AMR: First Auction Results

KopenTech conducted the first Applicable Margin Reset (AMR) refinancing auction on January 30, 2020 for TCW CLO 2019-1. The AMR procedure, a low-cost alternative to traditional refinancing through an arranging bank, consists of a secondary auction process in which broker-dealers bid to determine new spreads for each tranche.

AMR auctions are open to a wider array of investors than refinancings of the past. Traditional refinancing involves only one arranging bank, whereas AMR auctions allow multiple participating banks, each soliciting bids from their own set of customers. Expansion of the buyer base might have contributed to the successful refinancing. Despite an unfamiliar process, five secondary trading desks provided ample supply to refinance $351.3 million in CLO tranches. The first auction received more than $1 billion in orders, with the auction being three times oversubscribed.

After the inaugural AMR auction, several more banks joined the KopenTech AMR platform, setting the expectation that the investor base will only continue to grow going into future auctions. Over 30 different broker-dealers have secondary CLO trading desks. Of the five participating banks, BNP Paribas was the most active broker-dealer participant, submitting72% of the bids that received an allocation.

What Determines the Level of AAA Spread?

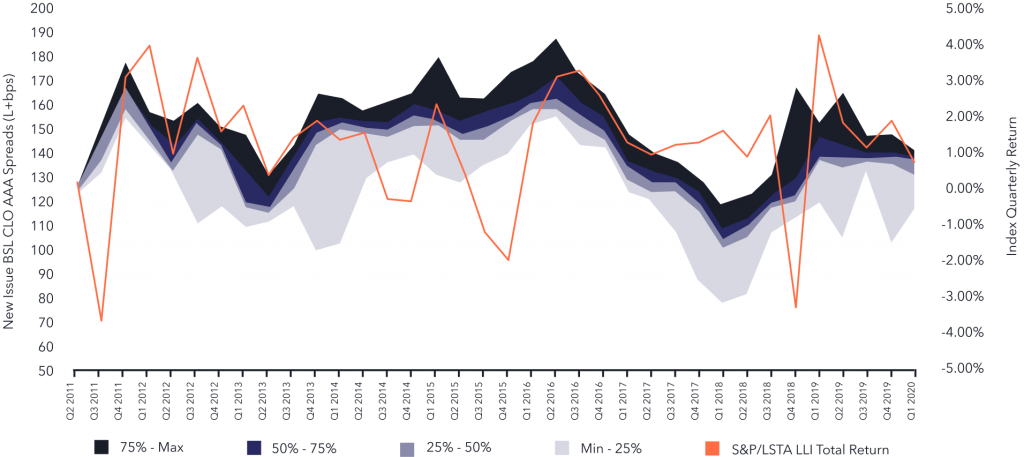

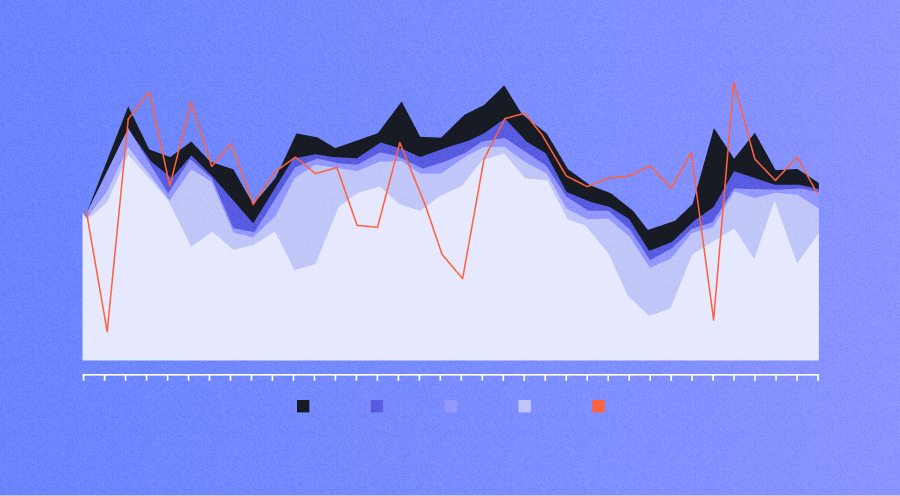

Approximately 130 managers are active issuers in the CLO market, each of which has a different style and investment philosophy. As a result, AAA tranches normally price within a range (90th percentile minus 10th percentile of new issue coupons) of 12 to 18 bps, with a long-term average of 14.6 bps. The variation can be due to objective criteria such as the frequency of issuance, platform size, and historical performance as well as more subjective matters, including the perception of platform strength and marketing efforts.

