AMRs: Similar to BWICs?

The AMR auction process is in many ways similar to the secondary BWIC

(“bids-wanted-in-competition”) trading process for structured products. Yet, AMR offers additional improvements, mainly around the certainty of execution, which, as a result, should bring in more participation from both investors and dealers.

AMR offers complimentary

business line for broker-dealers

AMR is a complementary offering for broker-dealer secondary desks; dealers now have the opportunity to bid on large volumes of paper that were previously considered new issue transactions. As AMR continues to gain adoption, more secondary trading desks are looking to become involved in the auctions.

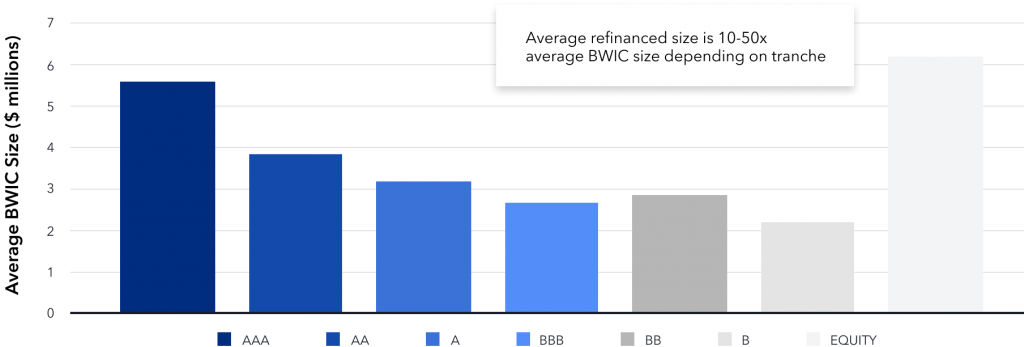

It’s also worth noting that the entire size of the tranches that get refinanced through the AMR process is larger than the average BWIC size.

Average Traded BWIC Size by Rating — 2020 YTD

As the AMR process becomes more widespread, the efficiency offered to dealers and investors to participate sets the stage for several auctions to happen on a weekly basis, creating a new source of revenue for the secondary trading desks.

AMR is a simple process

At times when refinancing opportunities become favorable, many arranging desks find themselves backlogged as several CLO managers will approach them to initiate the refinancing process.

For arrangers, this redirects resources that otherwise could go towards the more labor-intensive new issue pipeline, and it was not unusual in the past for some dealers to have to turn away some requests for refinancing as a result.

Fortunately, AMR is similar to a BWIC in that there is only one round of bidding. From 8 AM to 10 AM Eastern on the auction day, all interested investors put their “best foot forward.” With no seller feedback to solicit higher bids, AMR allows for all bid preparation to be done in advance with no surprises on auction day.

No wasted resources once

publicly available Cap Margin is met

The current system for secondary trading has been inefficient for some time.

Both dealers and investors have complained that a BWIC often hits the market on short notice, followed by interested investors performing analysis on the bonds, only for everyone to find out at the end that the seller either set high reserve prices or was merely conducting a pricing exercise. Dealers and investors looking to participate in the BWIC often end up wasting valuable time and resources.

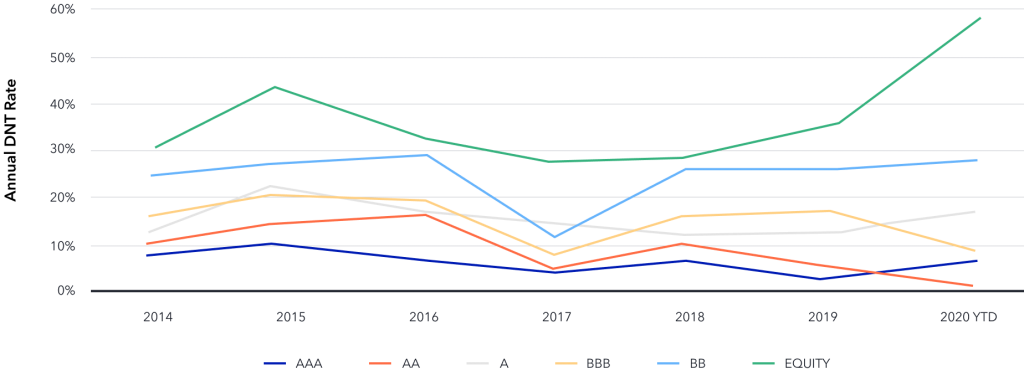

On average, between 10-20% of junior investment-grade CLO tranches will fail to trade on a BWIC, a figure that breaches 30% at times for below-investment-grade tranches.

BWIC DNT Rates by Rating

Such a scenario is unlikely to happen in an AMR auction as long as the Cap Margin (reserve price), which is publicly available, is met. If enough bids are submitted below the Cap Margin covering the size of the tranche being auctioned, both the majority equity holder and the CLO manager must accept the results of the AMR refinancing. Conversely, a seller can simply refuse to trade at the end of a BWIC, regardless of the levels received.

Investors already willing to

pay a premium over par for CLOs

One point of contention that has been expressed is that investors may be hesitant to participate in the AMR process because of the need to pay banks a 2-4 bps trade commission on top of purchasing the existing notes at par.

