CLO Market Trends: September 2024 Edition

HY TRACE volumes increase by 45%, Reset volumes are up 6% from August, reaching record highs

Guest Speaker: John Wu, Seix Investment Advisors

Primary Market

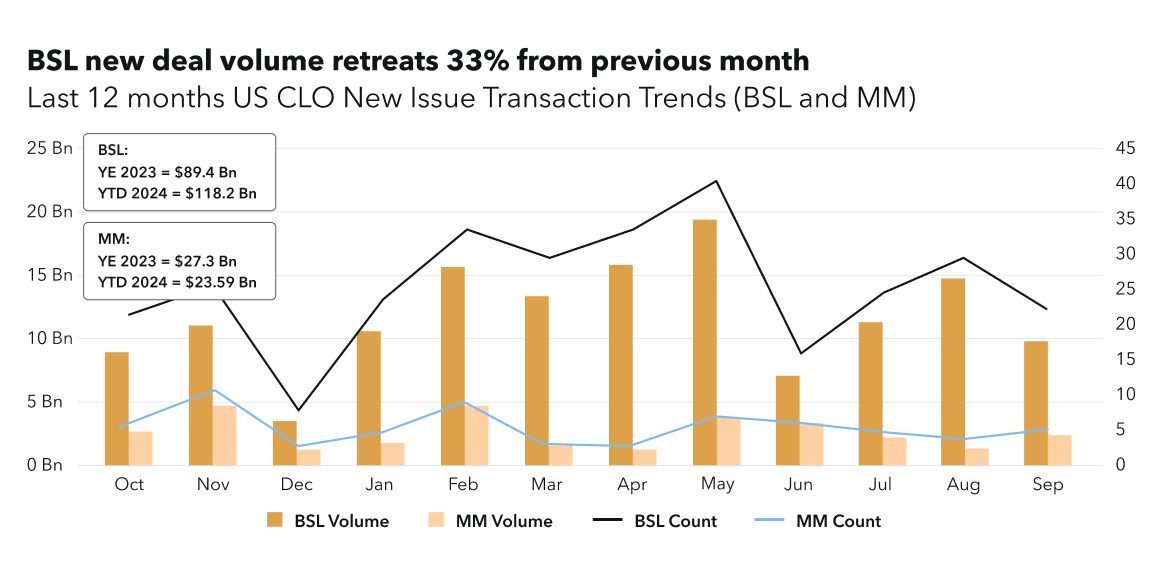

The US BSL new issue volume is 33% down compared to August. Year-to-date (YTD) 2024 volumes have totaled $118.2 billion. Yet compared to $65.5 billion for the same period in 2023, 2024 issuance is almost double! New issue AAA spreads remain unchanged from August at 135 bps tightest for the long-dated deals.

”Managers are relying on new issue loans to create attractive portfolios at a below par prices. With a weak new issue loan calendar, new issue CLO formation slowed down.” – John Wu

Primary issuance continues to be fueld by resets, with volumes are up 6% from August, reaching a record high of $21.6 billion in September. US MM reset volumes, have seen a slight slowdown from August, totaling $2.1 billion. U.S. BSL refinancing volumes also continue to decline, totaling $6.3 billion. Year-to-date 2024 refinancing volumes stand at $62.2 billion.

“From a manager’s perspective, reset transactions offer the benefit of extending CLOs and lowering the financing costs, resulting in longer cash flows.”– John Wu

Secondary Market

TRACE Volumes & Dealer’s inventory

Secondary trading continues on a strong note as well. HY TRACE volume increases 45% over September, reaching $4.8 billion. The YTD 2024 volume reached $156.7 billion, compared to $149.0 billion for the same period in 2023.

Broker-dealers’ positioning rebounded for the first time in four months, with a net purchase of $1.12 billion in September.

