CLO Equity is in for the Bid This Week

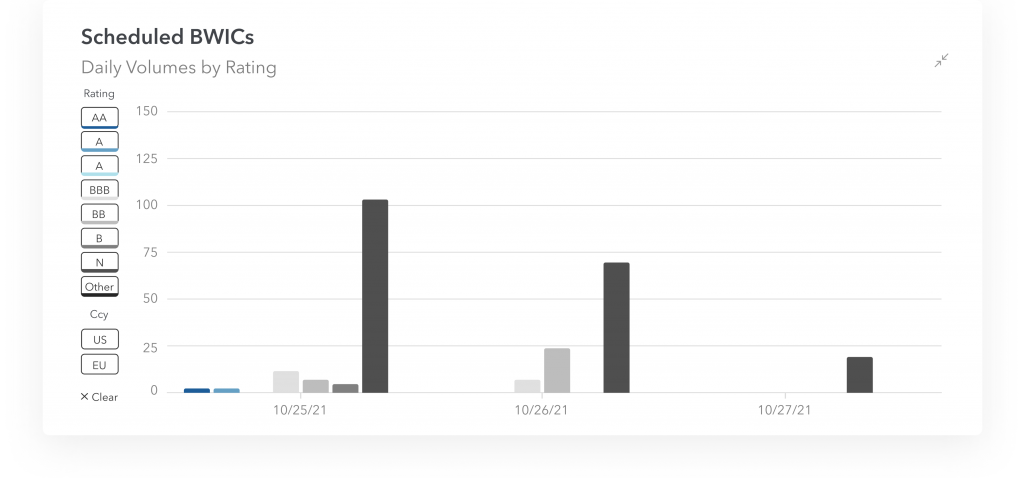

Investors are eyeing several sizeable CLO equity BWICs taking place over the next several days. Data from the KopenTech BWIC platform shows that over $100 million in CLO equity on Monday, October 25th, over $60 million on Tuesday, October 26th, and another $20mm on Wednesday, October 27th. An additional listing may add to the fury of equity trading in the upcoming days.

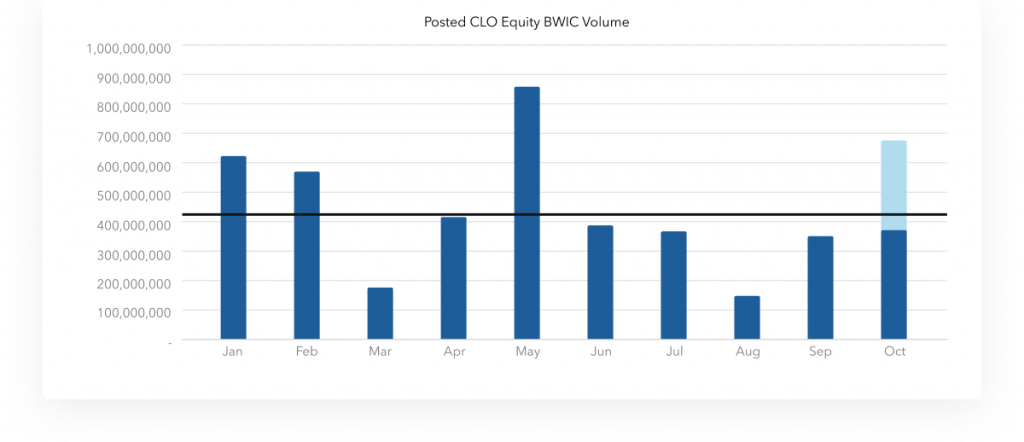

October is set to be the second-highest equity trading month this year. The second half of the month’s equity trading increased significantly with $352 million trading over BWIC last week. On average, investors have listed $434 million of CLO equity on BWICs monthly.

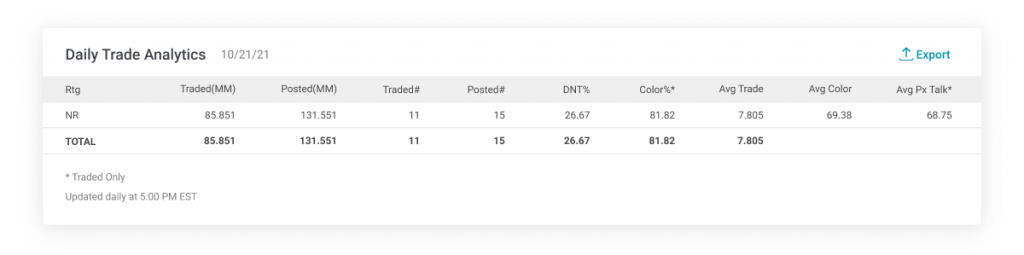

On Thursday, October 21, there was over $130 million of CLO equity posted with traded coming in at $86 million, resulting in a DNT rate of 27%. You can view upcoming and historical BWICs as well as trading session summaries on KopenTech’s platform. KopenTech’s BWIC Dashboard displays a table summarizing the day’s trading activities and data is updated daily at 5:00 PM EST.

