Is the Quarter-End DNT Spike Real?

Is the Quarter-End DNT spike real? KopenTech researchers investigated whether or not a spike in DNT’d CLO securities exists on quarter-end months as compared to non-quarter-end months.

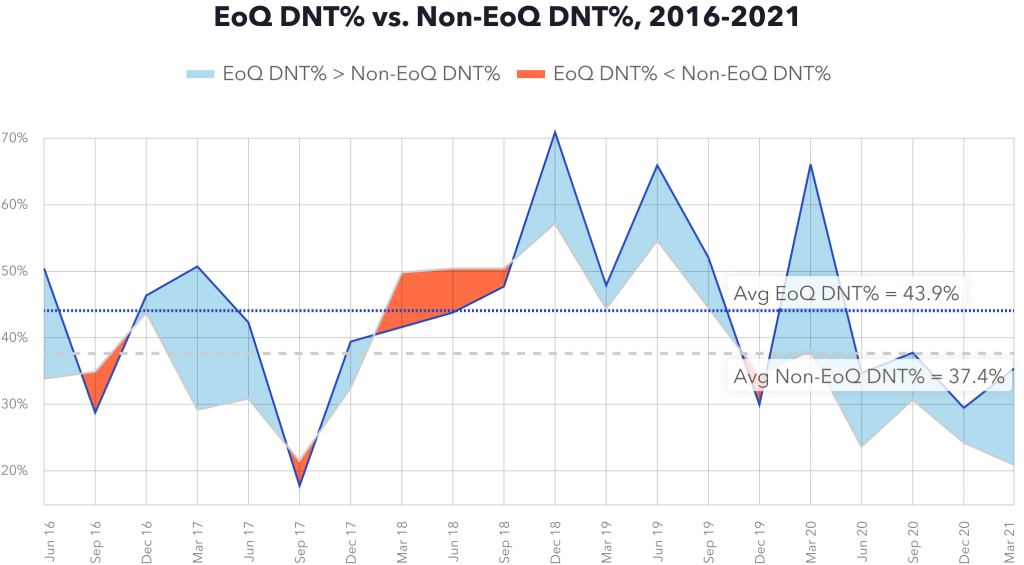

The investigation concluded that there is significant evidence of a persistent DNT Spike in the CLO marketplace. DNT rates rose from an average of 37% for non-end of quarter months to an average of 44% for end of quarter months.

In the graph, the light blue area represents quarter ends in which the DNT spike existed, and the orange area represents periods in which the DNT spike did not exist. A simple visual observation points out the persistent nature of the spike.

One possible suggested reason for the DNT spike is that asset managers are conducting portfolio valuations by accessing bids from broker-dealers without any intention of trading. Another possible hypothesis is that broker-dealers are trying to keep their own balance sheets smaller around quarter-ends and bidding to miss. Whichever reason it might be, or most likely both factors are at play, the reality of the quarter-end DNT spike is irrefutable.