CLO Market Trends: April 2022 Edition

High Trading Volumes Continue, New Issue Volumes Recover

April Webinar Guest Speaker: Dan Wohlberg, Eagle Point Credit Management

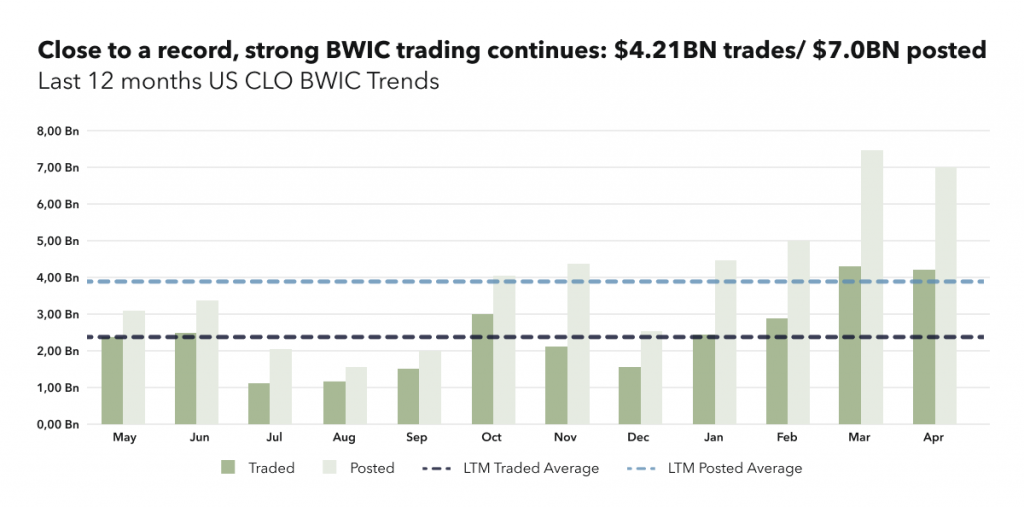

BWIC Volumes

April had close to a record in BWIC trading with 4.3BN trades/ $7.6BN posted. BWIC volume continues to be driven by IG-rated tranches, with $2.22BN in AAAs.

“We are seeing the rotation out of AAAs which like loans have generally held up. You can trade out of them into lower priced assets. AAAs are the dry powder to allow you to be an asset picker.” Dan Wohlberg.

TRACE Volumes

TRACE volume is $19BN in April, slightly down from the record high in March of $21BN and we continue to see volumes to be driven by investment grade.

“There is certainly a demand for CLO paper that is going to persist throughout the year and going forward … and that demand is not going away.“ Dan Wohlberg.

Dealer’s Inventory

Dealer net flows show dealers expanding their balance sheet buying $1BN from clients, partly a result of increased client selling but also showing willingness to put more dollars at risk at these levels.

“With the first quarter over, banks now have an incentive to put on risk, especially IG paper which is at a significant discount.” Dan Wohlberg.

DNT Rates

BWIC DNT rates are higher in mezzanine and equity as more securities were offered for sale. BBB DNT rates in April were almost double their LTM up to 45% and BBs were at 40%.

“This isn’t surprising with BBB and BBs being more volatile, and prices moving around so quickly. People might not be able to get the prices they want.“ Dan Wohlberg.

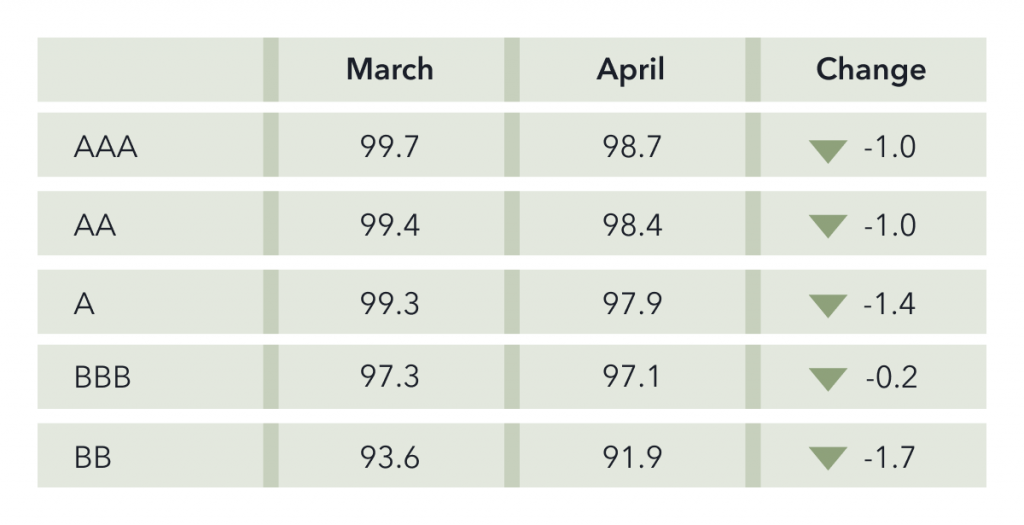

Prices** Across the Stack

April was another leg down in CLO prices across the stack. Price action reflected the flows and junior mezzanine fell less on a relative basis. BBBs were stable, down just -0.2. Investors down the capital stack exhibited less pressure to sell.

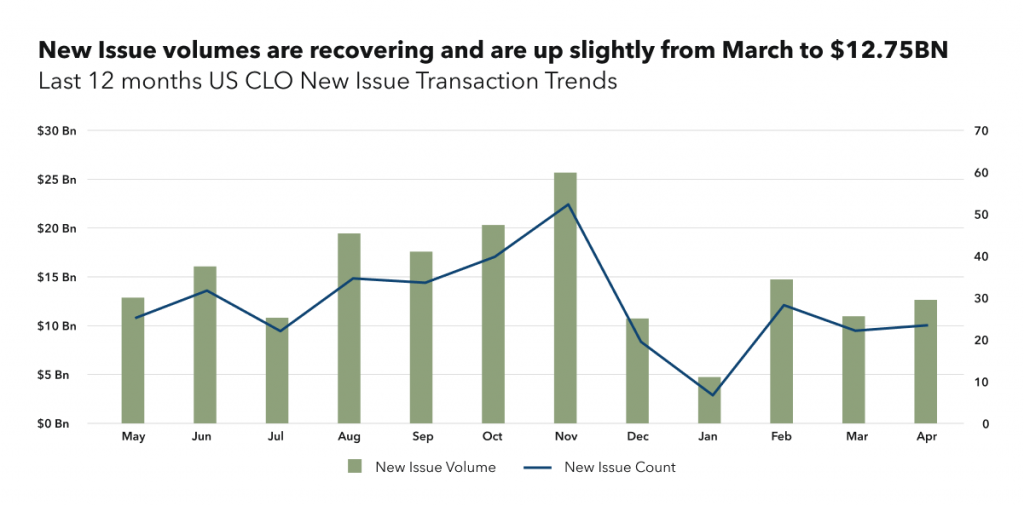

New Issue

New Issue CLO volumes were recovering and up slightly to $12.75BN from March lows.

“The primary pricing has caught up to the secondary. Primary AAAs spreads have widened and investors in primary can now invest without feeling like they are missing out on a relative basis to secondary.” Dan Wohlberg.

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at bwic.kopentech.com.

Please join us on June 7th for Market Trends Webinar and register here.

KopenTech is affiliated with KopenTech Capital Markets, a member of FINRA.