CLO Secondary Market Trends: January 2022 Edition

BWIC Volumes

January was a strong month for CLO trading. We had a total of $4.4 billion listed on BWICs, with $2.6 billion trading. The average volumes for the last 12 months are $3.2 billion for posted and $2.1 billion for traded.

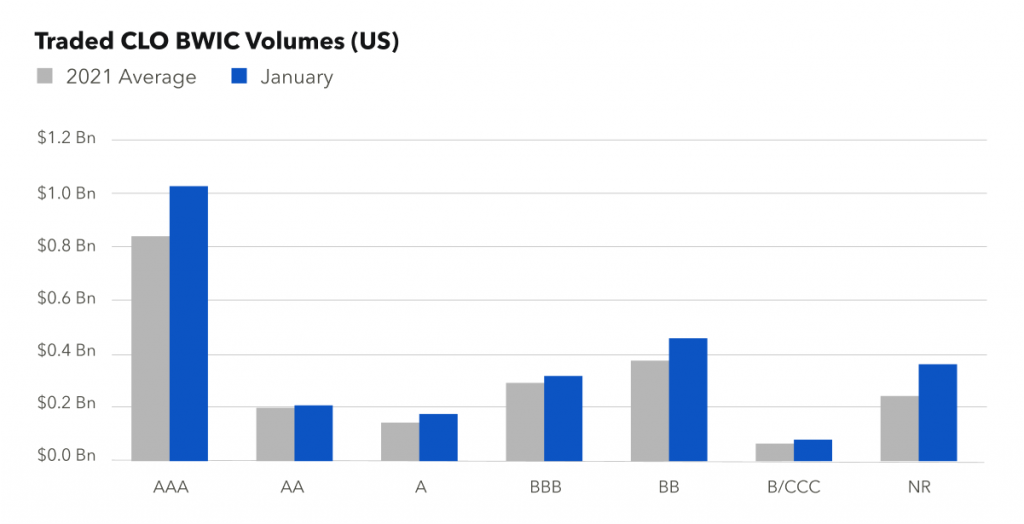

BWIC Volumes by Rating

An increase in traded volumes was across all ratings but barbelled led by AAAs and the lower part of the capital stack. AAAs led the way with over $1 billion trading via BWICs. January also saw over $400 million BBBs and $375 million in CLO equity trading via BWICs.

TRACE Volumes

TRACE volumes showed a similar increase, with a total of $15 billion trading in January. This represents an increase from $9 billion in December. $7 billion was investment grade and $5 billion was non-investment grade. This brings the average monthly IG volume to $7 billion and the average non-IG volume to $5 billion.

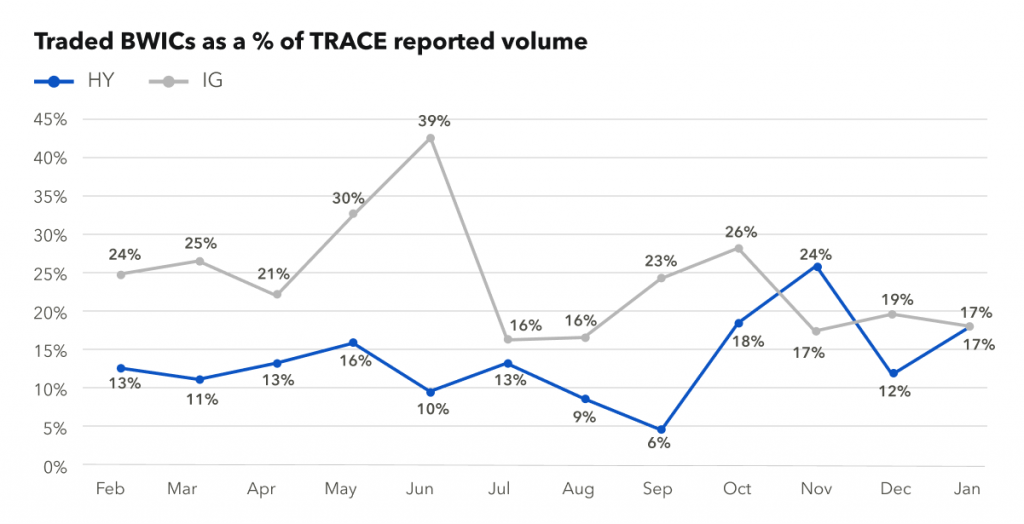

BWICs as a % of TRACE

January BWICs as a share of TRACE reported volume was of interest with both investment grade and high yield coming in at 17%. This was a decrease for IG and an increase for HY from December. These figures are lower than historical averages and showed that the majority of trading during December was out of comp.

DNT Rates

We’ve seen exceptionally low DNT rates the last several months with the exception of December. This indicates strong demand from buyers and January was strong evidence of this. AAAs continued their streak of sub-5% DNT rates. BB and CLO equity had slightly higher than the last 12 months’ average DNT rates.

Dealer’s Inventory

TRACE showed that January dealer flows were net neutral, with $6 million purchased from clients. This differs from December when $321 million was sold by dealers to clients.

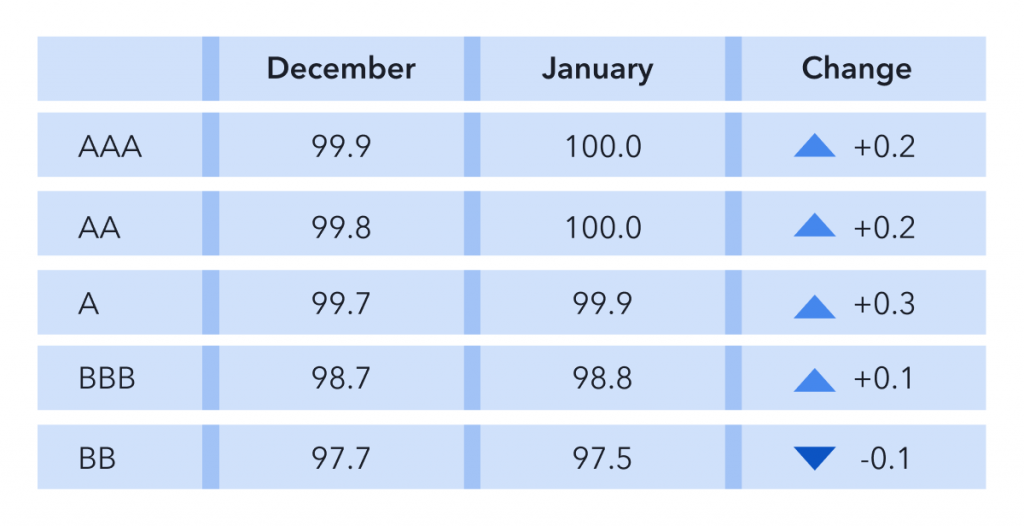

Prices** Across the Stack

From December to January we saw prices stay fairly constant with both AAA and AA trades average pricing at par. A-rated bonds also saw a slight price increase of 0.3 points bringing averages to 99.9.

*TRACE reports all CLO trades involving FINRA members.

**Prices are based on trades that provided color and are likely to underestimate actual traded levels.