

Refi and Resets disappeared post April

CLO issuance is still 24% higher than 2020.

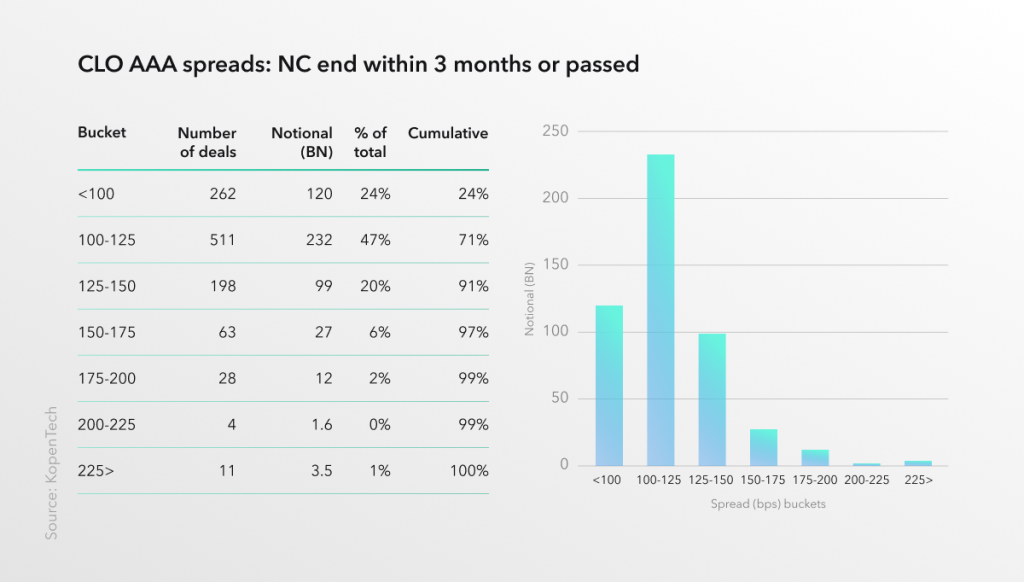

Barring a massive spread rally, refi and resets are not likely to come back soon

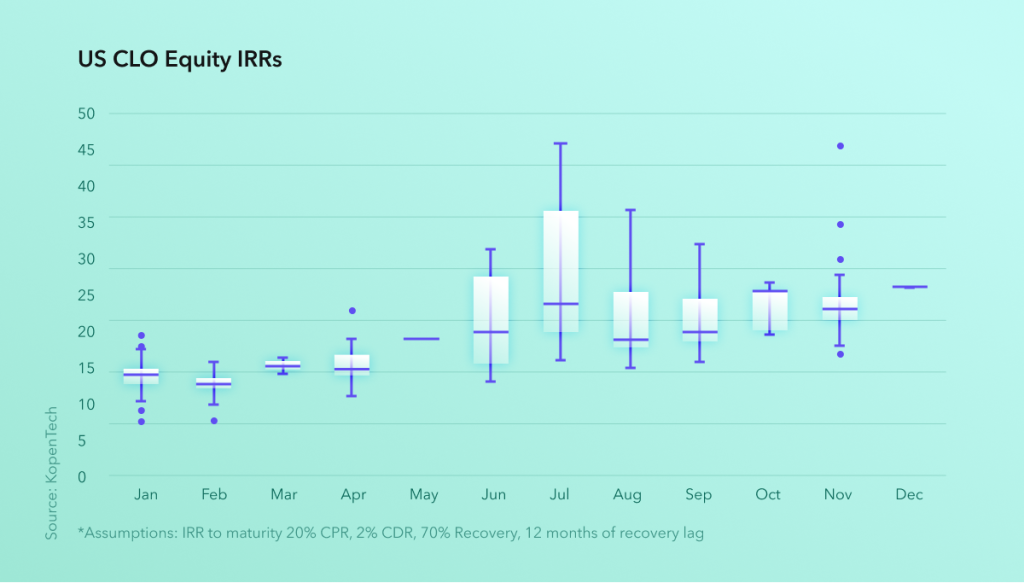

Equity IRRs are 31% higher YOY, with median of 16.33%

Despite market volatility, longer transactions dominate issuance

2022 Top Issuers and Arrangers

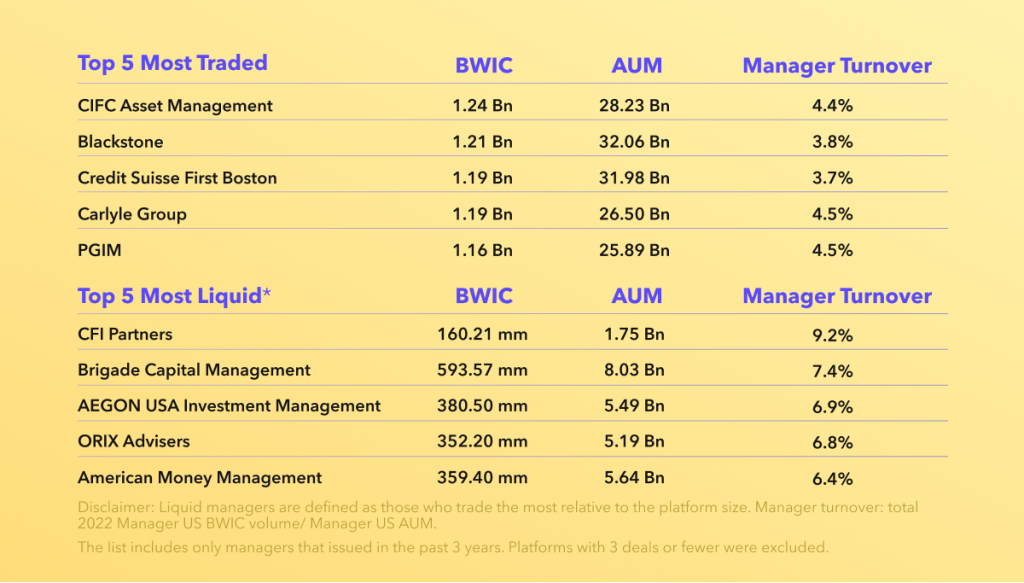

Most traded & liquid managers