CLO Market Trends: October 2024 Edition

$26Bn in monthly resets and $6Bn in private credit issuance hit all-time highs; BB prices up 3 points

Guest Speaker: Jonathan Insull & Edward Vietor, Nassau Global Credit

Primary Market

“Large AAA buyers are seeing their books pay down rapidly as post-reinvestment deals amortize. The demand for CLO liabilities is strong right now.” – Edward Vietor

U.S. BSL refinancing volumes are up compared to September, totaling $7.5 billion. Year-to-date 2024 refinancing volumes stand at $69.7 billion. Reset volumes are up 19% from September, reaching a record high of $25.8 billion in October.

“Makes sense to refi and/or reset so you can lock-in and save on your cost of capital to take advantage of an attractive loan market.” – Edward Vietor

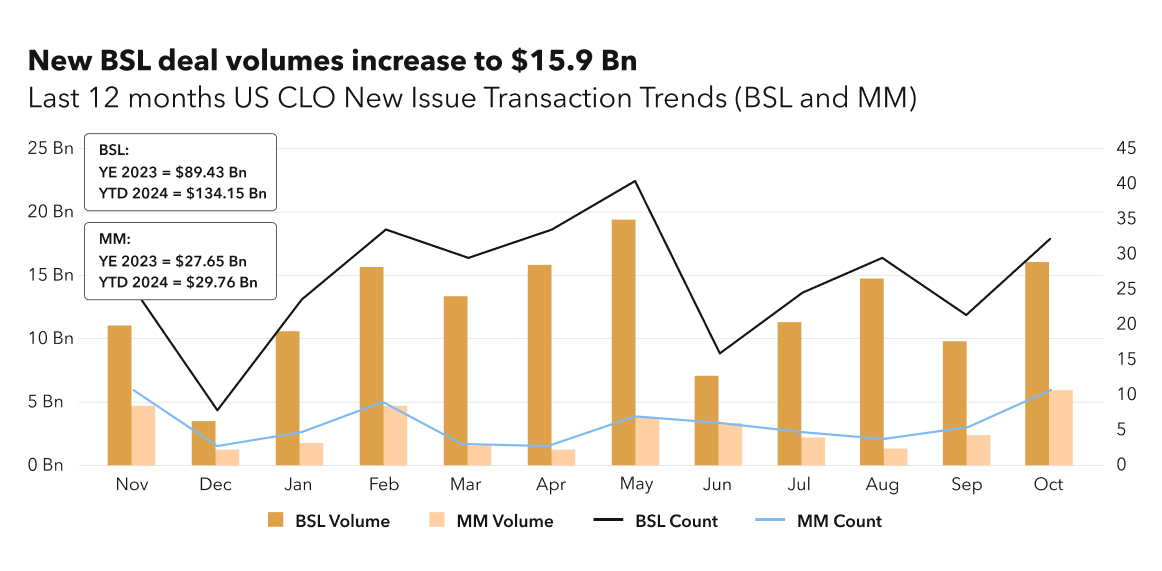

The US BSL new issue volume is 62% up compared to September, marking the second-highest month across 2023 and 2024.

Year-to-date (YTD) 2024 volumes have totaled $134.1 billion, compared to $74.6 billion for the same period in 2023. New issue AAA spreads remain unchanged from August at 135 bps tightest for the long-dated deals.

Middle market/PC CLO new issuance reached an all-time monthly record of $6.2Bn, and in the process, surpassed $30 Bn YTD – which is the new annual record.

Secondary Market

TRACE Volumes & Dealer’s inventory

HY TRACE volume decreases 13% over October, reaching $4.2 billion. The YTD 2024 volume reached $170.7 billion, compared to $164.2 billion for the same period in 2023.

Broker-dealers’ balance sheets remain flat, with a net purchase of $94.8 million in October.