Spread differences between managers can also vary widely from market conditions. In steady markets, the difference has been as narrow as 7 bps, such as in Q1 2012 when the S&P Leveraged Loan 100 Index returned 3.76%. But in more volatile markets, differences in AAA margins expand significantly. In Q1 2016, this range grew wider than 20 bps in response to spike in oil defaults and a -2.10% return on the S&P Leveraged Loan 100 Index in late 2015.

New Issue CLO AAA Spread Dispersion, 2011-Present

How does TCW CLO 2019-1 AMR Compare to the Rest of the Market?

TCW is an emerging CLO issuer; the manager has issued five post-crisis deals, whereas some managers issue as many deals annually. The tightest prints in the market are typically from frequent issuers; it was less likely for the refinanced TCW CLO 2019-1 AMR transaction to achieve AAA spreads at the tightest level in the market.

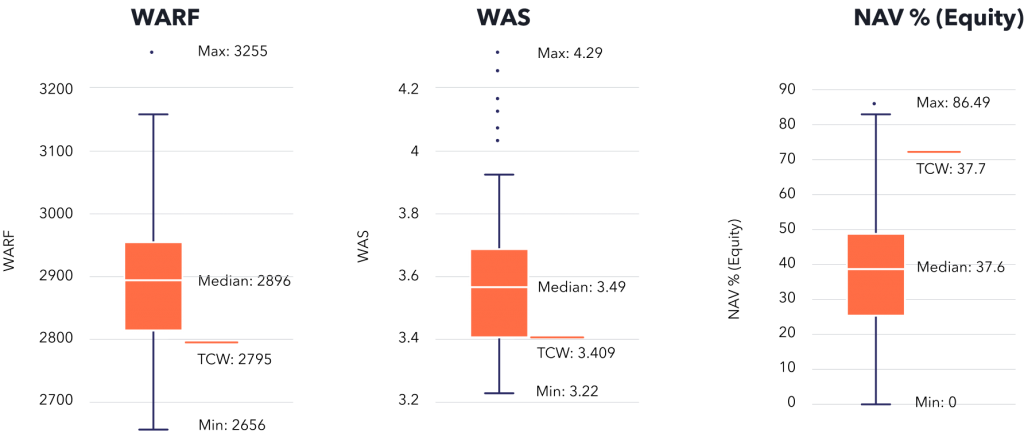

However, since the characteristics of TCW CLO 2019-1 AMR have been strong compared to other deals of the same vintage, the refinanced deal priced closer to the tighter end of the market through the first auction process. As of the last trustee report, TCW CLO 2019-1 AMR has a weighted average rating factor (WARF) of 2820, a weighted average spread (WAS) of 3.41%, CCC+ and below rated holdings of 2.18%, and 1.1% in second-lien loans.

