CLO Market Trends: August 2024 Edition

US MM Reset volumes reach $4.8 billion, the highest since September 2021; BWIC posted volumes reach LTM lows; only $1.3Bn reported as traded

Guest Speaker: Josh Soffer, Prospect Capital Management

Primary Market

“The environment is better. The arb improved over the past couple months and some managers are raising captive equity funds. I think that’s a driver.” – Josh Soffer

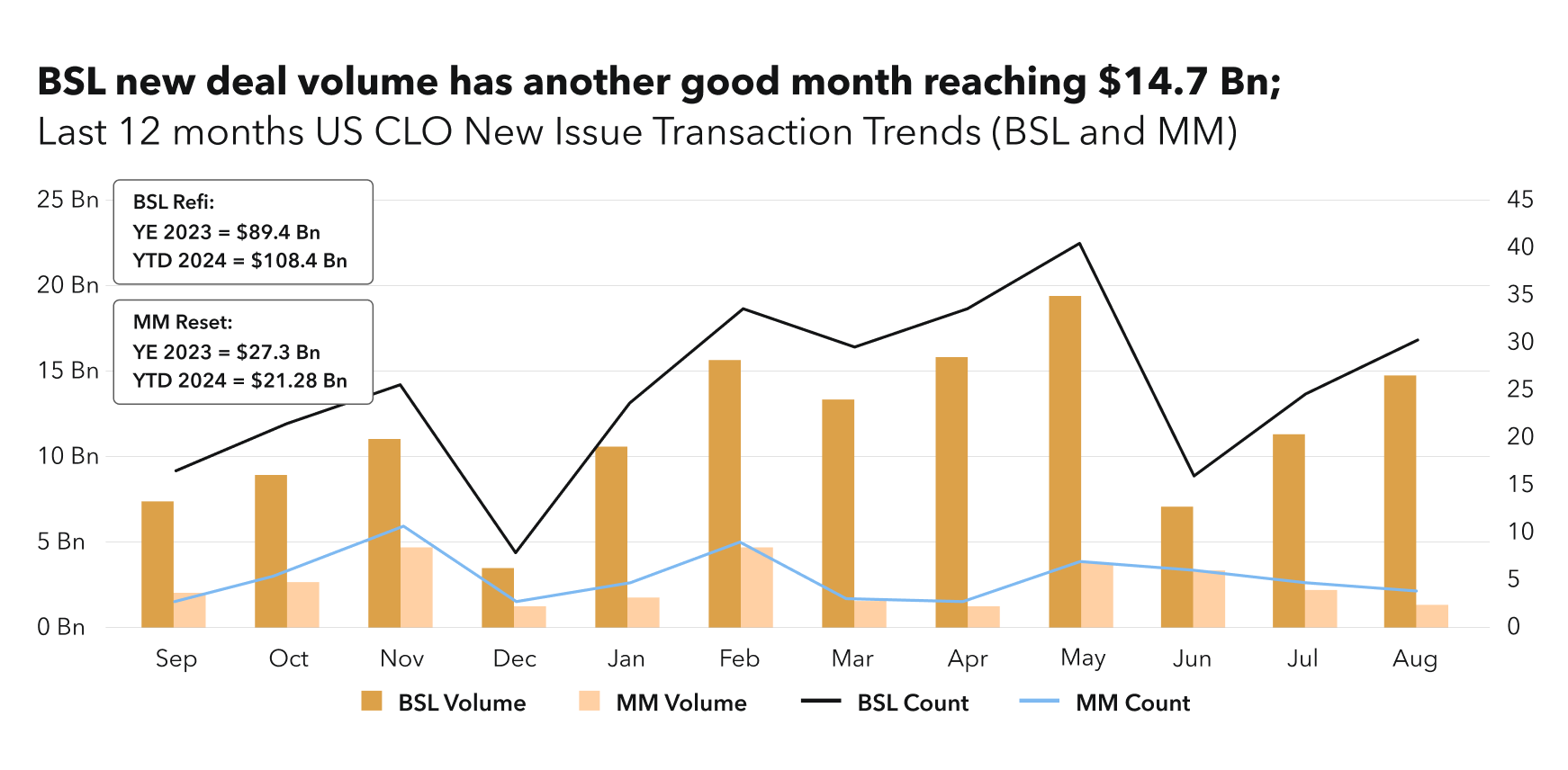

The US BSL new issue volume continues to grow from July with 30 new deals priced in August. Year-to-date (YTD) 2024 volumes have totaled $108.4 billion, compared to $58 billion for the same period in 2023. New issue AAA spreads remain unchanged from July at 135 bps tightest for the long-dated deals.

