CLO Market Trends: May 2024 Edition

New issue volumes rise to $23.5 Bn, AAA tightens 140 bps, dealer net purchase hits $2.52 Bn

Guest Speaker: Kenneth Szal, SLC Management

Primary Market

“It is a struggle to acquire bonds right now, especially in refinancings and resets. This trend is evident across different levels of the capital stack.” – Kenneth Szal

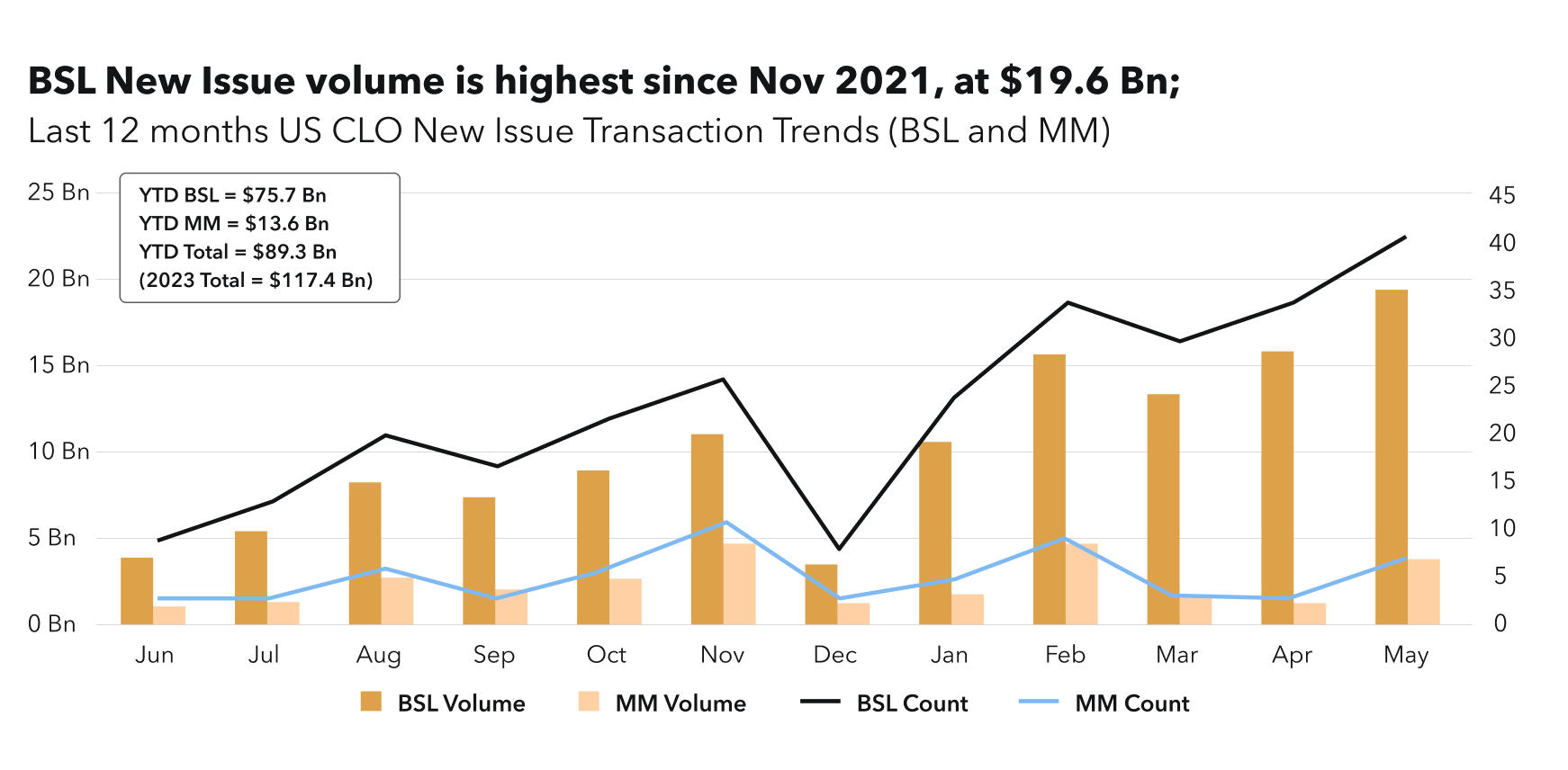

The US BSL new issuance continues to grow, with overall volume rising to $19.5 billion. Private credit new issuance also increased slightly to 3.9bn in May. Year-to-date (YTD) 2024 volumes have totaled $89 billion, compared to $51 billion for the same period in 2023. In May, 48 new deals were issued, the highest number since October 2021. New issue AAA spreads continue to tighten, reaching 140 basis points.

Refinancing volumes also spiked, reaching the highest levels in the last 12 months. YTD 2024 refinancing volumes totaled $31.987 billion, significantly higher than the 2023 total of $5.037 billion.

Secondary Market

“It’s been a ‘risk-on’ environment all through though May. We just had a softer-than-expected CPI release, which helped fuel the risk rally.” – Kenneth Szal

TRACE Volumes & Dealer’s inventory

TRACE volumes slightly increased in May, reaching $18.2 billion, driven mostly by high-yield and equity tranches, which saw a 15% increase from April. HY volumes reached $6.1 billion, the highest since November 2022. Investment-grade volumes remained flat to April levels.

