CLO Secondary Market Trends: May 2021 Edition

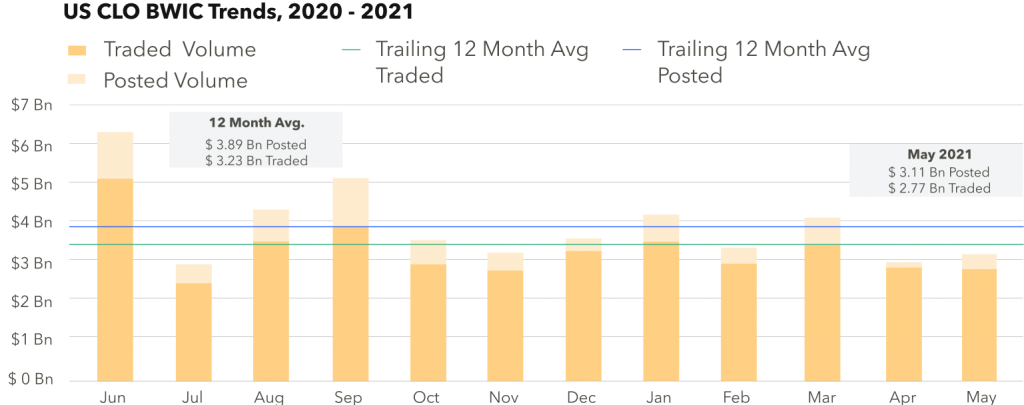

BWIC Volumes

May Posted and Traded BWIC volumes were below the 12-month average, at $3.11 Bn and $2.77 Bn respectively. Despite lower volumes, there was a high ratio of successful BWICs this month.

TRACE* Volumes

CLO trading volumes in May trended sideways at $13.4 Bn. HY-rated tranche volumes were at their 12-month high, with $6.5 Bn traded.

BWICs as % of TRACE

May saw IG-rated tranches executed via BWIC increase to 34%, the second highest in the last 12 months, while HY tranches were at 18%, also at the higher end of total TRACE volume.

BWIC Volumes By Rating

During May, AAA tranche trading trended downwards to $0.77 Bn from the trailing 12-month average of $1.88 Bn. Equity saw a 5x increase in listings, with $0.55 Bn traded compared to the $0.12 Bn 12 month average.

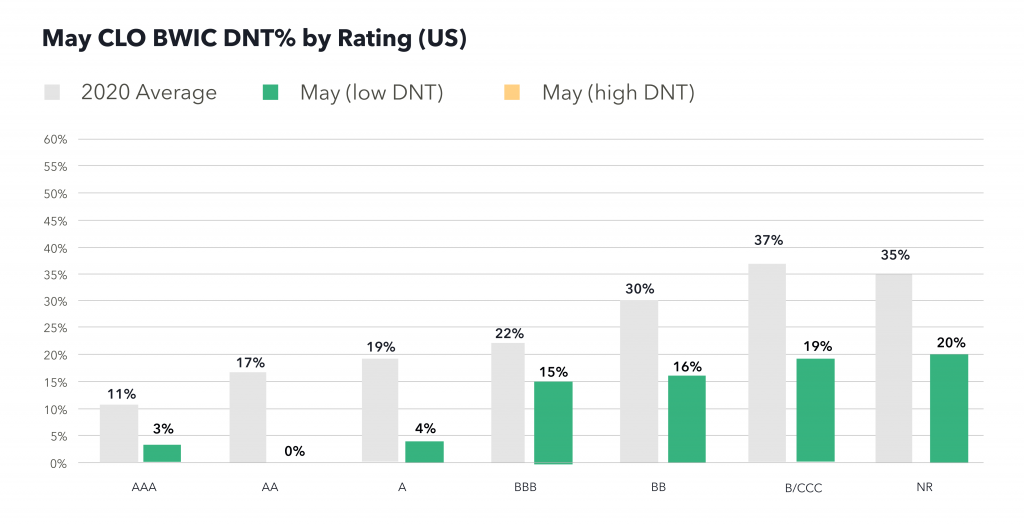

DNT Rates

CLOs continued their trend of low DNT%, with 97% of AAA BWICs trading. All other tranches also remained significantly lower than average, indicating strong demand.

Dealers Inventory

In May dealers bought $271 mm in bonds, reversing the 5-month streak of net selling, with April showing a record $1.1 Bn in sold bonds.

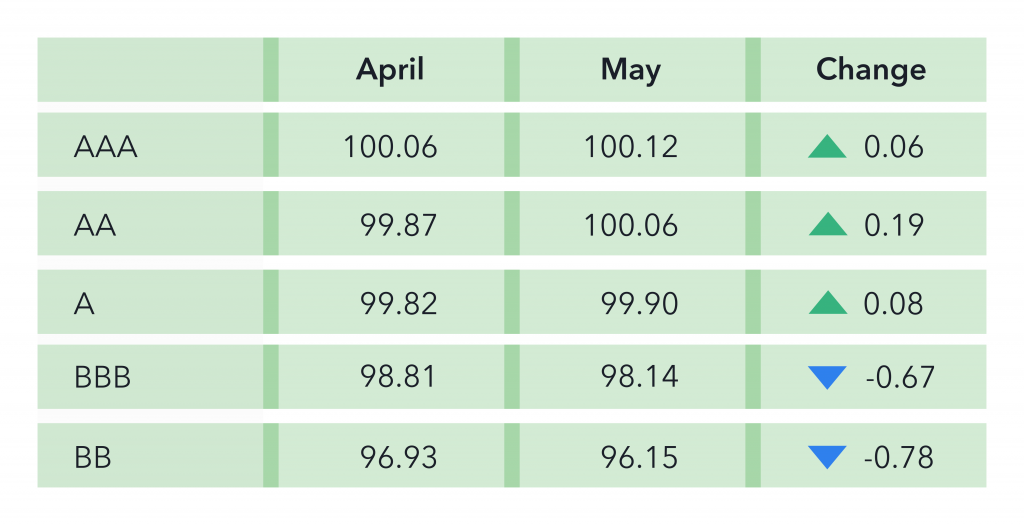

Prices** Across the Stack

Prices stayed relatively steady in IG, while BBB and BB bonds saw prices decrease.

Cathedral Lake VI embeds AMR

Carlson Capital’s $409.5 mm Cathedral Lake VI CLO became the 13th vehicle to embed AMR online refinancing into their deal in May. This brings total AMR AUM to $5.7 Bn. With the current wave of refinancings, bottlenecks on the rating agency front have made the process longer, revealing AMR as a useful tool to avoid the waiting line. As demand continues to grow, 15 broker-dealers are providing liquidity on the AMR platform.

*TRACE reports all CLO trades involving FINRA members.

**Prices are based on trades that provided color and are likely to underestimate actual traded levels.