HalseyPoint CLO II AMR Refinancing

KopenTech is pleased to announce the successful refinancing of HalseyPoint CLO II, managed by HalseyPoint Asset Management, via an AMR auction held on January 12, 2022. AMR, Applicable Margin Reset, is an electronic multi-dealer auction for refinancing CLO debt tranches. HalseyPoint CLO II is a $378 million CLO that was issued in July 2020 with a 1.5-year non-call period.

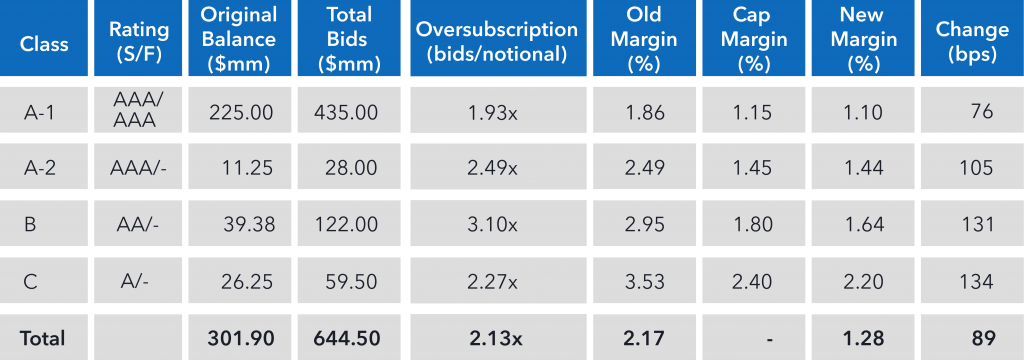

The auction had significant participation from the CLO broker-dealer community which accepted bids from their clients or bid for their own book in the online refinancing. Four classes were available for AMR refinancing: A-1 (AAA by S&P and AAA by Fitch, respectively), A-2 (AAA/-), B (AA/-) and C (A/-), all of which have a non-AMR (new non-call) period of 6 months making this CLO available for refinancing again in July 2022.

The KopenTech AMR platform received $644 million in bids making the auction 2.1x oversubscribed. The AAA-rated Class A-1 received over $430 million in bids making it 1.9x oversubscribed and the AA-rated Class B received over $120 million in bids making it 3.1x oversubscribed.

BBB and BB tranches were not offered in the AMR auction, and thus AMR refinancing reduced the weighted average cost of debt (WACD) by 80 bps.

The HalseyPoint CLO II AMR auction was the sixth successful AMR auction hosted on KopenTech’s platform, the most recent being the Catamaran 2014-1 auction which took place in June 2021.

LIBOR as the Base Rate

All four tranches of the HalseyPoint CLO II AMR were priced off LIBOR. AMR has moved refinancing from primary into secondary trading realm. Bond CUSIPs remain the same and there is no new issuance associated with AMR. As such, the transaction keeps its original base rate until such time that manager chooses to adjust the base rate according to the terms of the indenture.

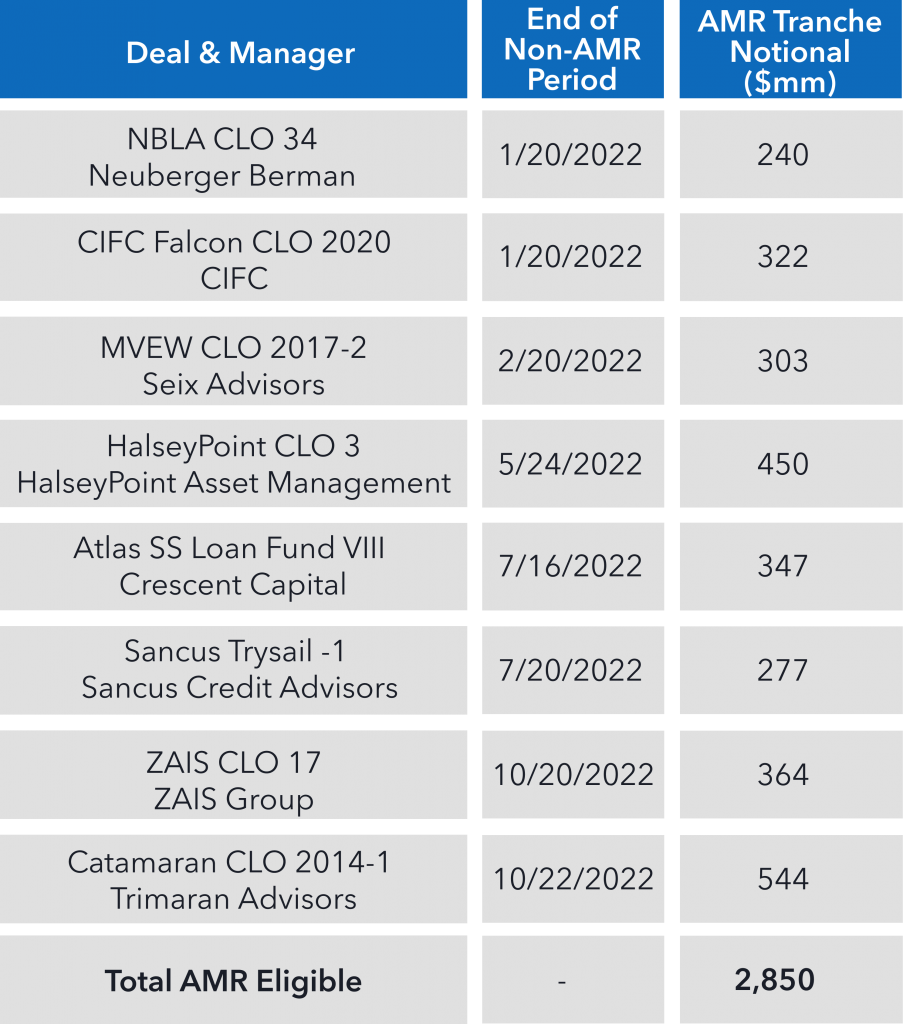

Potential AMR Refinancings for 2022

In addition to HalseyPoint CLO II, there are eight other CLO transactions with the AMR feature that will be exiting their respective non-call/non-AMR periods in 2022 and would be eligible for AMR refinancing, totaling over $2.85 Bn. Potential candidates for AMR refinancing are listed below.