CLO Market Trends: March 2023 Edition

Volumes are down, prices are lower across the stack.

March Webinar Guest Speaker: DJ Lucey, SLC Management

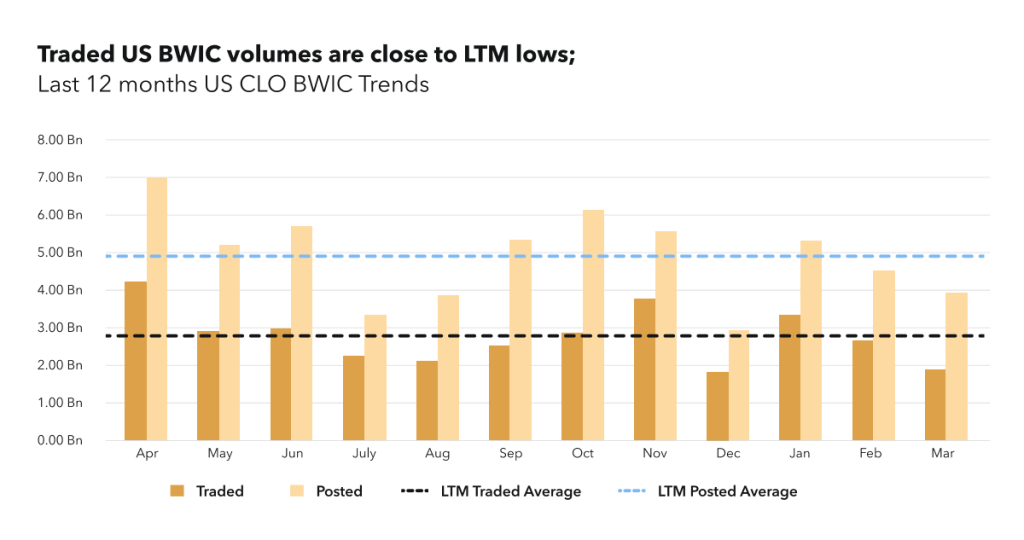

BWIC Volumes

Trading volumes in US BWICs continue to decrease, down 14% in posted (now $3.9BN) and 29% in traded (now $1.9BN), compared to last month’s figures. Both traded and posted volumes were below LTM averages in March, with traded volumes being only 100M higher than the LTM lows reached in December 2022. Looking at weekly trades, the week of SVB, March 6th to the 10th, had the highest notional amount traded of $655.5MM versus an average of $307MM for the other weeks of March. Further, almost nothing traded in BWIC on 3/10, the day SVB was taken over, with only 8 reported trades totaling $19.5MM.

BWIC Volumes by Rating & DNT rates

IG share in US BWICs remains high at 82%, with February AAA traded volumes being close to the LTM average of $1.6BN. AA and A traded volumes were less than 50% of their LTM average, with A being only $0.1BN. Average trade sizes for AA were flat, rose for A’s, both at $4MM, but dropped for AAA and equity.

“March sellers wanted yesterday’s levels, the bid/offer widened, but bonds are in stronger hands.“ – DJ Lucey.

TRACE Volumes

TRACE volumes have stayed flat since last month at $14.8BN, with 21% of that being HY, this supports the stability of the structured credit market despite fluctuating economic events and technicals. The daily TRACE shows 3 days trade higher than $1BN, the highest being $1.44BN.

Dealer’s inventory

On the dealer inventory side, March shows small dealer selling, with clients buying $110MM and dealers still being long $2.5BN.

“CLOs are not the center of the crisis; we see a less direct impact on them fundamentally and across all structured credit.” — DJ Lucey.

Prices Across the Stack

Average observed US BWIC prices fall from February highs, with AAA trading at 98.32 cents on a dollar on average. The last week of March however shows a significant fall, showing an average of $95.67 for AAAs and $87.58 for AAs. Average prices on AA deals for the month of March were $95.39 and are close to LTM lows of $94.38.

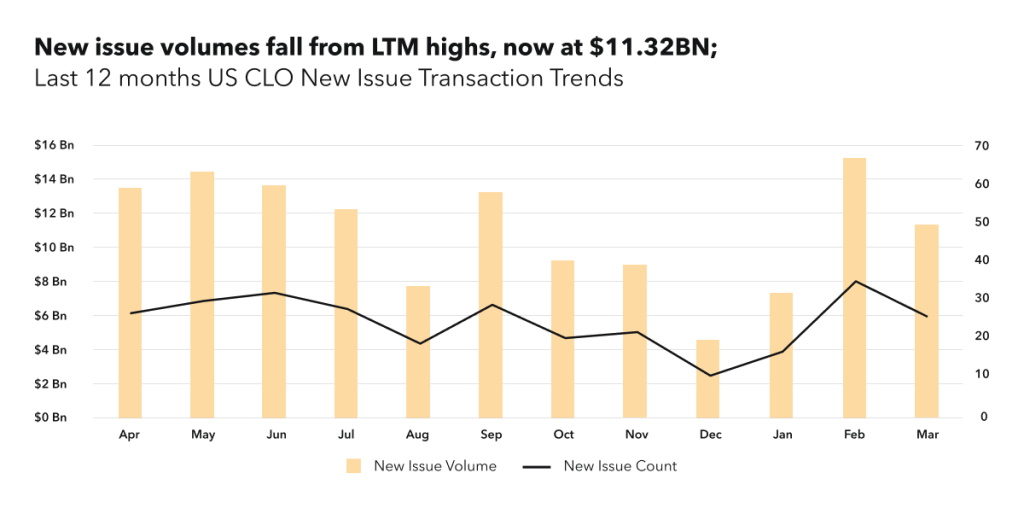

New Issue

March new issue volumes fall to $11.3BN, with 82% of that being long-duration deals. New issue spreads tighten further: US AAA spreads for longer BSL transactions are at 180-210 bps range (27 bps tighter than February range).

“Given broad market selloff, March felt relatively ordinary when looking at CLO new issue volume. April may look like February because the market feels healthy.” — DJ Lucey.

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at bwic.kopentech.com.

Please join us on May 11th for Market Trends Webinar and register here.

KopenTech is affiliated with KopenTech Capital Markets, a member of FINRA.