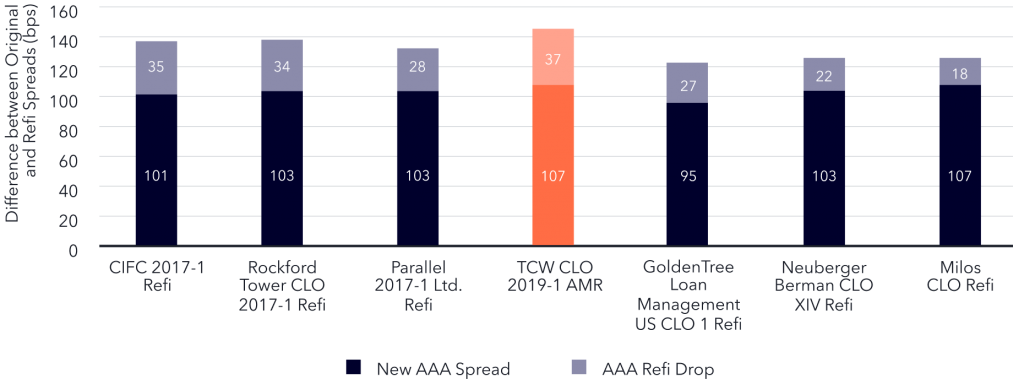

Comparison of TCW 2019-1 AAA Pricing to Traditional Refinancings

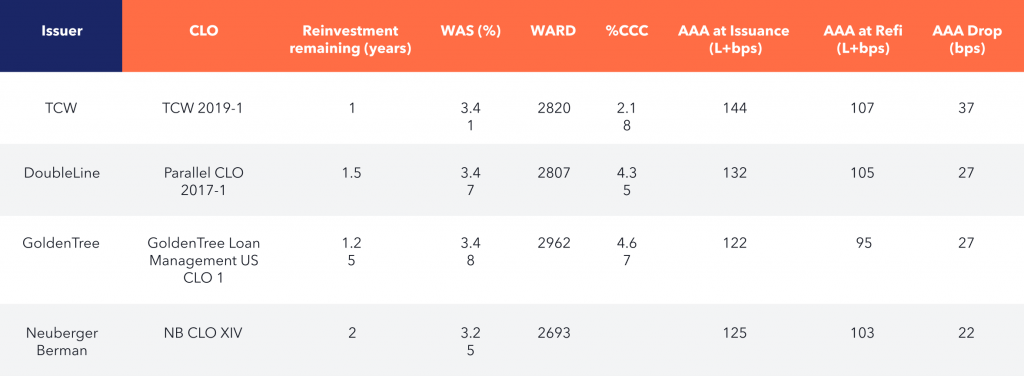

With one year left in its reinvestment period, the AAA tranche of TCW 2019-1 was reduced by 37 bps to 107 bps from 144 bps at issuance.

2020 CLO AAA Refi ’Drops’from Original Spread

A few days prior to the AMR auction, DoubleLine refinanced its Parallel CLO 2017-1 with 1.5 years remaining in its reinvestment period. The manager cut its AAA coupon by 27 bps, to 105 bps from 132 bps. DoubleLine is a comparable platform to TCW, first issuing in 2015 and again in 2017. Its refinanced portfolio is also similar to that of TCW, with a 3.47% WAS and 2807 WARF, but higher CCC+ and below exposure at 4.35%.

TCW still also managed to price closely to benchmark issuers such as Neuberger Berman, which refinanced its Neuberger Berman CLO XIV the day following the TCW 2019-1 AMR auction. That deal, which has two years left in the reinvestment period, reduced its AAA coupon 22 bps, to 103 bps from 125 bps originally. Of note, the Neuberger Berman CLO XIV runs a slightly more conservative portfolio with a 3.25% WAS and 2693 WARF.

On the same day as Neuberger Berman, GoldenTree also refinanced it’s GoldenTree Loan Management US CLO 1 with 1.25 years remaining in reinvestment, cutting its AAA coupon 27 bps, to 95 bps from 122 bps. The 95 bps print represents the lowest refinanced year-to-date AAA spread. GoldenTree is considered a benchmark CLO issuer and typically prices at the tighter side of the range The GLM US CLO 1 runs a slightly higher spread portfolio at 3.48% WAS, 2962 WARF, and 4.67% CCC+ rated loans and below.

TCW recently refinanced another deal, TAMCO 2017-1, through Jefferies. Talk for the refinanced AAA tranche, with 1.5 years of reinvestment left, was around 103 bps, a 25 bps drop from the original 128 bps spread at initial issuance. Given that dealers involved in the AMR auction charged 2-4 bps in commission, which was likely passed onto investors via a slightly wider spread, it appears that there was no additional premium priced into the TCW 2019-1 AAA tranche aside from that for dealer commissions. Considering the 300-400% greater cost of traditional refinancing over AMR, equity-holders for TCW 2019-1 may be satisfied paying this commission premium.

Refinancing Costs: Traditional vs AMR

It is worth noting that those spread differences exclude fees associated with the traditional refinancing process.

Traditional refinancings are expensive due to their structure; old CUSIPs are destroyed and new CUSIPs are issued, which calls for an arranging bank to conduct a de facto new issue. Equity investors, who stand to benefit the most from refinancing, pay 8-10 bps to an investment bank upfront, with an additional 8-10 bps in legal and rating agency fees. In total, a traditional refinancing can cost 18-22 bps, making this process uneconomical unless significant spread tightening occurs.

In contrast, costs in the first AMR refinancing are 60% lower. The auction agent, KopenTech, receives a success fee of 2 bps as well as a subscription of $225k over the life of a contract (to the end of the reinvestment period of the CLO), and the Trustee charges $20k annually between the end of reinvestment period and end of noncall. In the case of an unsuccessful auction, KopenTech does not receive the 2 bps success fee. Any subsequent AMR auction would incur only another 2 bps success fee. CLOs with AMR is to conduct four secondary refinancings for the price of one traditional refinancing.