BWIC Volumes & DNT Rates

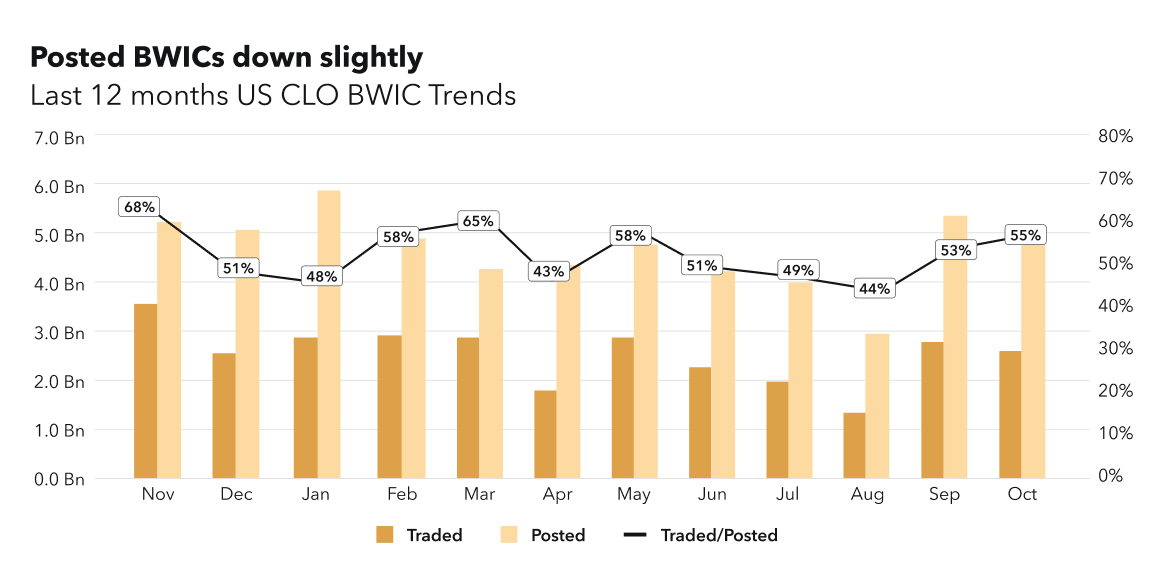

BWIC activity, representing the percentage of BWICs relative to total TRACE-reported volumes, is slightly down from 19.26% in September to 18.83% in October.

Total U.S. posted BWIC volume decreased by 8% compared to September, totaling $4.8 billion. Of the posted BWICs, 54.58% were traded, with a total volume of $2.6 billion.

CLO Tranche Prices

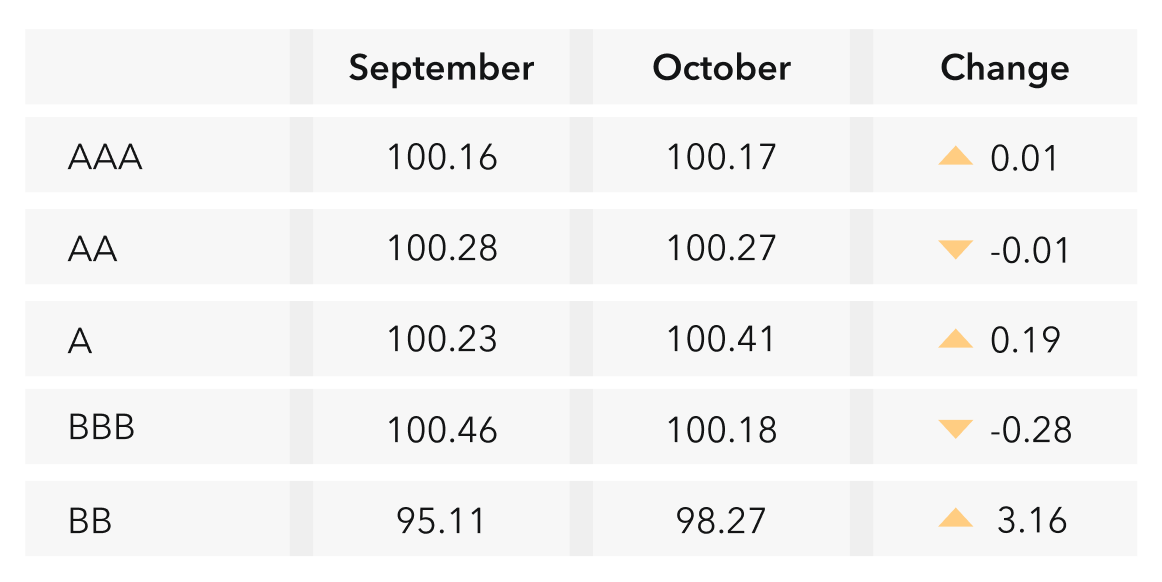

All IG CLO tranches continue to trade on average above par, while the average BB BWIC price has reached its LTM high.

“If you look at historical default and loss experience of BB tranches on a risk adjusted basis, they can be very compelling investments.”– Jonathan Insull

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on December 10th for Market Trends Webinar and register here.