CLO Secondary Market Trends: April 2021 Edition

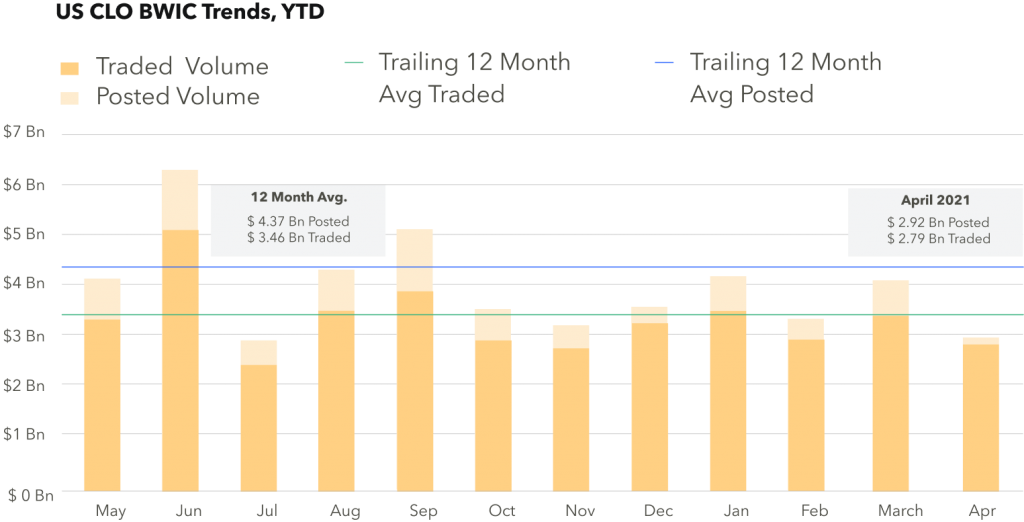

BWIC Volumes

April’s Posted and Traded BWIC volumes were both slightly lower relative to March. Volumes fell $1.4 Bn and $500 mm respectively. Despite decreased volumes, over 93% of posted BWICs traded in April, indicating robust demand for the asset class.

TRACE* Volumes

CLO bond trading volumes in April remained steady at $13 Bn, just below the trailing 12 month average of $13.6 Bn. Non-IG rated bonds were up to $5.5 Bn from $4.0 Bn in March.

BWICs as % of TRACE

April saw IG-rated tranches executed via BWICs spike to 37%, the second highest in the last 12 months, while HY tranches dropped to a 12-month low of 10%.

Prices** Across the Stack

Prices increased modestly across the stack with BBB bonds being the largest movers.

BWIC Volumes By Rating

During April, AAA tranche trading dropped substantially to $1.13 Bn from the trailing 12-month average of $1.99 Bn. AA and A had similar trading volume decreases. The remainder of the stock was in line with 12-month averages.

Dealers Inventory

Momentum from the start of 2021 continued with upwards of $1.1 Bn purchased by clients, a record amount in over a year.

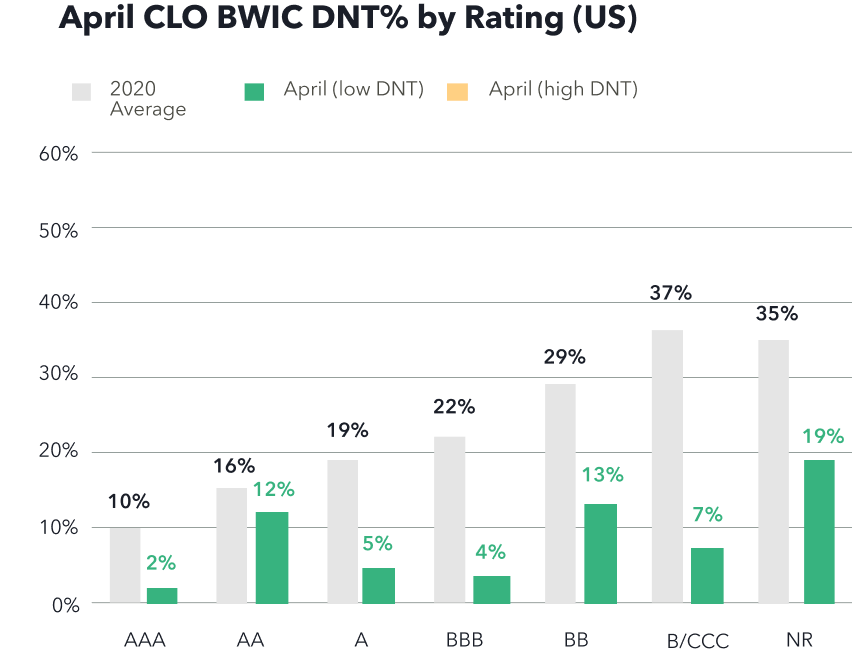

DNT Rates

DNT% plummeted across the capital stack, with 98% of AAA BWICs trading. All other tranches also decreased, pointing to strong demand.

KopenTech Live Bidding

Traditionally, BWICs are run in a first-price, sealed-bid auction format. Live Bidding is an innovative CLO selling method that consists of two time-limited rounds. During the first stage, investors bid on securities in a blind fashion. Highest bidders advance to the second round where bids are updated in real time until bids stop improving. With Live Bidding, selling CLOs is a fast-paced process, saving time for buyers and sellers and increasing competition, similar to high-end art auctions. Try this feature and send a BWIC.

*TRACE reports all CLO trades involving FINRA members.

**Prices are based on trades that provided color and are likely to underestimate actual traded levels.