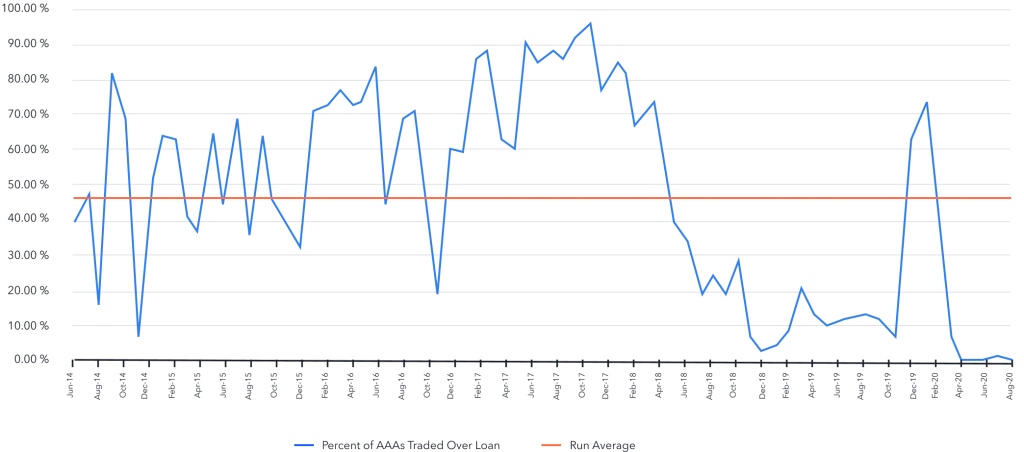

The data shows otherwise; AAA notes consistently trade above par.

On average, nearly 50% of AAA-rated tranches appearing on BWICs have traded above par, at times rising to as high as 90% of all AAA tranches on BWICs. Obviously, in times of tight new-issue spreads, most older vintages with wider spreads would trade above par, like in 2017. Conversely, in times of high volatility, such as during the coronavirus pandemic, nothing trades above par because the market spreads become so wide. Similar premiums can be priced into AMR bids by bidding at higher margins closer to the cap margin, so the issue is really a matter of purchase price versus true discount margin.

It’s also worth noting that since March 31, 2019, insurance companies have the ability to purchase CLO tranches above par without a penalty to their NAIC ratings (increase in capital charges) from doing so.

Percent of AAAs Trading Above Par in BWICs

AMR does not require anchor investors

One of the significant challenges in refinancing a CLO is finding a substantial anchor investor to purchase the bulk of its senior debt. AMR, on the other hand, is analogous to a broad syndication process; the CLO manager invites multiple broker-dealers to submit bids. More investors suggest more demand and better competition, so AMR can be seen as a tool to optimize CLO refinancing.

In some new CLOs, especially for a benchmark issuer, it is common for a syndicate to sell over 75% of a AAA tranche to one investor. While this makes the syndication process much easier for the bank, it often excludes many interested investors from the process.

However, there is little reason for those investors to be ignored; data from Citi shows that the average size of a CLO AAA tranche in the secondary market last year was under $5 million, whereas refinancing a AAA tranche usually requires about 50 times that amount in commitments.

Through AMR, boutique investors interested in tranches will find they can still bid for smaller pieces and not be ignored as they would in the current refinancing pipeline. AMR provides an inclusive source of secondary paper that can be utilized as a supplement to BWIC trading

Additional liquidity added to the CLO market

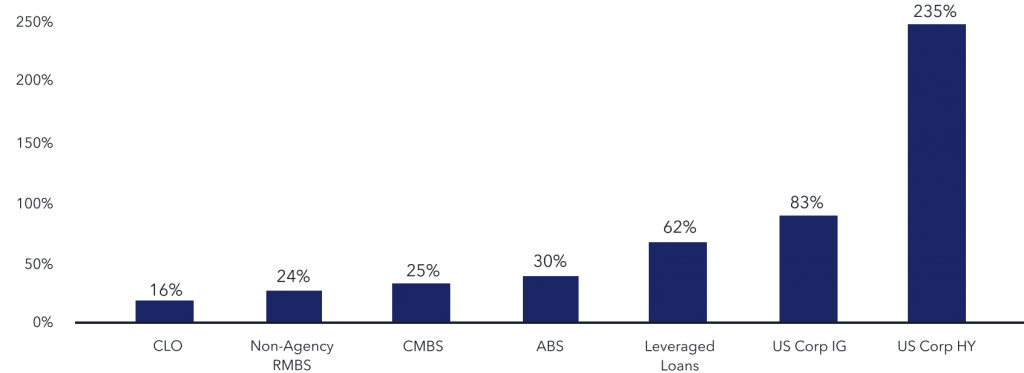

Finally, the increasing adoption of AMR offers existing holders another route to enter and exit a CLO position. Only a very small fraction of the entire CLO market trades as is.

2019 Turnover Rates of Select Securities

Conclusion

AMR offers investors the opportunity to source various sizes of CLO paper more easily and readily than the traditional BWIC process.

As CLOs continue to adopt AMR language and reduce barriers to refinancing, more securities will be available through the auction process, bringing in more dealers and investors who will find it to be a robust new way to invest in CLOs.