CLO Market Trends: July 2024 Edition

July resets reach historical highs of $21BN, AAA new issue spreads are in mid-130s bps.

Guest Speaker: Jonathon Siatkowski, Marathon Asset Management

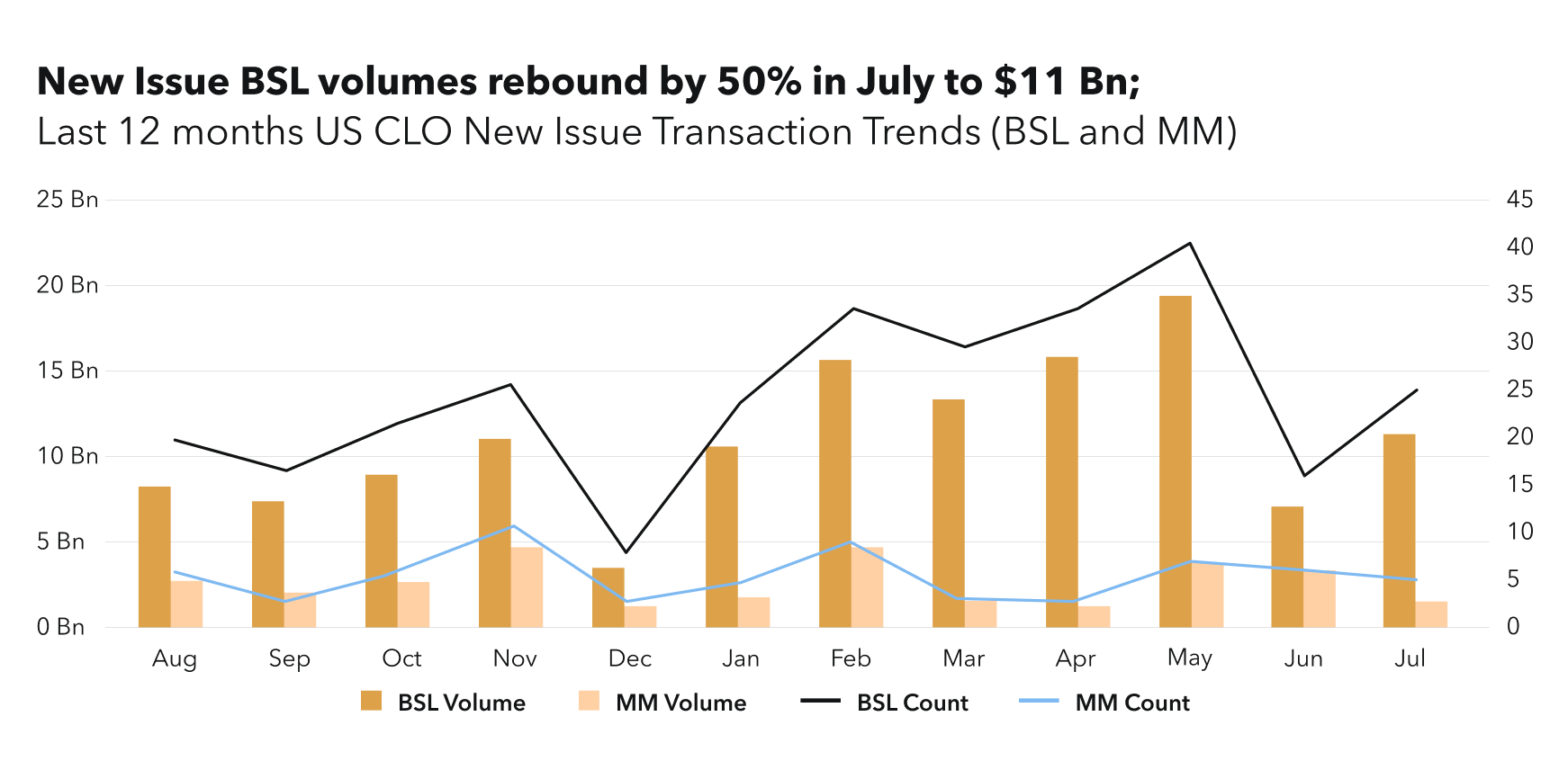

Primary Market

“In July, we began to see primary spreads continue tightening again, and new issue pace regain momentum.” — Jonathon Siatkowski

The US BSL new issue volume recovers from June with 24 new deals priced in July. Year-to-date (YTD) 2024 volumes have totaled $94.1 billion, compared to $49 billion for the same period in 2023. New issue AAA spreads continue to tighten, reaching 135 bps for long-dated deals, with the basis between BSL and private credit AAAs currently standing at roughly 40 bps.