* Assumptions are based on a hypothetical $367.5MM CLO transaction with an AMR auction held after the end of a two-year non-call period

** Through the end of the reinvestment period

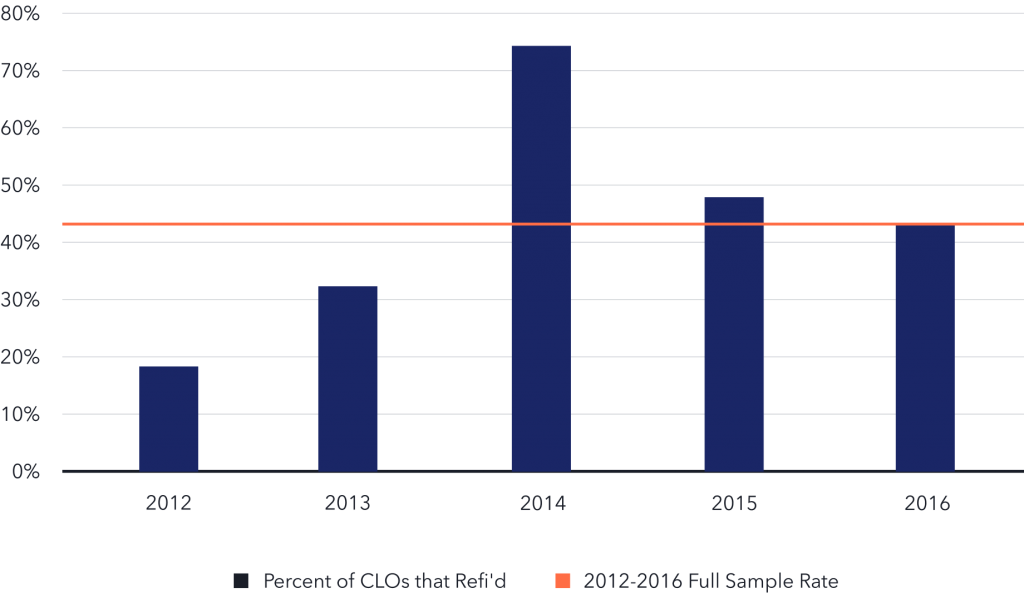

Since 2012, fewer than 5% of post-noncall CLOs refinance more than once. Why? Costs are too high to justify multiple refinancings.

Based on a marginal cost of 2 bps, CLO refinancings via AMR are likely to become the market standard.

CLO Refi Rates by Vintage

Since AMR is drastically less expensive than alternatives, it also helps to separate the decision to extend maturity (reset) versus lowering the rate (refinancing). Before the advent of AMR, many CLO investors opted to reset too early, simply because the cost of a traditional refinancing and a reset were similar.

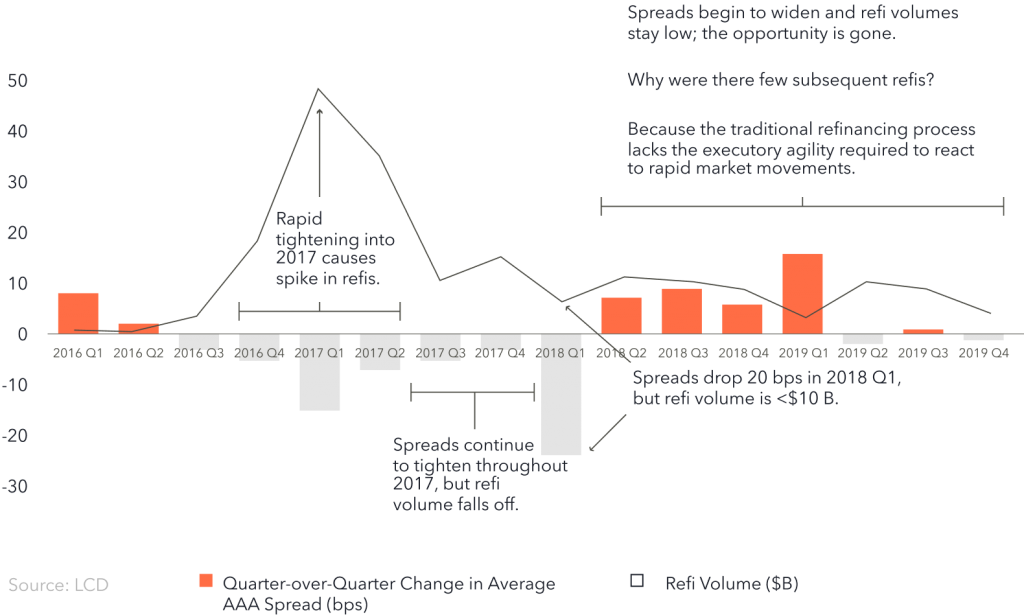

Execution Speed

How much value should an investor put on speedy transaction execution?

Traditional refinancings can take between two and three months to execute. Much can happen in this time span, leaving investors exposed to unnecessary market and execution risks.

