CLO Market Trends: February 2024 Edition

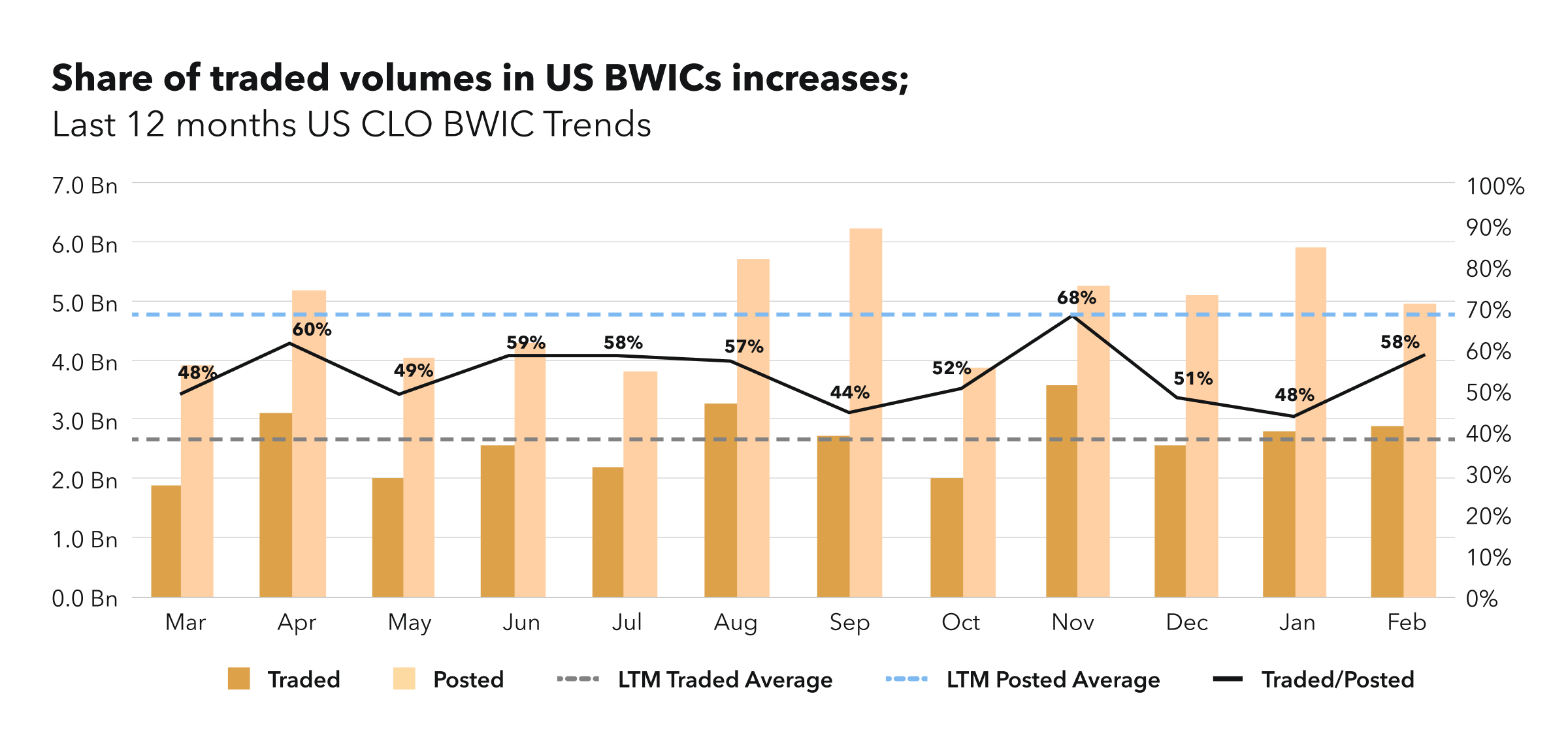

US BWIC volumes are on par with LTM averages with $2.9 BN traded. New issue volumes are highest in last twelve months, and refi/reset deals are becoming more prominent.

BWIC Volumes

US BWIC volumes in February were slightly below January numbers for posted volumes, but experienced an increase in traded. There were $5.0 BN posted, of which $2.9 BN traded.

BWIC Volumes by Rating & DNT rates

The traded volume breakdown by rating shows February BBBs still higher than respective average LTM volumes. The whole IG tranche seems to trade more compared to LTM averages (except As), marking the improvement in AAA trading compared to last month ($1.47 Bn traded). With this, investment grade trading accounted for 84% of the total February volume.

DNT rate is uneven across the stack for US BWICs, with lower DNT% for AAAs and way higher for AAs (compared to LTM averages): DNT rate for AAs was at 17%. The share of deals that did not provide color decreased compared to LTM averages, with 39% for AAAs and only 16% for BBs.