“There’s opportunity to extend at a time of some collateral scarcity. So managers/majority equity holders are definitely erring on the side of ‘let’s reset when it’s close.”– Josh Soffer

US BSL Refinancing volumes continue to decline, totaling to $7 billion; YTD 2024 refinancing volumes are at $55.8 billion. Resets volumes continue to dominate primary market, reaching $19.9 billion in August. US MM Reset volumes reach $4.8 billion, the highest since September 2021.

Secondary Market

“The volatility seen was macro driven but we recovered quite quickly. So much paper now is above par and when there’s opportunity to buy below par, investors take advantage of that.”– Josh Soffer

TRACE Volumes & Dealer’s inventory

TRACE volumes remained stable at $14 billion. The YTD TRACE volume reached $142.06 billion, compared to $128.8 billion for the same period in 2023.

Broker-dealers continue to be taken out of paper by clients and lightening up their balance sheets, with a net sell volume of $1.25 billion in August, $361 million more compared to July.

BWIC Volumes & DNT Rates

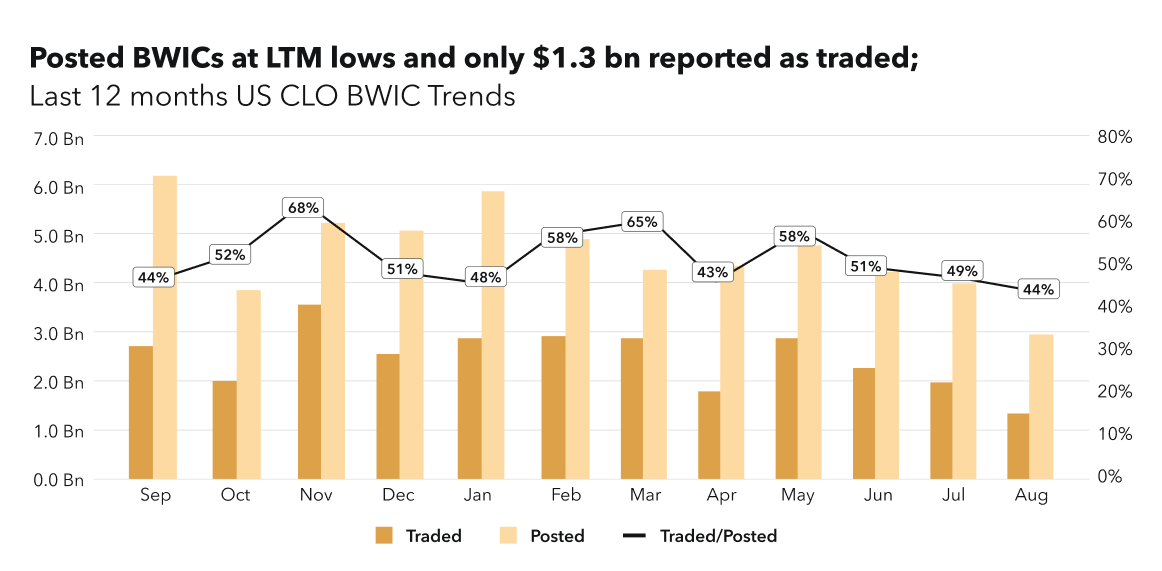

BWIC % activity, representing the percentage of BWICs relative to total TRACE-reported volumes has dropped by 4.73% compared to July, with IG % reaching LTM lows. The total traded volume of BWICs in the US reached $1.3 billion, while the posted volume was $2.9 billion, both being the lowest in the last 12 months.

Prices Across the Stack

Early August volatility weighted on monthly average prices.

Sign Up for Our Platform

Get up to the minute data on CLO new issue and secondary BWIC trading by signing up at kopentech.com.

Please join us on October 8th for September Market Trends Webinar.