CLO managers and equity investors find that opportune times to refinance often lead to multiple points of backlogs within the existing refinancing pipeline, whether delayed by arranging banks, law firms, or rating agencies.

In the past, when traditional refinancings could only be conducted on a quarterly payment date, CLOs that could not make it into the extensive queue would often get pushed back another quarter, unnecessarily cutting into the returns for the next quarter for equity investors.

Alternatively, with only nine business days from initiation to auction, AMR allows investors to take advantage of market tightening much faster than traditional refinancing. This risk reduction is difficult to quantify and is dependent on deal structure and market movement, but it is undoubtedly positive and significant.

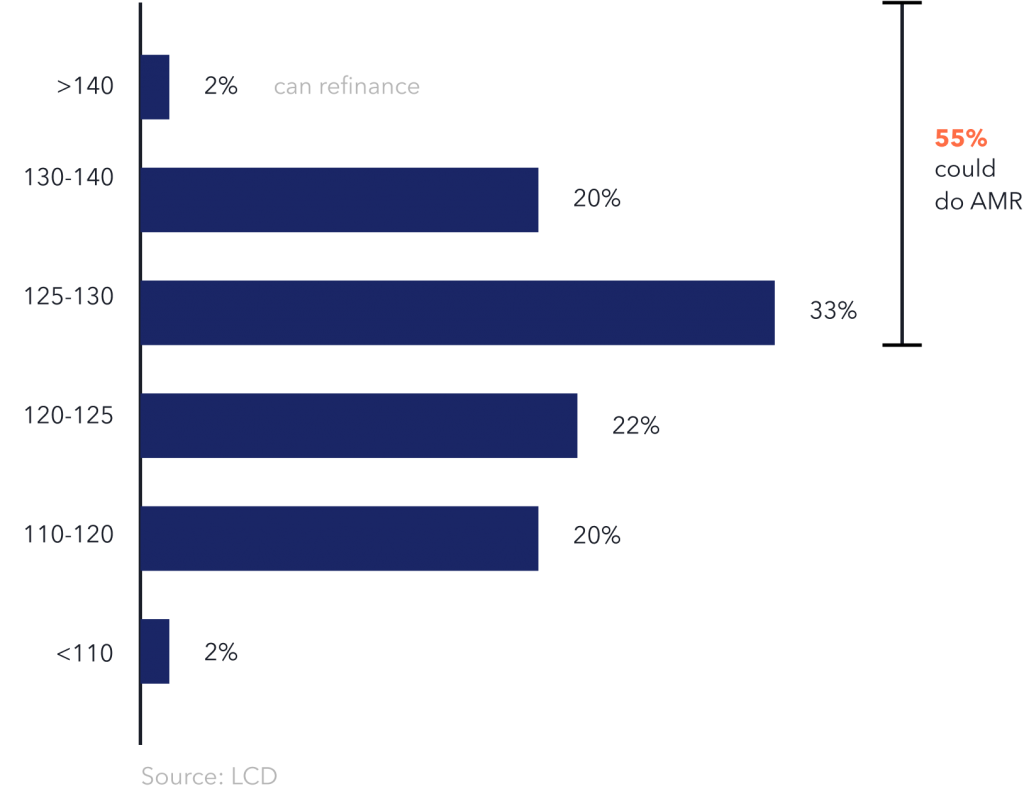

Illustration: 2017 Vintage CLOs are “Stuck in the Mud”

An interesting example to prove out this thesis is that of 2017 vintage CLOs. This cohort printed particularly tight relative to neighboring years.

2017 New Issue AAA Spread (bps)

Most 2017 vintage CLOs came out of their non-call periods in 2019. Few refinanced because it was uneconomical to do so.

As of early 2020, spreads have tightened, prompting investors to again determine whether the costs of a traditional refinancing are economically justified. This decision is even more complicated and untimely given the backlog of deals requiring rating agencies and investment banks. Investors could learn valuable lessons from AMR and integrate a simpler, cheaper process into CLOs at new issuance to avoid these potentially expensive and time-consuming problems.

“Stuck in the Mud” – A Missed Opportunity Case Study

Are We There Yet?

AMR, like any novel feature, was initially greeted with skepticism. The resounding success of the inaugural auction has proven that AMR is effective not only conceptually, but also practically.

Cost savings associated with AMR range from 13-15 bps compared to a traditional refinancing and this figure does not incorporate the benefit that future auctions will have from an even wider investor base bidding. As the CLO market continues to grow, old structures evolve into superior methods. The first successful AMR auction was a watershed moment for structured products.