TRACE Volumes & Dealer’s inventory

TRACE volumes are down from January highs, approaching the LTM averages: $15.7 BN in IG and $3.9 BN in HY. 10 days are reporting higher than 1 BN, with one day showing trading volume of $2.08 BN. The BWIC/TRACE ratio flips, falling to 12% for HY, but increasing to 16% for IG.

“Dealers are building up inventory while they have confidence in spreads tightening.” – Milton Bonellos

Prices Across the Stack

US BWIC prices keep increasing for a big portion of the capstack: AAAs, AAs and BBs show highest average cover levels LTM. AAAs average price is above par, at 100.22 cents on a dollar.

“We’ve seen the tightening in spreads, with tier one managers outperforming.”– Milton Bonellos

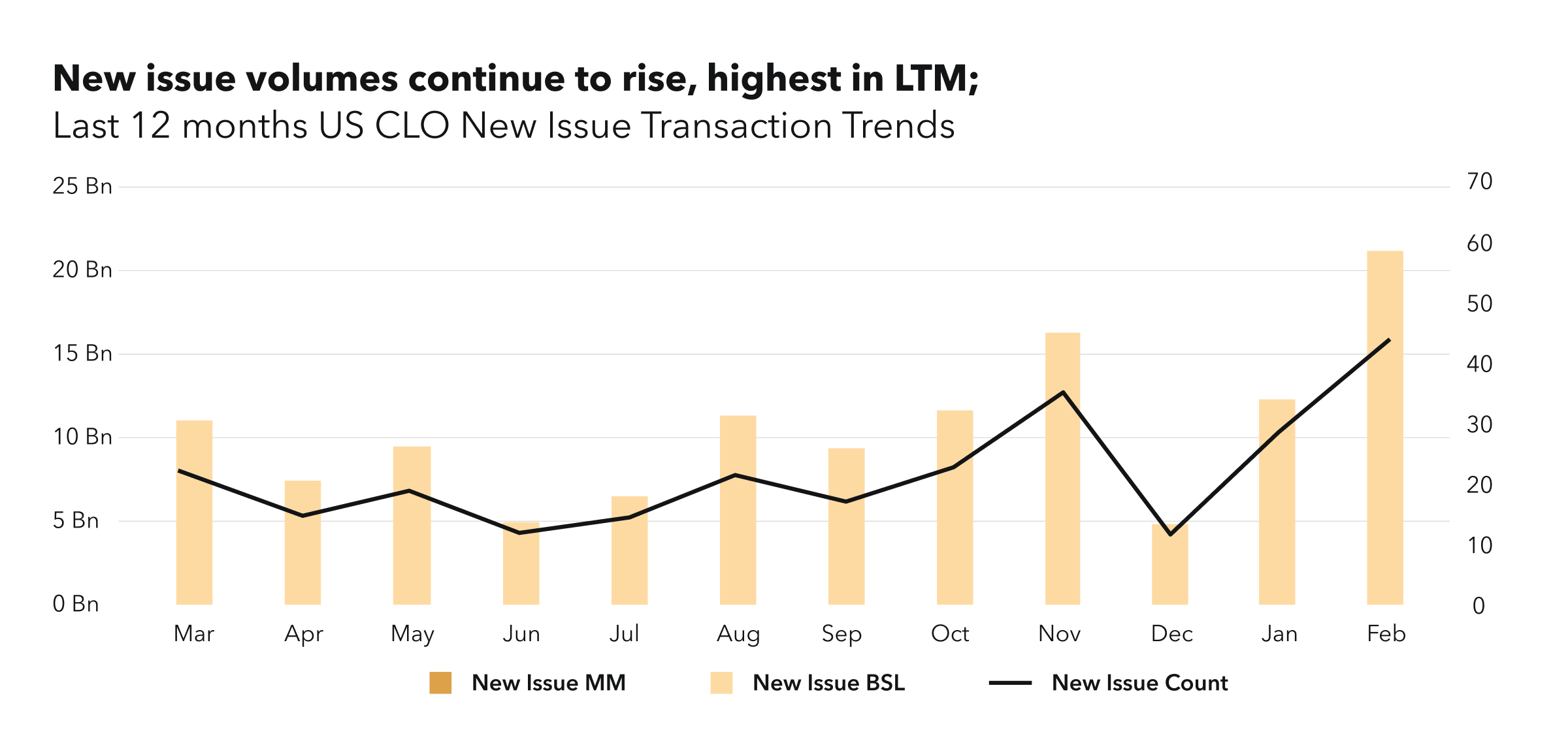

Primary Issuance

New issue volumes rise by 71% since January, surpassing $20 BN across 43 newly issued deals. The portion of short deals in total issued volumes increased, now taking up 14% of the total issuance. US spreads keep tightening in longer BSL transactions: the lower end of the range is still at 148 basis points, but monthly median for February is at 155 bps compared to 160 in January and 175 for the last twelve months.

“We saw a big tiering between Tier 1, Tier 2 and newer managers, but now it’s compressing.” – Milton Bonellos

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on April 9th for Market Trends Webinar and register here.