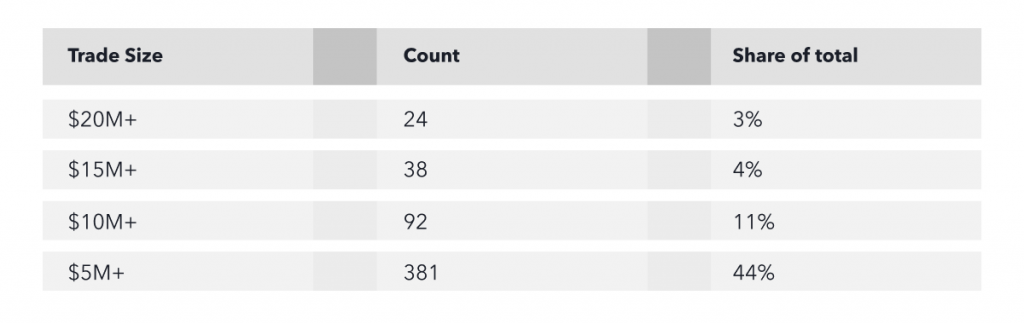

While none of the upcoming BWICs are control equity positions, at least two are positions of $10 million or more. Historically, the average size of a listed CLO equity on BWICs is $5 million.

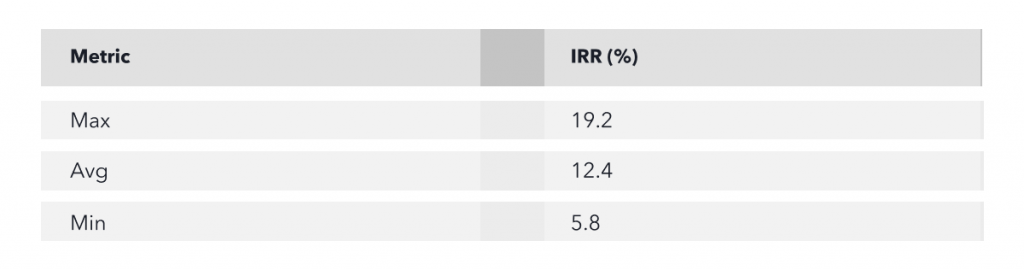

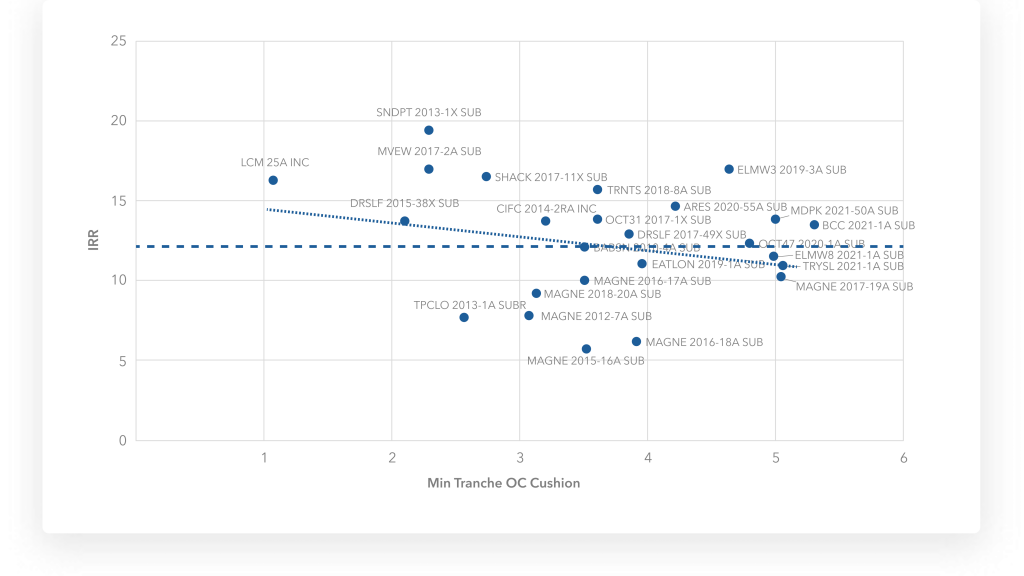

What is causing such a large number of CLO equity trades? One possible reason is attractive IRRs. Internal rates of return can be calculated based on CLO equity where public color (the second-highest bid received during a BWIC RFQ) is available. Month to date, among the 27 trades that posted public color, the average IRR is 12.4%.

The range of IRRs was wide: from roughly 6% to almost 20%. While generally, CLO equity IRRs have a high correlation with a minimum junior OC cushion, this month the data looks like a cloud with barely noticeable correlation.

KopenTech is the premier source of secondary and primary issuance data for the CLO marketplace. Get this information and more at bwic.kopentech.com.