Refinancing volumes are down compared to June, totaling to $7.7B; YTD 2024 refinancing volumes are at $48.8 billion. Resets volumes continue to dominate primary market, reaching $20.9 billion in July, up another 9%.

“Managers are choosing resets due to the in-the-money optionality. With the challenge of assembling new issue portfolios, and deep in-the-money cohorts coming out of non-call each month, this trend is likely to continue throughout the year.” — Jonathon Siatkowski

Secondary Market

“The tone stayed consistent month over month, but trading slowed, due to the strong rally so far this year, and from resets taking the attention of “rollers” who might otherwise trade in secondary.” — Jonathon Siatkowski

TRACE Volumes & Dealer’s inventory

TRACE volumes are the lowest for the past 12 month, reaching $13.9 billion. The YTD 2024 volume reached $128.0 billion, compared to $109.0 billion for the same period in 2023.

Broker-dealers continue to lighten their balance sheets, with a net sell volume of $890 million in July, $122.4 million more compare to last month.

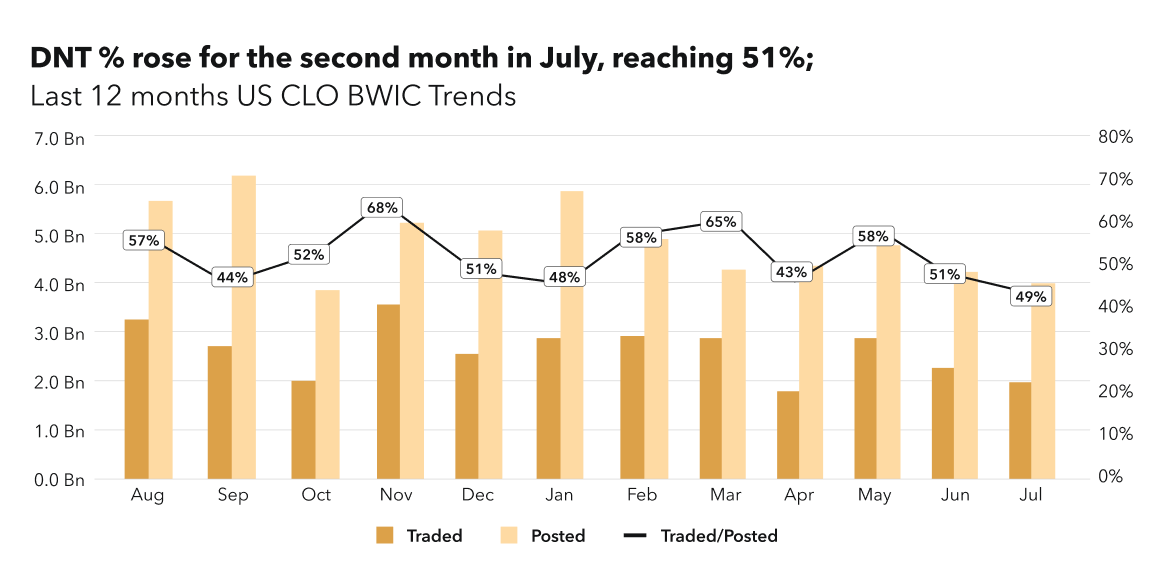

BWIC Volumes & DNT Rates

BWIC activity, representing the percentage of BWICs relative to total TRACE-reported volumes, continued to drop: 15.45% in June vs 14.05% in July. The total traded volume of BWICs in the US reached $1.9 billion, while the posted volume was $3.9 billion. This drop in traded volume and the increase in DNT% in July could be a reflection of the strong reset primary market and the typically quieter summer months. BWIC IG volume lowered despite increase in TRACE IG volume.

