CLO Market Trends: September 2023 Edition

BWIC volumes drop, prices fall, but new issue keeps coming

October Webinar Guest Speakers: Jim Stehli, Polen Capital

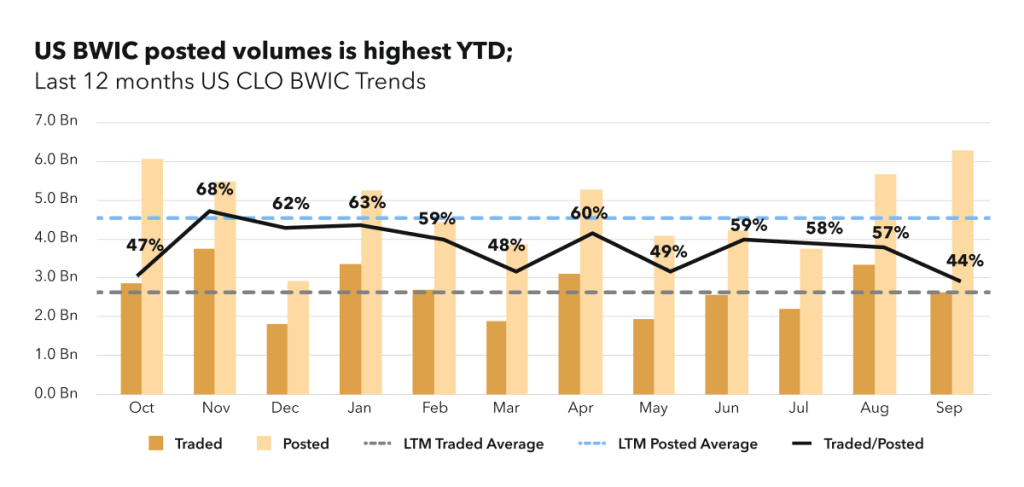

BWIC Volumes

US BWIC traded volumes fell in September to LTM averages but posted volumes were at their highest – $2.7 BN and $6.2 BN, respectively. 44% of the posted volume traded. Overall, YTD volumes are lower by 12% in traded and 9% in posted.

BWIC Volumes by Rating & DNT rates

US BWIC traded volumes fell in September to LTM averages but posted volumes were at their highest – $2.7 BN and $6.2 BN, respectively. 44% of the posted volume traded. Overall, YTD volumes are lower by 12% in traded and 9% in posted.

“We saw $1BN posted, and $600mm traded on HY BWICs in September which is close to 5yr high. Seems like investors thought it was a good time to lock in gains.” — Olga Chernova

DNT% in US BWICs is uneven across the stack, and a large percentage of deals with no information about their color was reported in AAAs and AAs. Equity trading, however, picked up – the traded volumes were lower than in August, but the number of trades was higher: 48 deals showed color out of 68 traded.

“There were 68 trades in September, many with small notionals reflective of investor interest in price discovery on the back of improvements in NAV.” — Olga Chernova

TRACE Volumes & Dealer’s inventory

TRACE volumes in September hold steady close to August levels, hitting $20.2 BN in July, with 10 days reporting higher than $1 BN. The BWIC/TRACE ratio for high yield increases to 21%, while the IG portion is at 12%. On the dealer inventory side, net flow shows dealers buying $825 MM, the most dealer buying since last September.

Prices Across the Stack

September average US BWIC prices rise to LTM highs across all ratings, hinting that the market remains stable (LTM lows were in October 2022). AAA average price is at 99.57 cents on a dollar.

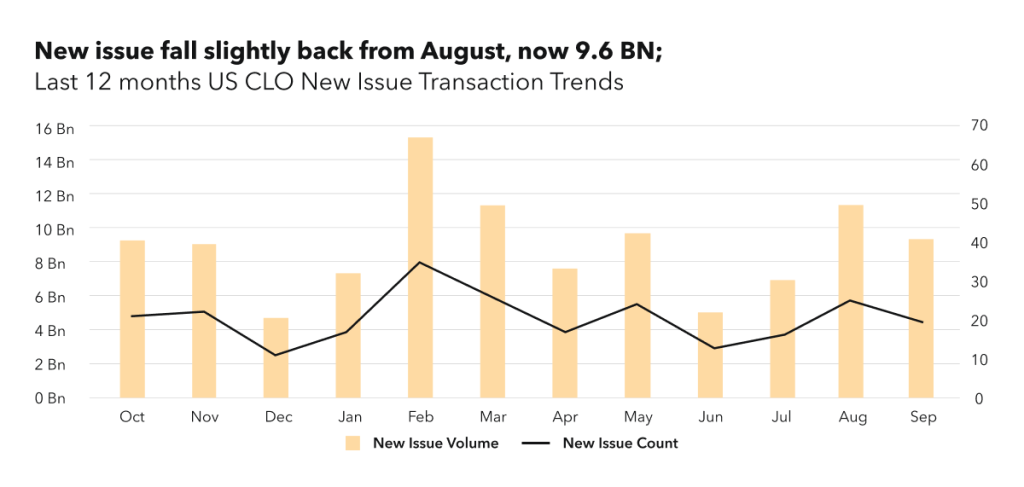

New Issue

New issue volumes fell slightly back from August, now at $9.6 BN. Short deals come back to the market, constituting 25% of the total issuance. This includes 3 short new deals and 4 short refies. US AAA spreads for the longer BSL transactions tighten, with current range of 167-200 bps.

“We see a steeper CLO AAA curve developing. This is a very healthy sign and good for the CLO formation.” — Olga Chernova

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on October 9th for Market Trends Webinar.