AMR Refinancing Results: Mountain View CLO XIV

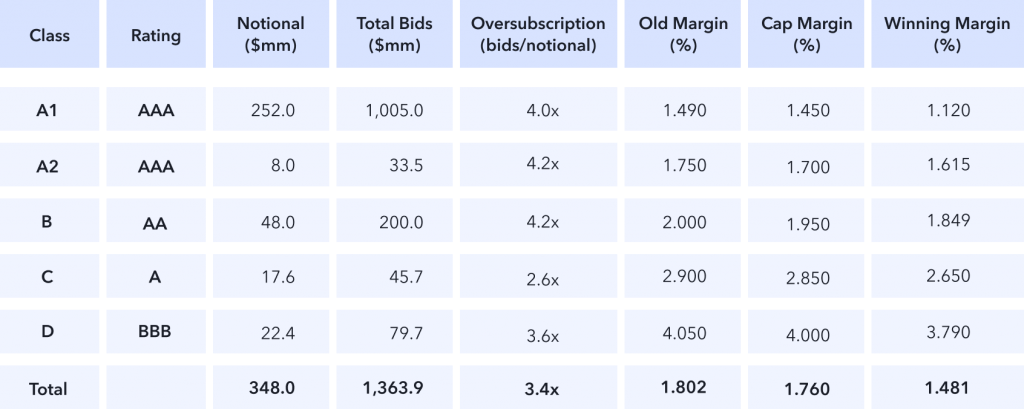

On January 14, 2021, KopenTech held an online refinancing AMR auction for Seix’s Mountain View CLO XIV. Classes A1 through D totaling $348 million all cleared below the cap margin. The maximum acceptable spread level. Over $1.3 billion in bids were submitted through KopenTech’s platform resulting in the auction being nearly 3.5x oversubscribed.

The A1/AAA tranche cleared at L+112, being 4x oversubscribed and close to L+110, the price guidance from investment banks. The auction lowered the cost of AMR-able debt from L+180 to L+148.

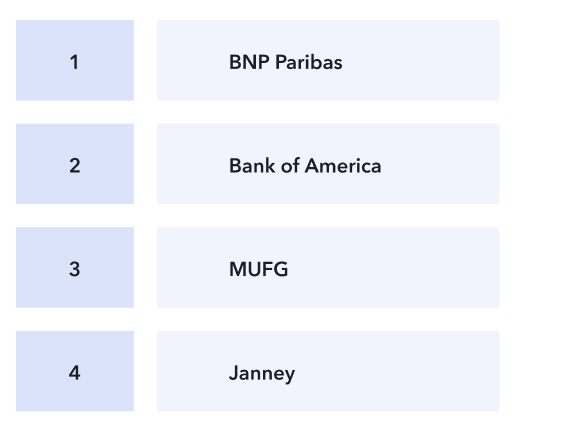

It was the second AMR auction hosted on the KopenTech platform. AMR is now embedded in approximately $5 billion in CLO AUM and continues to gain traction among investors and broker-dealers alike. The KopenTech AMR platform has 15 broker-dealer members. The January 2021 AMR refinancing of Mountain View XIV had strong participation among broker-dealers. The top 4 participating broker-dealers are listed below.

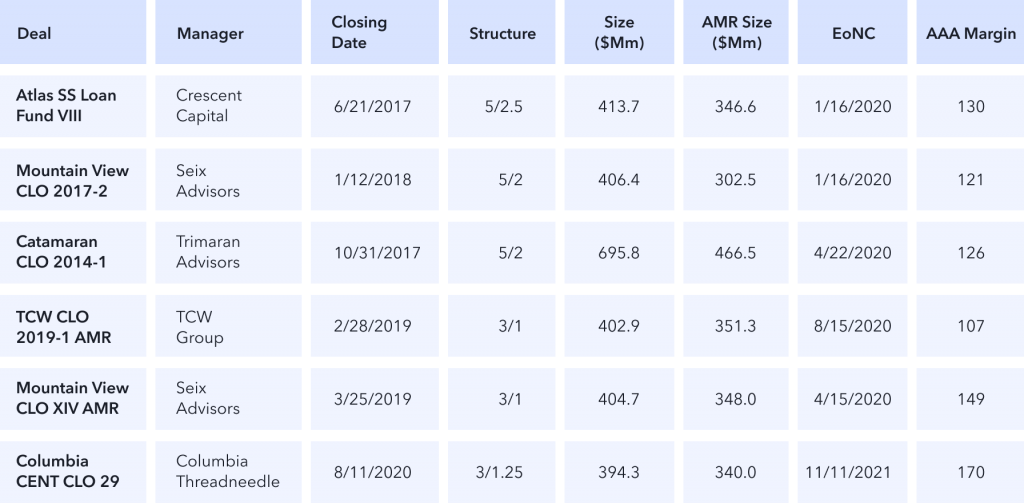

KopenTech is expecting to hold more online refinancing auctions this year. 6 CLO transactions with the AMR feature will be out of their noncall period in 2021, a total of $2.15 billion. Potential candidates for AMR refinancing are listed below.

This is intended solely for institutional investors and broker-dealers.