The YTD TRACE 2024 volume reached $99.8 billion, compared to $75.7 billion for the same period in 2023.Broker-dealers showed a strong bullish trend, with a net purchase volume of $2.52 billion in May, the highest since September 2021.

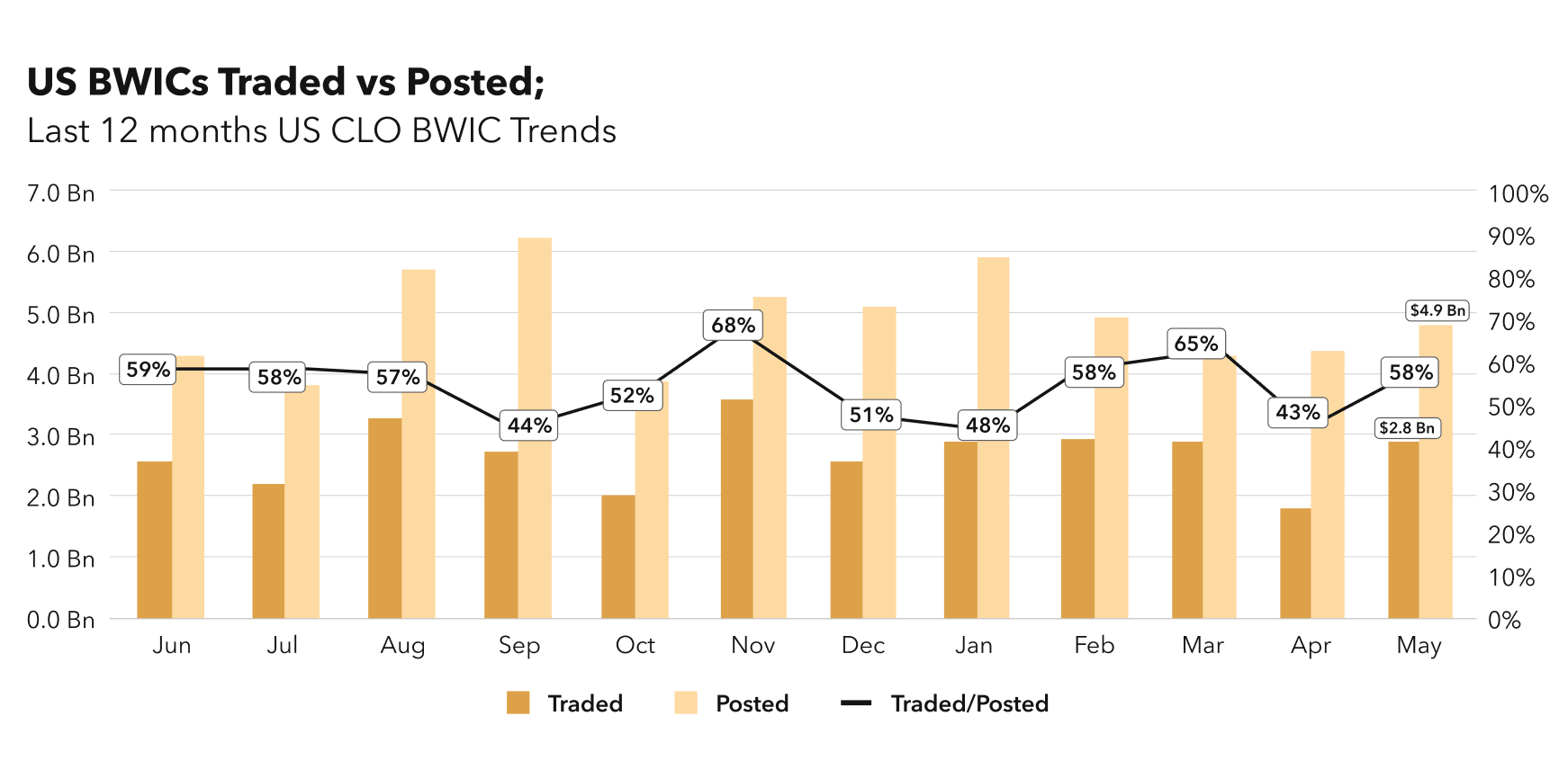

BWIC Volumes & DNT Rates

BWIC activity increased in line with TRACE volume. BWICs as a percentage of TRACE increased 5% compared to April. The total traded volume of BWICs in the US reached $2.8 billion, while the posted volume was $4.9 billion. US BSL CLO equity trading reached its highest volume since 2021, totaling $440 million.

CLO Tranche Prices

“Even with the overall level of strong demand, you see discounted prices down the capital stack. So, there’s still some price convexity left in the BBs compared to the higher rated tranches.” – Kenneth Szalv

CLO prices are at LTM highs, with 98% of AAAs trading above par. BB tranches experienced strong increases, rising from 96.50 in April to 98.14 in May.

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on July 9th for Market Trends Webinar with John Kerschner of Janus Henderson and register here.