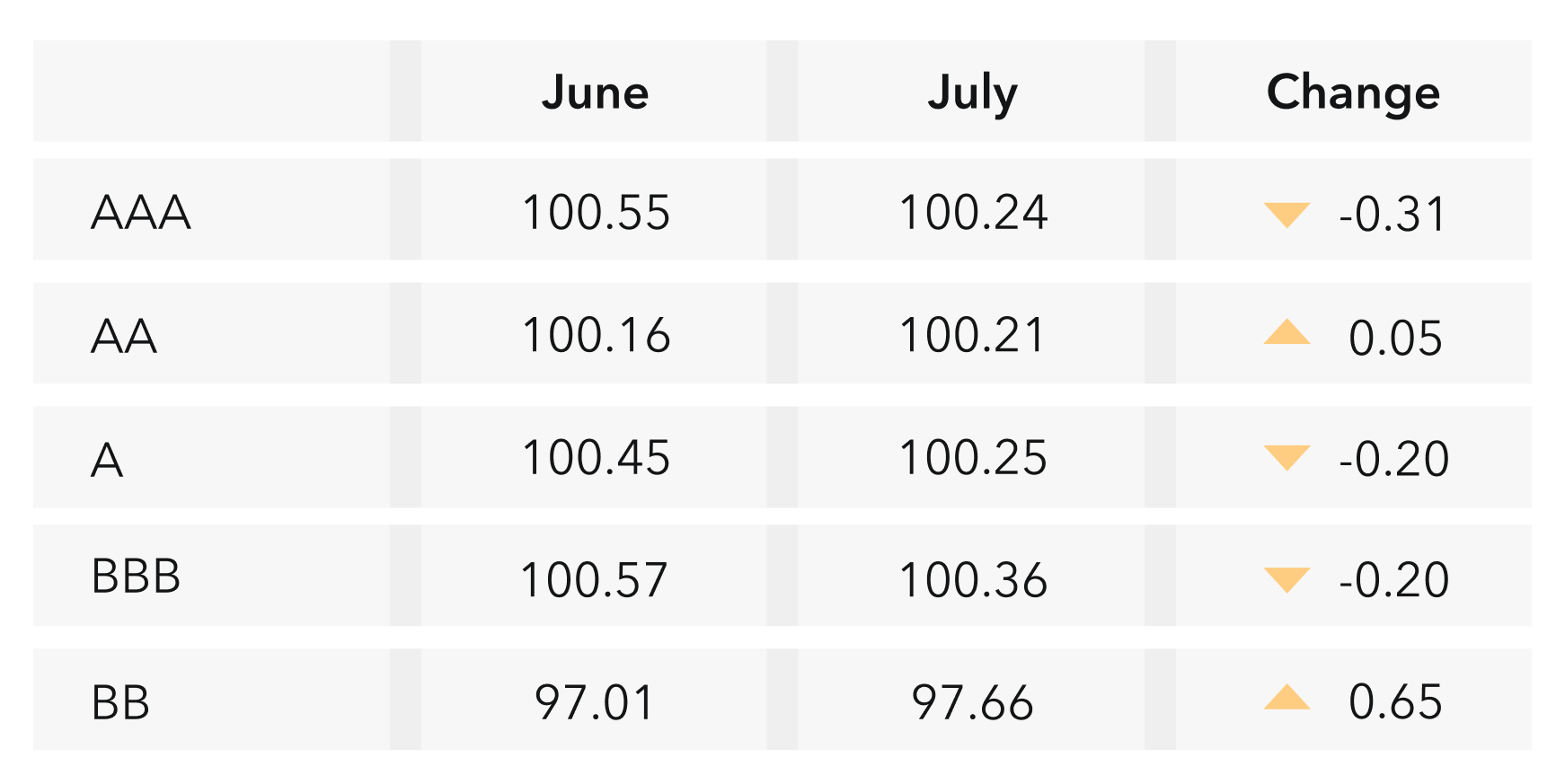

Prices Across the Stack

All IG CLO traches remain traded on average above par.

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on September 10th for the August Market Trends Webinar.