BWIC Volumes & DNT Rates

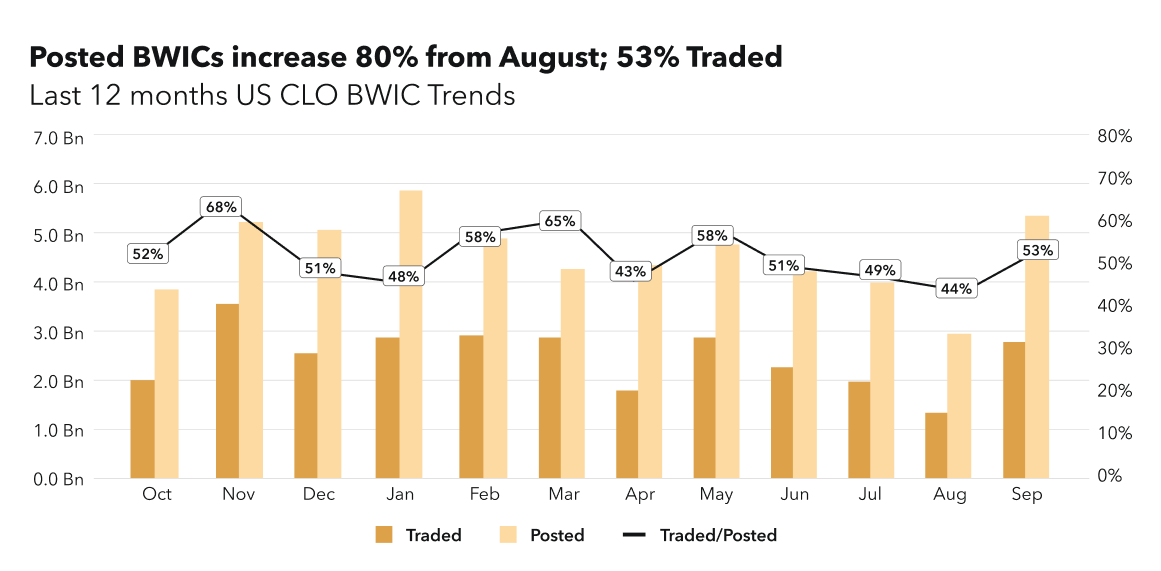

Posted BWICs increased 80% over the previous month to $5.3 billion. However, executed trades were only 53% of posted. Executed BWIC trades of $2.8 billion represented only 20% of the total TRACE-reported volumes.

“Make sense for investor with older vintage deal and more storied portfolios to trade through trading desks where they may know where to find demand.”– John Wu

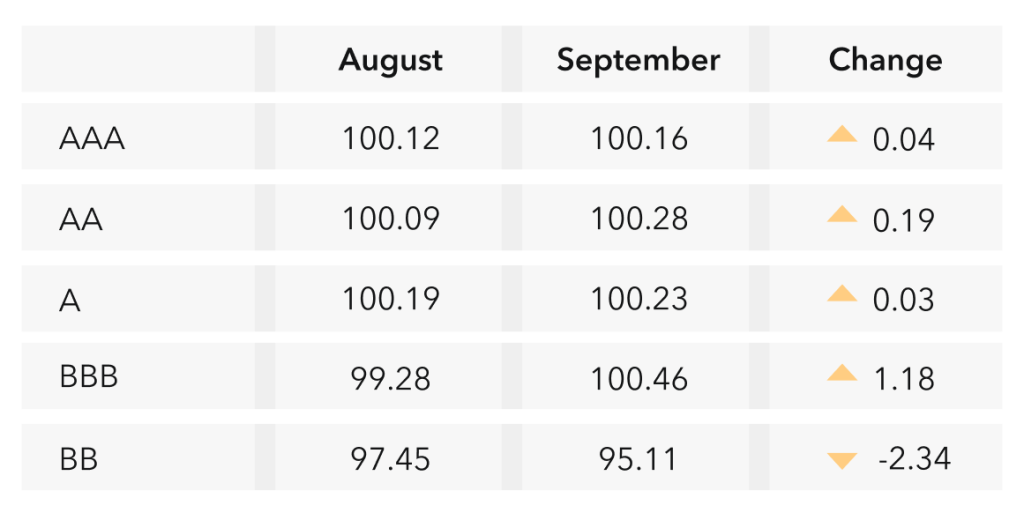

Prices Across the Stack

Prices across the capital structure remained firm, with exception on BBs. However, lower BB BWIC prices due to the shorter beaten up profiles, masks wider market interest in fresh BBs with longer reinvestment periods, as reflected in TRACE numbers.

“The market was anticipating a lower benchmark rate and investors picked up more spread by going lower in the capital structure, increasing demand.”– John Wu

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on November 12th for September Market Trends Webinar.